The recent collaboration announcement between Intel (NASDAQ: INTC) and Amazon‘s (NASDAQ: AMZN) cloud computing division, Amazon Web Services (AWS), has set the financial world abuzz. This partnership not only involves co-designs on new computer chips utilizing Intel’s architecture but also includes substantial spending commitments on Intel’s forthcoming manufacturing plants.

Despite Intel’s stock soaring 10% on this news, it still struggles, down approximately 70% from its decade-high position. Fierce competition from other chip manufacturers and lagging advancements in semiconductor manufacturing have hampered Intel’s progress lately. However, with Amazon showing strong faith in Intel, one of the largest purchasers of computer chips worldwide, the tide may just be turning.

The burning question: Should you jump on the Intel bandwagon?

A Helping Hand from Amazon

AWS, the titan of cloud computing services, heavily relies on robust computer chip infrastructure. Amazon’s massive spending on semiconductors – estimated in the tens of billions – powers its extensive network of data centers. While Intel has historically been a significant supplier to AWS and other data center clients, it has lagged behind in AI compared to rivals like Nvidia and Advanced Micro Devices. Nvidia’s prowess in AI has allowed it to impose substantial price hikes on customers like AWS, propelling Nvidia’s stock to stratospheric heights.

The collaboration between Amazon and Intel seems a strategic fit. Intel needs financial injections to close the gap with Nvidia, while Amazon seeks to avert exorbitant price surges from Nvidia by fostering competition and diversifying its chip suppliers. This partnership could not only reduce Amazon’s reliance on Nvidia but also pave the way for significant investments in Intel’s upcoming chip innovations.

As Intel and Amazon join forces to co-create cutting-edge computer chips, they signal a united front against the competition. This collaborative effort holds promise for both companies’ futures in the tech landscape.

Forging U.S. Subsidized Manufacturing

While chip design is one aspect of the Intel-Amazon partnership, the other – perhaps more pivotal – involves custom-designing chips for Intel’s new Ohio-based manufacturing plants. Intel’s significant investment in these facilities echoes its shift towards a foundry business model, producing chips for third parties such as Amazon. Previously focused on internal chip designs, Intel’s move to outsourced manufacturing led to technological setbacks over the past decade.

Intel’s foundry business faces challenges, evident from its $4.3 billion revenue and $2.8 billion operating loss last quarter. To steer this unit towards profitability, Intel requires substantial commitments from clients to offset the hefty fixed costs of running these manufacturing facilities. Amazon’s embrace as a key customer marks a pivotal stride forward.

Watchful eyes should also track Intel’s potential grants from the U.S. government under the CHIPS Act, designed to buoy domestic chip manufacturing amid geopolitical concerns with China. Intel has already secured $3 billion for defense-focused chip endeavors, a positive start that could be further instrumental in enhancing its chip production capabilities.

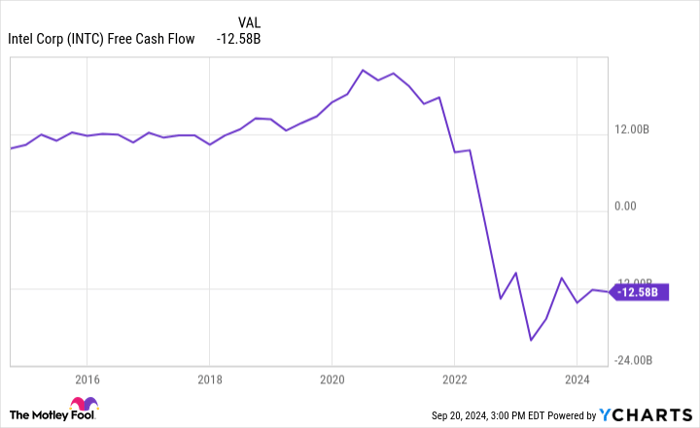

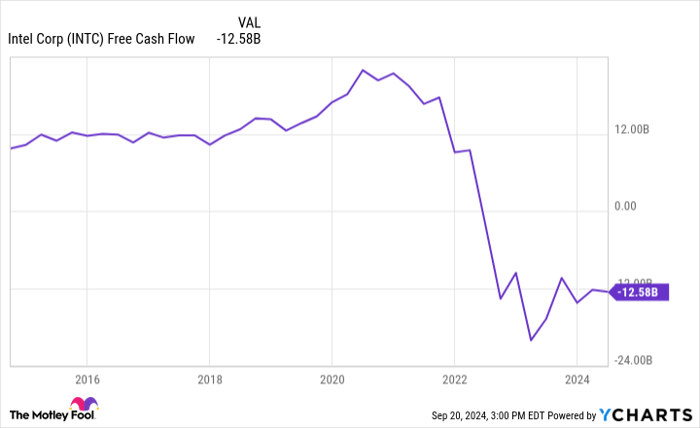

INTC Free Cash Flow data by YCharts

Navigating Turbulent Waters Towards Calmer Horizons

Intel’s current financial landscape appears rugged, with an annual free cash flow burn exceeding $12 billion amid market share erosion to Nvidia and significant investments in new foundry sites. At face value, Intel’s stock seems unattractive despite the substantial dip from its historical highs.

However, this challenging phase could be Intel’s nadir. With the U.S. government keen on fostering Intel’s success and likely to extend further support, the company is poised for potential subsidies. Amazon’s substantial chip expenditures confirm the tech giant’s vote of confidence in Intel. Not to mention, Intel boasts nearly $30 billion in cash reserves, cushioning temporary financial strains. The headwinds from the foundry expansions are expected to abate once these state-of-the-art facilities commence operations.

All factors considered, now might be the opportune moment to consider delving into Intel shares. As a cherished brand with a legion of supporters rooting for its resurgence, investing in Intel and holding for the long haul could prove a wise move.

Is Investing in Intel Stock Now a Smart Move?

Before leaping into Intel stocks, ponder upon this:

The Motley Fool Stock Advisor analysts have identified what they deem the 10 best stocks in which investors should stake their claims, and Intel didn’t make the cut. These selected stocks hold potential for substantial returns in the forthcoming years.

Recall when Nvidia graced this list on April 15, 2005… with a $1,000 investment back then, you’d be sitting on $710,860!*

Stock Advisor offers a roadmap to investment success, featuring portfolio-building guidance, analyst updates, and bi-monthly stock picks. Over the years, the Stock Advisor service has surpassed the S&P 500’s returns since 2002*

Explore the top 10 stocks »

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, sits on The Motley Fool’s board of directors. Brett Schafer has holdings in Amazon. The Motley Fool has stakes in and endorses Advanced Micro Devices, Amazon, and Nvidia. The Motley Fool advocates for Intel and suggests considering options: short November 2024 $24 calls on Intel. The Motley Fool abides by a disclosure policy.

The perspectives articulated here represent the author’s views and opinions, not necessarily those of Nasdaq, Inc.