Energy Sector Stocks: Uncovering Opportunities in Oversold Markets

Investors may find value in the energy sector as several stocks are currently labeled as oversold.

The Relative Strength Index (RSI) serves as a momentum tool that measures a stock’s performance. It does so by comparing days when a stock’s price increases to days when it decreases. Stocks with an RSI below 30 are generally thought to be oversold, according to Benzinga Pro, suggesting potential buying opportunities.

Below is a list of notable stocks in the energy sector that have an RSI approaching or below the 30-mark.

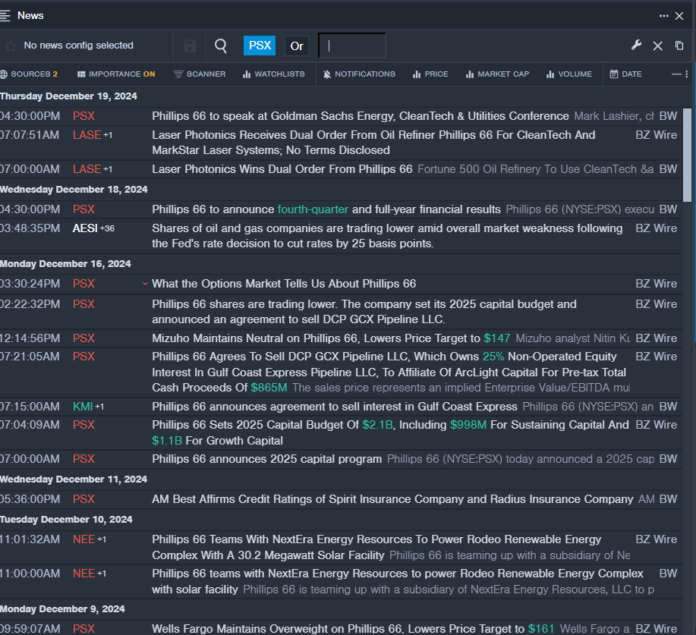

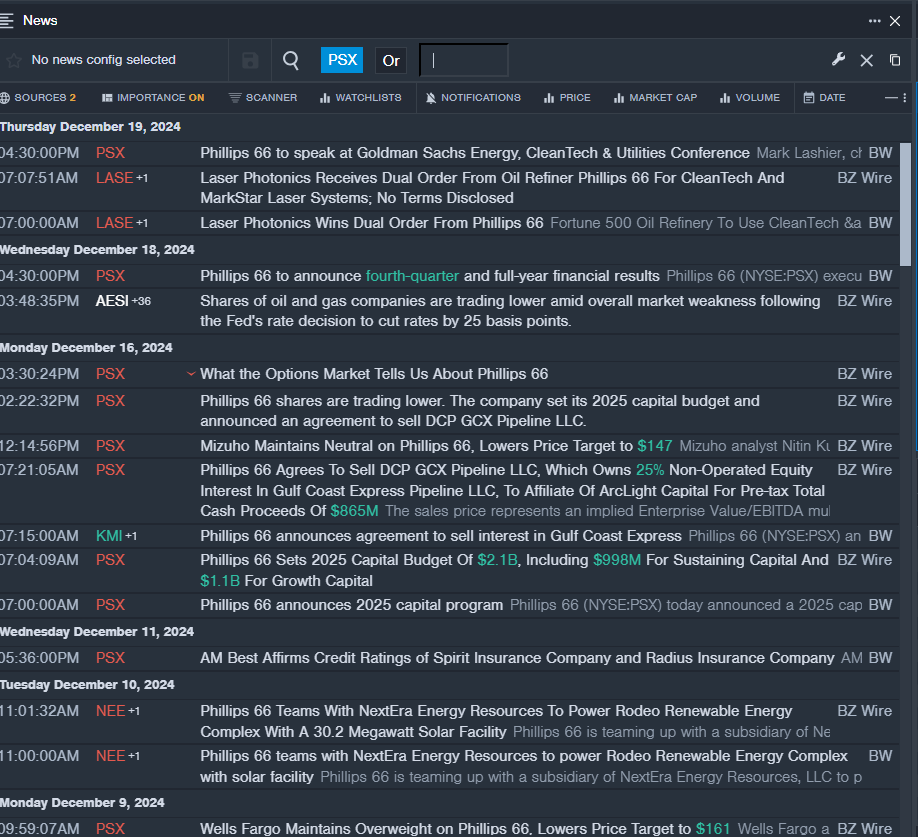

Phillips 66 PSX

- On December 16, Phillips 66 revealed its 2025 capital budget and announced plans to sell DCP GCX Pipeline LLC. Over the last month, the stock has seen a decline of about 16%, reaching a 52-week low of $108.90.

