Newell Brands Inc.’s NWL success hinges on its key operational and financial priorities for the year. Notably, in the last quarter, the company operationalized a new operating model and continued to execute its strategy, which emphasizes investments in innovation, brand building and go-to-market excellence for the largest and most profitable brands and markets.

The company has been witnessing stronger cross-functional partnerships, which are enabling more agile and efficient decision-making, and streamlined ways of working. These improvements are critical to the company’s transition into a high-performing, innovative and inclusive organization.

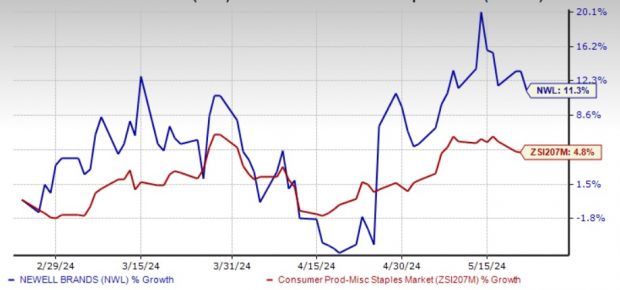

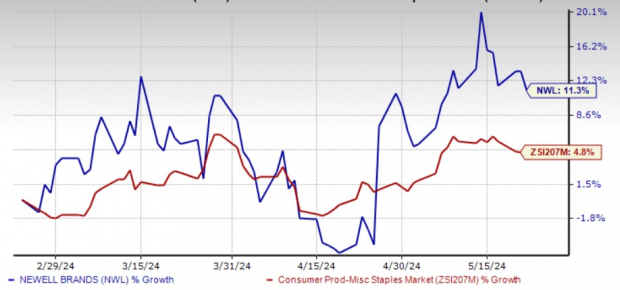

Shares of the Zacks Rank #3 (Hold) company have shown an impressive performance, driven by the aforementioned upsides. Over the past three months, NWL shares have recorded a notable rise of 11.3%, surpassing the industry‘s growth of 4.8%.

Image Source: Zacks Investment Research

Let’s Dig Deeper

Newell Brands experienced an upswing in core sales, driven in part by new distribution gains that exceeded the company’s outlook. The new business development team played a crucial role in achieving these gains quickly and effectively. The distribution gains were noted across several brands like Groco, Rubbermaid Brilliance, Calphalon, Commercial cleaning products and many more.

Newell’s investments in front-end commercial capabilities, with a particular focus on innovation and new business development, coupled with the streamlined organizational structure resulting from organizational realignment, have significantly bolstered its top and bottom-line results.

Newell Brands’ first-quarter results demonstrated notable improvements in key financial metrics. The company reported a gross margin expansion of 410 basis points (bps) and an operating margin increase of 220 bps year over year. These gains occurred despite an increase in advertising and promotion spending, which rose approximately 100 bps, as a percentage of sales, compared with the previous year.

These upsides reflect Newell Brands’ strategic initiatives aimed at enhancing productivity and profitability. Focusing on profitable segments of the portfolio, discontinuing structurally unattractive SKUs and categories, and channeling innovation efforts toward the MPP and HPP segments are a few factors driving growth.

Further, NWL introduced a restructuring and savings initiative known as Project Phoenix. This plan aims to reduce overhead costs, streamline the operating model, centralize supply-chain functions and increase efficiencies. As part of this plan, the company closed three offices in the first quarter of 2023 and anticipates additional office closures in the coming years. Newell Brands is on track to achieve the headcount reduction targets set by Project Phoenix, along with annualized pre-tax savings of $220-$250 million upon full implementation.

Hiccups on the Path

Newell has been witnessing a challenging macroeconomic environment and elevated levels of core inflation that have led to slow demand for discretionary and durable products. Additionally, normalization in category trends, stringent inventory management practices and the adverse effects of Bed Bath & Beyond’s bankruptcy acted as hindrances. Consequently, net sales experienced an 8.4% year-over-year decline, attributed to lower core sales, adverse currency translations and the impacts of business exits.

Management issued guidance for the second quarter and reaffirmed the view for 2024. For the second quarter, net sales are envisioned to dip in the band of 7-9%, with a core sales decline of 4-6%. The company expects a normalized operating margin in the range of 9.1-9.6% and normalized earnings per share (EPS) in the band of 18-21 cents compared with 24 cents in the year-earlier quarter.

The company foresees 2024 sales to decrease in the band of 5-8% year over year with a core sales decline of 3-6%. The normalized operating margin is expected to be in the range of 7.8-8.2% . Normalized EPS is forecast to be in the band of 52-62 cents, down from 79 cents reported last year.

Key Picks

Here, we have highlighted three better-ranked stocks, namely Vita Coco Company COCO, Vital Farms VITL and Colgate-Palmolive CL.

Vita Coco, which develops, markets and distributes coconut water products, currently sports a Zacks Rank #1 (Strong Buy). COCO has a trailing four-quarter earnings surprise of 25.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vita Coco’s current financial-year sales and earnings suggests growth of 3.5% and 37.8%, respectively, from the year-ago reported numbers.

Vital Farms offers a range of produced pasture-raised foods. It currently sports a Zacks Rank of 1. VITL has a trailing four-quarter average earnings surprise of 102.1%.

The consensus estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Colgate, which manufactures and sells consumer products, currently carries a Zacks Rank #2 (Buy). CL delivered an earnings surprise of 4.4% in the trailing four quarters, on average.

The Zacks Consensus Estimate for Colgate’s current fiscal-year sales and earnings suggests growth of 3.9% and 9.3%, respectively, from the year-ago reported numbers.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

Newell Brands Inc. (NWL) : Free Stock Analysis Report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.