HSBC Shares Surge as the Bank Restructures for Future Growth

HSBC Holdings saw its shares peak at a five-year high of $49.46 during Thursday’s trading session. So far this year, the stock has increased by 21.5%, vastly outperforming the industry average increase of 7.8%.

During the same period, HSBC’s competitor, UBS Group AG, has experienced a decline of 0.9%, while Barclays has soared by 70.5%.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

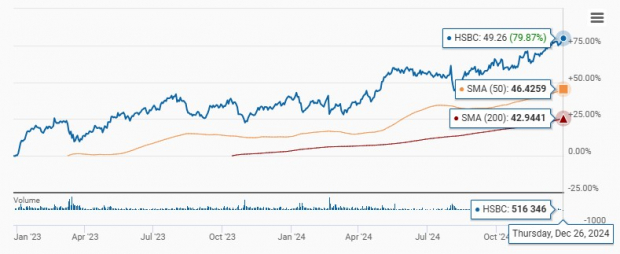

Recent technical indicators point to strength for HSBC. The stock is trading above both its 50-day and 200-day moving averages, suggesting strong upward momentum and stability. Such performance reflects positive market sentiment and investor confidence in the company’s overall health and future growth as it pivots towards Asia and simplifies its global operations.

50-Day & 200-Day Moving Averages

Image Source: Zacks Investment Research

HSBC is actively restructuring to reduce costs and simplify operations. Its goal is to become a leading financial institution catering to high-net-worth clientele in Asia. Recently, HSBC announced several divestitures, including a deal to sell its French life insurance division to Matmut Société d’Assurance Mutuelle. In September 2024, it agreed to sell its private banking division in Germany to BNP Paribas, as well as its South Africa operations to FirstRand Bank and Absa. Other divestitures include its Argentina unit announced in April 2024 and its Armenian unit in February. Notably, HSBC has already exited retail banking ventures in various countries, including the U.S., Canada, France, New Zealand, Greece, and Russia.

Funds from these sales will be reinvested in expanding HSBC’s footprint in Southeast Asia and China, regions where the bank has a strategic advantage. The company has already acquired Citigroup’s retail wealth management business in China and a stake in Singapore’s SilkRoad Property Partners Group, in addition to reviving its private banking operations in India.

To streamline operations, HSBC is restructuring into four main divisions: Hong Kong, UK, Corporate & Institutional Banking, and International Wealth & Premier Banking. This change aims to eliminate inefficiencies and improve execution speed, a strategy also being adopted by BCS and UBS as they fine-tune their focus on core business areas to enhance profitability.

Despite a challenging macroeconomic landscape, HSBC’s financial stability remains strong. With a solid capital position and a lower debt-to-equity ratio than its peers, HSBC consistently rewards its shareholders. The bank is targeting a dividend payout ratio of 50% (excluding acquisition and divestiture effects) for 2024, along with a share buyback initiative of up to $3 billion, expected to conclude by February 2025.

HSBC Stock Trading at a Discount

HSBC shares currently trade at a 12-month trailing price-to-tangible book (P/TB) ratio of 0.89X, significantly lower than the industry’s 1.99X, indicating that the stock may be undervalued.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

In comparison, HSBC’s stock is cheaper than UBS, which has a P/TB ratio of 1.27X. Conversely, it trades at a premium above Barclays’ P/TB of 0.60X.

Is HSBC Stock Worth Investing In?

HSBC’s strong capital base, ongoing restructuring, and operational simplification align well with its strategic pivot towards Asia. The company’s brand strength, competitive rates, and global network are favorable factors. By 2025, HSBC is expected to capitalize on its transition away from less profitable global operations.

Considering its promising long-term outlook and advantageous valuation, investors may find it appealing to invest in HSBC shares now. Existing shareholders might also want to hold their positions for the potential high returns ahead.

Currently, HSBC has a Zacks Rank of #2 (Buy). You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be informed early about our top 10 picks for the entire year of 2025?

History shows their outcomes could be remarkable.

Since 2012, when our Director of Research Sheraz Mian took over the portfolio, the Zacks Top 10 Stocks gained over +2,112.6%, far surpassing the S&P 500’s +475.6%. Now, Sheraz is analyzing 4,400 companies to select the best 10 stocks to buy and hold for 2025. Make sure to seize the opportunity to get in on these stocks when they’re released on January 2.

Stay updated on the latest tips from Zacks Investment Research by downloading 5 Stocks Set to Double. This report is available for free.

Barclays PLC (BCS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.