- RSI Value: 26.9

- PSX Price Action: The stock climbed 1.7%, closing at $113.93 on Tuesday.

- Benzinga Pro’s real-time alerts provided updates on the latest developments surrounding PSX.

Halliburton Co HAL

- On December 18, Barclays analyst David Anderson downgraded Halliburton from Overweight to Equal-Weight, adjusting the price target from $43 to $33. The stock dropped approximately 14% in the last month, with a 52-week low of $25.51.

- RSI Value: 29.5

- HAL Price Action: Halliburton’s shares increased by 0.9%, closing at $27.19 on Tuesday.

- Insights from Benzinga Pro’s charting tools helped highlight the current trends affecting HAL stock.

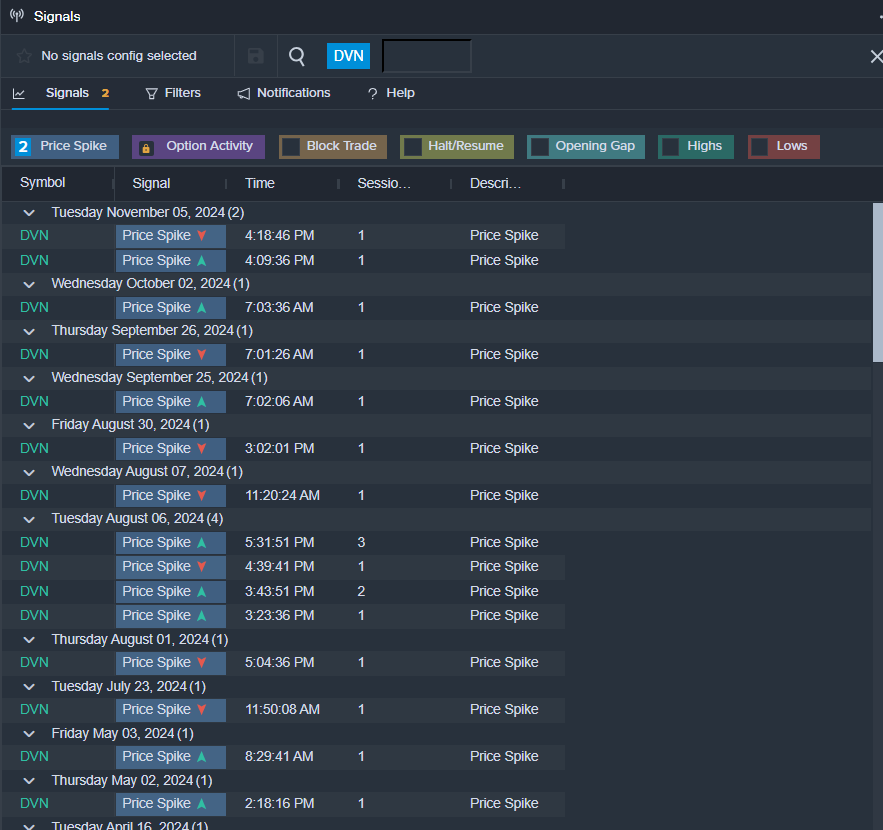

Devon Energy Corp DVN

- Devon Energy has announced the retirement of its CEO and Director, effective March 1. The stock has fallen about 13% in the past month, marking a 52-week low of $30.39.

- RSI Value: 26.6

- DVN Price Action: Devon Energy’s shares rose 2.4%, closing at $32.73 on Tuesday.

- Signals from Benzinga Pro indicated a potential breakout for DVN shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs