Investing in Boeing has been like white-knuckling through turbulence on a transatlantic flight. From the tragic mishaps of its aircraft in 2018 to recent quality control concerns culminating in a door detaching from an Alaska Airlines plane mid-flight, it’s been a rollercoaster ride. Amidst this turmoil, the COVID-19 pandemic dealt a final blow, leaving the aerospace giant struggling to regain its footing. But perhaps there is a glimmer of hope on the horizon.

A Revolution in Leadership

Boeing recently dropped a bombshell by announcing a massive overhaul of its executive team. The departure of the CEO, chair of the board, and head of commercial airplanes signals a fresh start for the embattled company. Bringing in new blood holds promise for much-needed reform.

The incoming chair of the board, Steve Mollenkopf, an engineer by trade and former CEO of Qualcomm, seems well-equipped to steer Boeing back on track. Stephanie Pope steps up to lead the commercial airline division, an internal choice with a track record across various Boeing units. Meanwhile, the quest for a CEO intensifies, with Patrick Shannahan, a Boeing veteran with a defense background, emerging as a potential candidate.

As the new leadership takes the reins, all eyes are on Boeing to see if this transformation will mark a turning point in its tumultuous journey.

Rebuilding Production and Prosperity

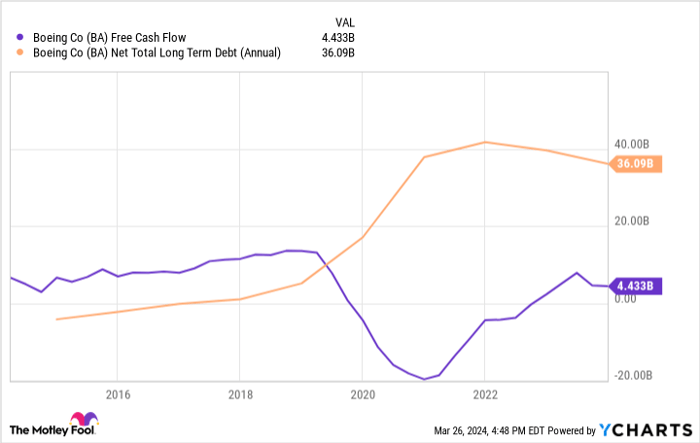

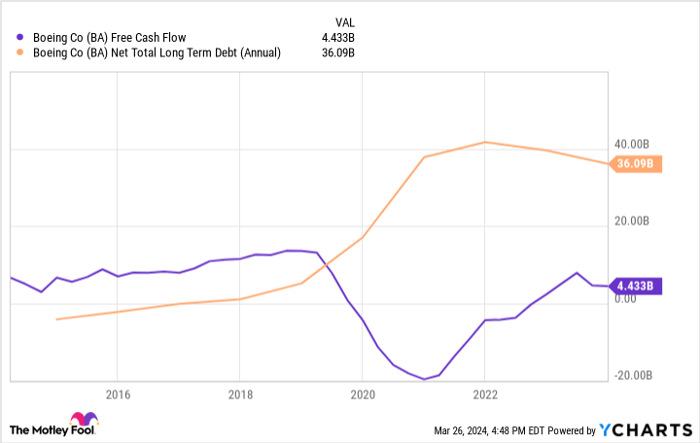

Boeing’s financial woes can find relief through a robust production strategy. Prior to the 737 Max incidents, the company boasted over $10 billion in annual free cash flow. However, post-crisis, production plummeted, adversely impacting cash flow. While there was a modest recovery, recent events threaten this progress.

Yet, Boeing’s grip on the market remains firm with limited competition domestically. The key lies in ramping up production efficiency and quality standards. By achieving these dual objectives, the aviation giant can restore its cash flow to former glory.

BA Free Cash Flow data by YCharts

A Stock Worth the Gamble?

Boeing’s stock valiantly battles to rise from the ashes, currently down 57% from its peak. Laden with a $36 billion debt post-COVID, the company urgently needs to steer its operations back to cash flow stability.

The key once again lies in bolstering production levels. A successful recovery could propel Boeing to $15-20 billion in annual profits by 2030, painting a promising picture for patient investors. However, this dream hinges on the company’s ability to surmount its production challenges.

Is Boeing’s stock a diamond in the rough? It all boils down to its production prowess. A future resurgence could spell riches, but failure to address its production woes may cast a shadow over its prospects. The saga of Boeing’s redemption beckons, with investors watching intently.

Should you invest $1,000 in Boeing right now?

Before diving into Boeing stock, ponder this: The Motley Fool Stock Advisor team has unearthed what they deem the 10 best stocks for investors today, with Boeing notably absent. These chosen stocks hold the potential for monumental returns in the foreseeable future.

Stock Advisor offers a roadmap to success, offering insights on portfolio building and a steady influx of stock recommendations. Since 2002, it has outperformed the S&P 500 by a wide margin*

See the 10 stocks

*Stock Advisor returns as of March 25, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Qualcomm. The Motley Fool recommends Alaska Air Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.