OUTFRONT Media‘s OUT well-diversified portfolio of advertising sites and large-scale presence bodes well. Also, strategic investments and expansion efforts to enhance its digital billboard portfolio provide scope to capitalize on long-term growth opportunities.

The Zacks Consensus Estimate for its 2024 funds from operations (FFO) per share stands at $1.71, indicating an increase of 1.3% from the year-ago reported figure.

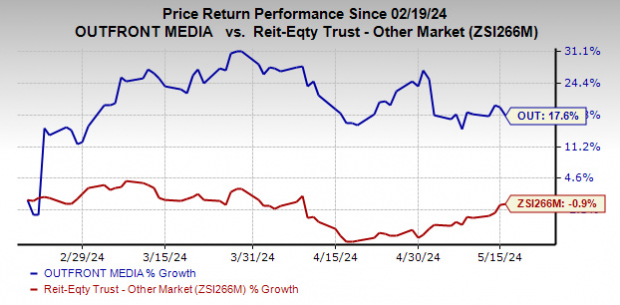

Over the past three months, shares of this Zacks Rank #2 (Buy) company have gained 17.6% against the industry‘s decline of 0.9%. Given the strength in its fundamentals, there seems to be additional room for growth for this stock.

Image Source: Zacks Investment Research

Factors That Make OUTFRONT Media a Solid Pick

Portfolio Diversification: OUT’s advertising sites are geographically diversified, with a solid presence across the United States and Canada. This geographic diversity enables its clients to reach a national audience and provides the flexibility to tailor campaigns to specific regions or markets.

This out-of-home (“OOH”) advertising company not only provides communication and advertising services for several transit authorities but also offers services to various industries, including entertainment, healthcare/medical and retail.

The diversification makes the company’s revenues less volatile in nature.

Focus on Digital Billboards: OUTFRONT Media has been making strategic investments in its digital billboard portfolio over the years. In the first quarter of 2024, the company built or converted 32 new digital billboard displays in the United States and seven in Canada.

In 2023, the company built or converted 84 and 45 new digital billboard displays in the United States and Canada, respectively. Its total digital billboard displays reached 2,191 at the end of 2023, up from 1,970 at the end of 2022.

These demonstrate the company’s efforts to shift its business from traditional static billboard advertising to digital displays, which are helping expand the number of new advertising relationships, thereby providing the scope to boost digital revenues.

Industry Tailwinds: Since the cost of advertisement through the OOH medium is also comparatively lower than other media alternatives, the OOH advertising space has been gaining traction, with a significant increase in its market share, in comparison with other forms of media. In the upcoming years, higher technology investments are expected to provide further support to OOH advertising.

Capitalizing on this, the company is expanding its footprint and providing unique technology platforms to marketers in order to tap growth opportunities.

In March 2024, it announced the expansion of programmatic transit advertising in New York City’s Metropolitan Transportation Authority (MTA) system. It would cover nearly all subway stations owned by the MTA across New York City’s five boroughs and key areas of Long Island and Metro-North Railroad Systems. This expansion will create America’s largest programmatically available full-motion transit network.

Acquisitions: OUTFRONT Media has capitalized on acquisitions to enhance its portfolio. For the three months ended Mar 31, 2024, the company carried out asset acquisitions for a total of $6 million. It also carried out asset acquisitions for a total of $33.7 million in 2023, $353.9 million in 2022 and $136.5 million in 2021. With such expansion efforts, the company remains poised to grow over the long term.

Favorable Valuation: OUT stock has a Value Score of B. Our research shows that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best upside potential.

Other Stocks to Consider

Some better-ranked stocks from the REIT sector are Lamar Advertising LAMR and Cousins Properties CUZ, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for LAMR’s current-year FFO per share has moved 3.7% northward over the past month to $8.03.

The Zacks Consensus Estimate for CUZ’s 2024 FFO per share has been raised marginally over the past two months to $2.61.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.