Rivian (NASDAQ: RIVN) may be a newcomer in the electric vehicle (EV) space, but its journey in the stock market has been nothing short of a rollercoaster ride. With aspirations to rival industry behemoth Tesla, Rivian captured investors’ imaginations when it went public three years ago. However, the stark reality for early investors paints a grim picture of dashed hopes and vanishing fortunes.

Rivian at IPO: The Initial Euphoria

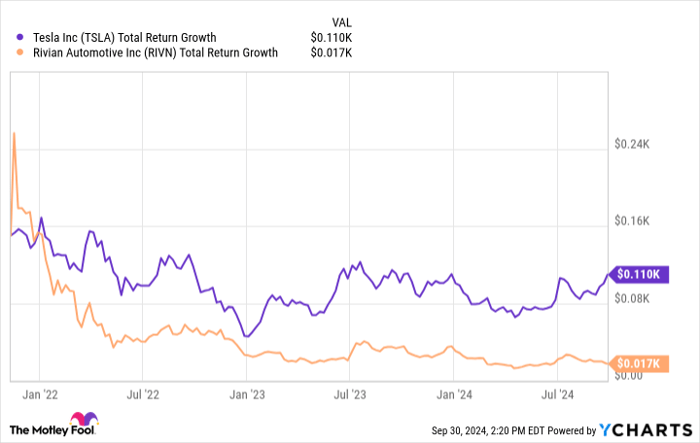

When Rivian made its stock market debut on Nov. 9, 2021, shares opened at $78 and closed the day at over $100. Those who took a leap of faith and invested $150 at the IPO would have had a stake worth merely $17 today. A jaw-dropping plunge that defies logic and rationality, leaving many scratching their heads in disbelief.

While Rivian’s revenue has shown exponential growth, surging from $55 million in 2021 to over $5 billion in the past year, its stock performance tells a different tale. The company’s high valuation, peaking at $153 billion shortly after going public, was a mirage that quickly dissipated as reality set in.

Lessons Learned: A Word of Caution for Investors

The harsh truth facing Rivian investors serves as a sobering reminder of the risks that come with investing in capital-intensive and fiercely competitive industries. Overvaluation and lofty expectations can spell disaster for even the most promising companies. While Rivian’s future prospects with mass-market models look promising, the road ahead remains fraught with uncertainty.

As the EV market grapples with shifting tides and changing demands, even industry leader Tesla has faced headwinds, signaling caution for those looking to dive into the EV sector. Yet, for risk-tolerant investors seeking bargains amidst the rubble of fallen growth stars, Rivian may present an opportunity worth exploring.

Investing Wisely: Look Before You Leap

Before diving into Rivian stock or any investment opportunity, prudent investors would do well to heed the advice of seasoned analysts. The Motley Fool Stock Advisor team, renowned for their astute picks, recently shared their top 10 stock recommendations, with Rivian conspicuously absent from the list.

Reflecting on past successes like Nvidia, where a $1,000 investment in 2005 would have ballooned to a staggering $716,988, underscores the power of shrewd investing decisions. The Stock Advisor service, known for outperforming the S&P 500 since 2002, offers a roadmap to potential financial success for prudent investors.

While each investment carries its unique risks and rewards, the cautionary tale of Rivian stock serves as a poignant reminder to approach opportunities with a discerning eye and a well-informed mind. Regrets may linger for early Rivian investors, but for others, the lesson learned may be worth more than any fleeting gains in the market.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.