Hewlett Packard Enterprise: Strong Performance Amid Uncertain Times

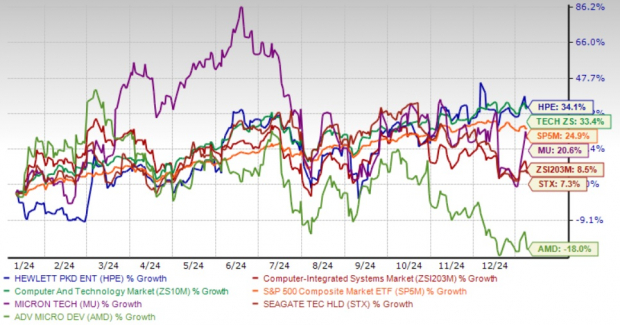

Hewlett Packard Enterprise Company HPE has shown impressive growth over the past year, with its stock rising by 34.1%. This outpaces the returns of the Zacks Computer – Integrated Systems sector, the Zacks Computer and Technology sector, as well as the S&P 500 index, which reported returns of 8.5%, 33.4%, and 24.9%, respectively. HPE also outperformed notable competitors like Micron MU, Seagate Technology STX, and Advanced Micro Devices AMD.

Despite this strong showing, investors must consider whether there’s still potential for growth or if taking profits is the way to go. Holding onto the stock for now may be the best approach.

Key Drivers: GreenLake and AI Leverage HPE’s Growth

The surge in HPE’s stock can be attributed to its robust performance in key areas, especially HPE GreenLake and artificial intelligence (AI) systems. Companies are increasingly adopting HPE GreenLake for its flexibility and scalability, which aids in IT transformation.

Hewlett Packard Enterprise Price Performance Chart

Image Source: Zacks Investment Research

In the fourth quarter of fiscal 2024, HPE saw its GreenLake customer base grow by about 34.5% year over year, reaching 39,000. This rise contributed to an annualized revenue run rate that climbed 48% year over year, surpassing $1.9 billion by the end of the fiscal fourth quarter.

Additionally, demand for HPE’s AI offerings remains strong. The company reported $6.7 billion in cumulative orders for AI products and services since fiscal 2023’s first quarter, with new AI orders contributing to a backlog of $3.5 billion by the fourth quarter of fiscal 2024.

Valuation: HPE Presents a Good Opportunity

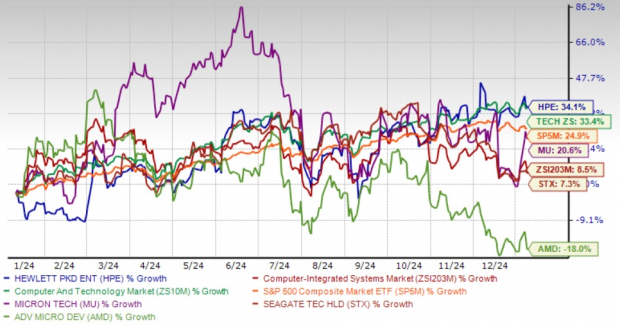

The current valuation of HPE adds to its appeal. The stock is trading at a forward 12-month price-to-earnings (P/E) ratio of 10.31, well below the Zacks Computer – Integrated Systems industry’s average of 19.39. Additionally, its forward 12-month price-to-sales (P/S) ratio stands at 0.89, compared to the industry average of 3.34. This favorable valuation suggests that HPE could be a strong choice for long-term investors.

Hewlett Packard Enterprise P/E (F12M) Chart

Image Source: Zacks Investment Research

Short-Term Headwinds Challenge HPE’s Outlook

Despite the positive aspects of HPE’s growth from AI adoption, the company is confronting challenges. Declining IT spending may impact HPE’s near-term outlook, as higher interest rates and ongoing inflation are squeezing consumer spending. Companies are deferring large IT investments due to a sluggish global economy and various geopolitical issues.

HPE’s Intelligent Edge division has faced pressures from increased inventory levels among customers, leading to a 20% year-over-year revenue decline in this sector during the fourth quarter of fiscal 2024. Demand for HPE’s switching and campus solutions has weakened in this area.

Furthermore, a reliance on low-margin Intelligent Edge revenues is affecting HPE’s overall gross margin. The company’s non-GAAP gross margin fell by 390 basis points (bps) year over year and by 90 bps from the previous quarter, settling at 30.9% in the fourth quarter.

Also, HPE’s financial services division has only seen minimal growth, with revenue of $893 million reflecting a 2% increase year over year for the fourth quarter of fiscal 2024. Both segments have shown softer performance due to reduced IT spending.

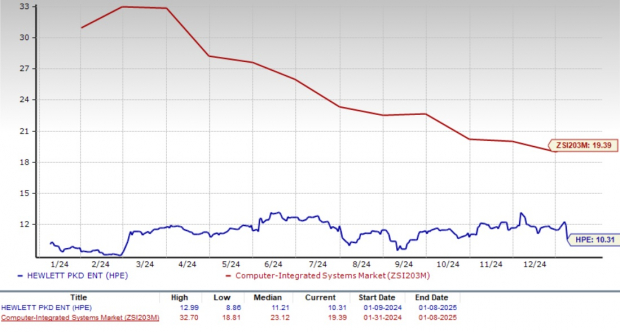

Current forecasts from Zacks Consensus for fiscal 2025 and 2026 do not indicate a robust financial recovery for HPE. Earnings estimates for fiscal 2025 have been revised downward to $2.10 over the past month, while estimates for fiscal 2026 earnings have also been cut to $2.28.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Conclusion: Continue to Hold HPE Stock

HPE’s growth driven by GreenLake and AI offers promising long-term potential. However, short-term hurdles like softening demand and margin pressures introduce some caution. With its attractive valuation and solid market standing, it seems prudent to hold onto the stock for now. As HPE works through these challenges, investors who remain patient may find their investment pays off in the longer run.

HPE stock currently holds a Zacks Rank #3 (Hold). For those interested, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names “Single Best Pick to Double”

Among a vast number of stocks, five Zacks experts selected their top choice expected to gain +100% or more in the coming months. From these, the Director of Research, Sheraz Mian, identified one with the most explosive potential.

This featured company focuses on millennial and Gen Z markets, generating nearly $1 billion in revenue last quarter. A recent price drop offers a great entry point. While not every recommendation turns out to be a winner, this one is poised to greatly outshine previous Zacks recommendations, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Get insights on our Top Stock and four runners-up.

Interested in the latest picks from Zacks Investment Research? Download our free report outlining the 7 Best Stocks for the Next 30 Days.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Seagate Technology Holdings PLC (STX): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.