Recent evaluations of the iShares U.S. Healthcare Providers ETF (Symbol: IHF) reveal that it holds promising prospects according to analyst target prices. This analysis compares trading prices of its underlying assets to average 12-month target projections from analysts.

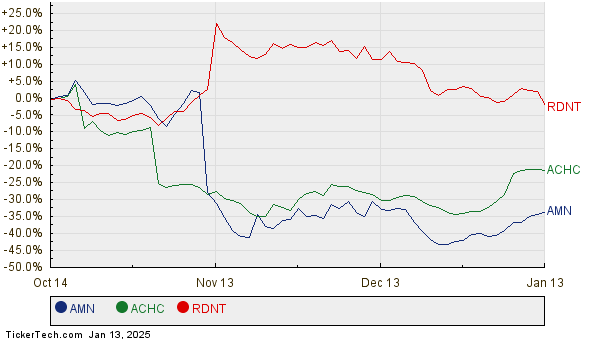

The implied target price for IHF stands at $62.31 per unit. Currently, IHF is trading at around $49.17 per unit, suggesting a potential upside of 26.72% based on these targets. Within this ETF, several stocks show especially strong potential. For example, AMN Healthcare Services Inc (Symbol: AMN) has a recent trading price of $26.87 per share, yet its average analyst target price is set at $43.43, indicating a notable upside of 61.62%. Similarly, Acadia Healthcare Company Inc. (Symbol: ACHC) is priced at $44.92 with an expected average target of $61.46, offering a potential upside of 36.82%. RadNet Inc (Symbol: RDNT) also shows promise, as its current price of $68.78 falls short of an average target of $91.40, translating to an upside of 32.89%. Below is a twelve-month price history chart that illustrates the stock performance of AMN, ACHC, and RDNT:

A summary table of the current analyst target prices is provided below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Healthcare Providers ETF | IHF | $49.17 | $62.31 | 26.72% |

| AMN Healthcare Services Inc | AMN | $26.87 | $43.43 | 61.62% |

| Acadia Healthcare Company Inc. | ACHC | $44.92 | $61.46 | 36.82% |

| RadNet Inc | RDNT | $68.78 | $91.40 | 32.89% |

These targets raise important questions: Are analysts being realistic, or are their predictions overly optimistic? Assessing the rationale behind their target prices is crucial for investors. A significant target in relation to the current market price might indicate bullish expectations, but it may also lead to revisions if those targets reflect outdated information. Investors should conduct further research into the current state of the companies and industry trends.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SIMO Historical Stock Prices

• UCO Options Chain

• FBIN Stock Predictions

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.