Lantheus Holdings, Inc. (LNTH) stands poised for growth fueled by an unwavering commitment to pipeline development. The company’s resilience in light of macroeconomic concerns and dependency on third parties may pose challenges. Despite facing headwinds, Lantheus has displayed promise, benefiting from its strategic approach to radiopharmaceuticals.

Steering Through Industry Turbulence

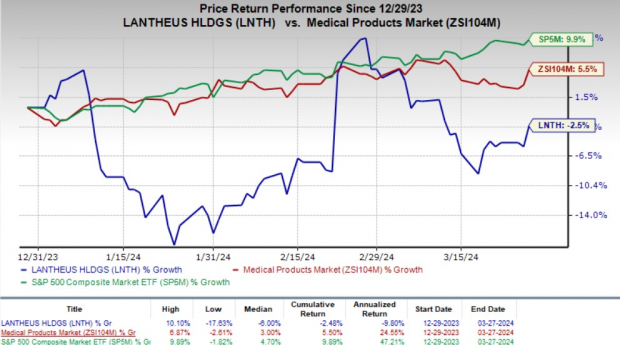

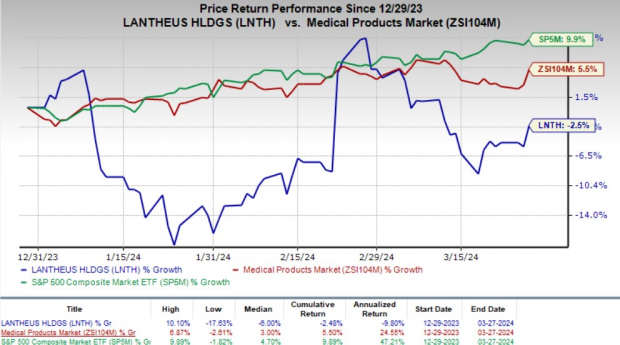

In the last year, Lantheus witnessed a modest decline of 2.5% compared to the industry’s 5.5% surge, while the S&P 500 experienced a 9.9% uptick. The company currently boasts a market cap of $4.03 billion and projects a growth rate of 5.6% for 2024, anticipating sustained business enhancements. Notably, Lantheus has consistently outperformed earnings expectations, averaging a 14.8% surprise over the past four quarters.

Image Source: Zacks Investment Research

Within the radiopharmaceutical space, Lantheus has emerged as a frontrunner, particularly excelling in prostate-specific membrane antigen (PSMA) positron emission tomography (PET) imaging. The company’s product, PYLARIFY, has garnered significant demand, accentuating Lantheus’ market presence and reinforcing its position in the industry. Notably, the recent FDA approval for label expansion of DEFINITY (Perflutren Lipid Microsphere) in pediatric patients signifies a strategic move, enhancing the company’s product portfolio.

Leveraging Growth Opportunities

Pipeline Development: Lantheus has strategically expanded its pipeline, securing promising assets such as PNT2002 and PNT2003 through collaborations with POINT Biopharma Global Inc. This development underscores the company’s commitment to innovation and future growth prospects.

Strong Q4 Results: Lantheus exhibited solid performance in the fourth quarter of 2023, reflecting robust top-line and bottom-line figures. The company’s relentless focus on key products like PYLARIFY and DEFINITY has bolstered its financial position, evidenced by favorable gross margin expansion.

Overcoming Challenges

Macroeconomic Concerns: Lantheus remains susceptible to the ever-shifting economic landscape, which could impact operational and financial outcomes unpredictably. Factors influencing healthcare service demands and pharmaceutical needs pose uncertainties, potentially affecting the company’s revenue stream and overall financial stability.

Dependency Upon Third Parties: The production of PYLARIFY across various PET manufacturing facilities (PMFs) necessitates FDA approval at each location. While Lantheus is actively seeking to onboard additional PMFs, the uncertain approval process and manufacturing capabilities of these facilities could pose operational risks, impacting the company’s future trajectory.

Forecasting Growth

Recent estimates indicate a positive trend for Lantheus in 2024, with a 5.1% upward revision in the Zacks Consensus Estimate for earnings per share, now standing at $6.58. Moreover, first-quarter 2024 revenues are projected to reach $349 million, showcasing resilience in the face of industry challenges.

Conclusion

While Lantheus navigates industry complexities, its strategic focus on radiopharmaceuticals, pipeline expansion, and prudent financial management position it for sustained growth. By addressing macroeconomic concerns and reducing dependence on third parties, Lantheus can unlock latent potential, offering investors a compelling opportunity in the evolving healthcare landscape.