HSBC Upgrades Trane Technologies to Buy Amid Fund Growth

Fintel reports that on April 25, 2025, HSBC upgraded its outlook for Trane Technologies (BIT:1TTH) from Hold to Buy.

Fund Sentiment Overview

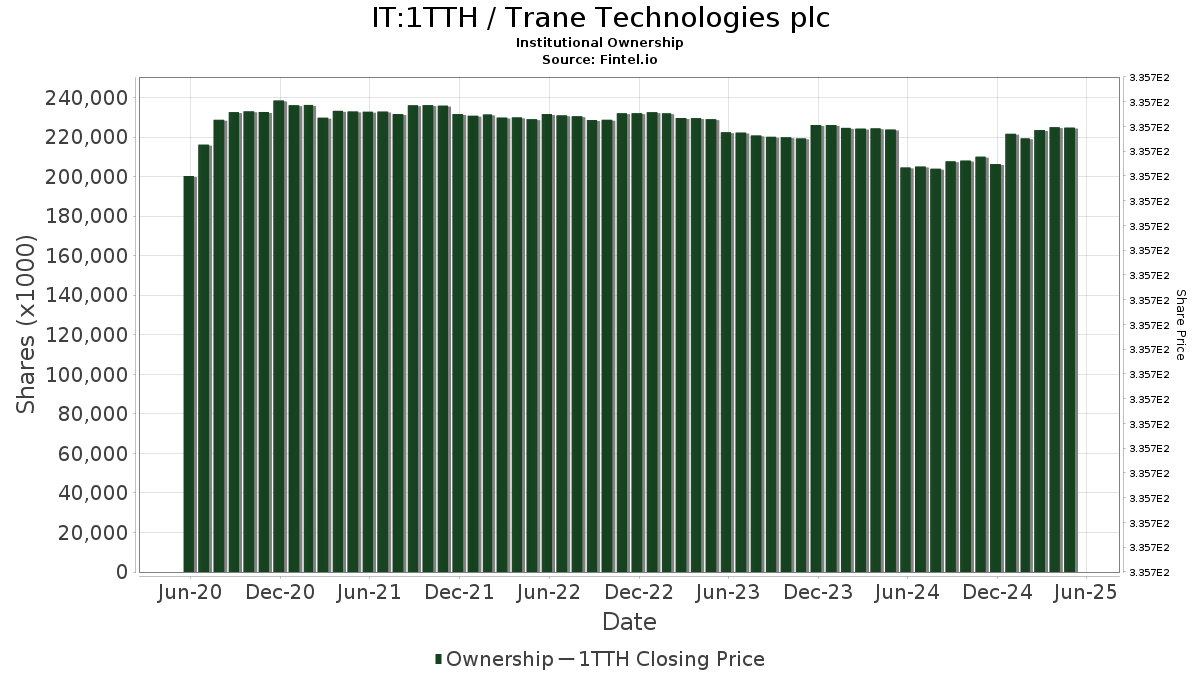

Currently, there are 2,646 funds or institutions reporting positions in Trane Technologies. This represents an increase of 102 owners, or 4.01%, over the last quarter. The average portfolio weight of all funds dedicated to 1TTH is 0.39%, reflecting an astounding increase of 6,673.45%. Additionally, total shares owned by institutions have risen by 2.47% in the past three months, reaching 224,722K shares.

Shareholder Adjustments

JPMorgan Chase holds 14,314K shares, which accounts for 6.42% ownership in the company. The firm reported a decrease of 9.39% from its previous holding of 15,658K shares. This represents a 14.88% reduction in portfolio allocation to 1TTH over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 7,046K shares, equating to 3.16% ownership. Previously, the firm held 7,148K shares, marking a decrease of 1.44% and a reduction of 7.70% in its portfolio allocation over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares possesses 6,091K shares, reflecting a 2.73% ownership stake. An increase of 2.97% was noted compared to its prior holding of 5,911K shares. However, the firm still reduced its portfolio allocation in 1TTH by 7.36% last quarter.

Geode Capital Management holds 4,775K shares, representing 2.14% ownership. The firm observed a slight increase of 2.86% from its previous holding of 4,639K shares, while also lowering its portfolio allocation by 6.29% in the last quarter.

Ameriprise Financial possesses 3,343K shares, which signifies a 1.50% ownership in Trane Technologies. The firm previously held 3,213K shares, showing an increase of 3.91%, but it also decreased its portfolio allocation by 1.24% over the past quarter.