Climbing against the tides of market unpredictabilities, Nordson Corporation NDSN continues to paint a picture of strength and resilience within the industrial sector. The company has found a goldmine of success in its Industrial Precision Solutions segment, leveraging the soaring demand for its packaging and nonwoven product offerings. Fueling the flame of profitability further, the Medical and Fluid Solutions segment thrives on the back of robust demand for its fluid solutions in the industrial and electronics realms, propelling revenues skyward.

With a bullish outlook, Nordson Corporation envisions its sales reaching the stellar orbit of $2.665-$2.705 billion in fiscal 2024. This trajectory hints at a 2.1% year-over-year growth at the midpoint, a testament to the company’s enduring prowess in the market.

The Strategic Chess Moves

Every successful company is a master of strategic chess moves, and Nordson Corporation is no exception. In August 2024, the company sealed the deal on acquiring Atrion Corporation, a strategic leap that broadened its horizons by integrating Atrion’s major businesses — Halkey Roberts, Atrion Medical, and Quest Medical. This strategic alliance opens up avenues for Nordson Corporation to widen its footprint in the infusion and cardiovascular therapies market.

Another notable power play was the ARAG Group acquisition in August 2023. This move not only bolstered the company’s core competencies in precision dispensing technology but also served as a launchpad for Nordson into the thriving precision agriculture end-market. The expanse of acquired assets reflected positively in a 4% upswing in total revenues during the third quarter of fiscal 2024.

A Promise in Dividends and Buybacks

True to its pledge, Nordson Corporation stands firm in its commitment to shareholders. In the first nine months of fiscal 2024, the company dished out dividends worth $116.8 million, marking a 4.8% year-over-year increment. Adding to this, a share repurchase spree saw Nordson buying back shares amounting to $34.1 million in the same period.

Not content with the status quo, the company upped the ante by hiking its dividend by a solid 15% to 78 cents per share in August 2024, making it the 61st consecutive year of dividend increase for the stalwart.

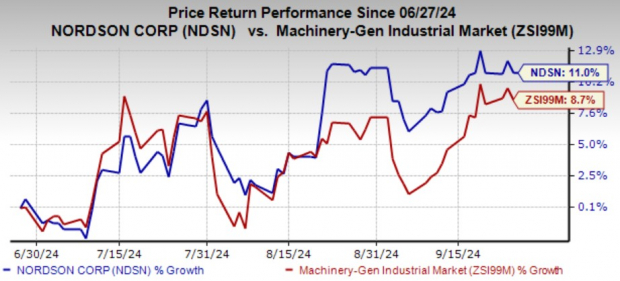

In the topsy-turvy world of stocks, Nordson Corporation has charted a course that saw its shares ascend by 11% over the last three months. This impressive feat stood tall against the industry’s 8.7% growth, a testament to the company’s mettle and mettle in the face of market fluctuations.

Yet, challenges loom on the horizon. The performance of the Advanced Technology Solutions segment is clouded by diminished demand for electronics processing and x-ray and test product lines. Similarly, soft demand in the Medical and Fluid Solutions segment perturbs the waters, especially in interventional solutions and fluid components.

Watchful eyes pin the threat posed by escalating costs and expenses, which have the potential to cast shadows on Nordson Corporation’s bottom line. The third fiscal quarter saw a 1.5% uptick in cost of sales due to rising raw material costs, while selling and administrative expenses surged by 2.4% due to escalating acquisition costs. The accentuated percentage of selling and administrative expenses in relation to total revenues, climbing to 30.5%, underscores the necessity for a judicious financial strategy.

Exploring Greener Pastures

The terrain of industrial stalwarts offers a vista of opportunity, with companies like Flowserve Corporation, Crane Company, and RBC Bearings making waves. Flowserve Corporation boasts a Zacks Rank #2 (Buy) and an impressive trailing four-quarter average earnings surprise of 18.2%. Crane Company makes a mark with a Zacks Rank of 2 and a trailing four-quarter average earnings surprise of 11.2%. RBC Bearings, holding a Zacks Rank of 2, offers a rousing tale with a trailing four-quarter average earnings surprise of 4.8%, underpinning the opportunities rife in the market.

The Looming Infrastructure Stock Surge

A future of infrastructure stock boom beckons the industrial universe. As America gears up to revamp its infrastructure, the opportunity is rife, the momentum palpable, and the potential immense. Trillions are set to be infused into this venture, paving the way for fortunes to be made.

Are you in for the ride of a lifetime, poised to benefit from the colossal spending on infrastructure? Zacks offers a Special Report to guide you through this journey, ensuring you find your way to the stocks with the greatest growth potential. The report is now available for free, promising insights into the 5 companies poised to reap the most benefits from the upcoming transformations in infrastructure.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>