Unbeknownst to many, Immuneering Corporation, more commonly symbolized as IMRX, is a fledgling biotech endeavor fixated on crafting revolutionary RAS/RAF medications to battle cancer. Their arsenal, however, lacks a marketable gem, leaning entirely on a budding pipeline for sustenance. Leading the charge is IMM-1-104, a boundary-pushing RAS therapy under scrutiny in a phase I/IIa examination on individuals with advanced solid tumors nurturing RAS mutations.

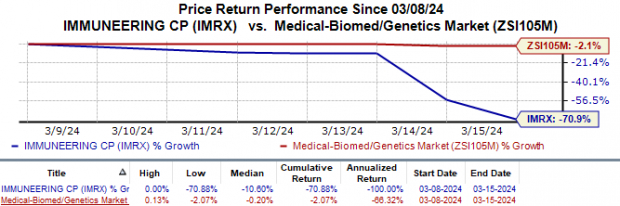

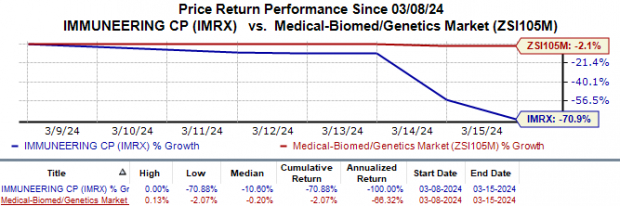

In the recent chronicle, disseminated whispers suggest that Immuneering’s shares have nosedived by a staggering 70.9%, an abyss unmatched by industry peers who merely dipped by 2.1%. This disgraceful plummet followed the grand unveiling of the peak-line conclusions from the phase I leg of the phase I/IIa exploration on IMM-1-104, just last week.

Image Source: Zacks Investment Research

The phase I objectives involved scrutinizing the safety and tolerability of IMM-1-104, pinpointing a designate dose for Phase 2 (RP2D), and appraising pharmacokinetics (PK). By Feb 20 (the fateful cut-off), the management had embarked on roping in heavily-exhausted subjects hosting a dozen diverse RAS mutations throughout eight cancer breeds.

By the cut-off, the drug exhibited a mild reception within the guinea pigs, with a singular grade 3 anomaly (a nonchalant rash). Results flaunted palpable proof of concept, signaling encouraging stirrings of preliminary clinical efficacy through profound cyclic mechanisms. Rooted in this revelation, the authorities sanctioned the 320mg dose as RP2D.

Now, hold your horses! Did this news spark fireworks of joy among investors? Not quite. While the data undeniably greenlit the drug’s journey through the clinical labyrinth, the absence of confirmed responses across varying doses – including the sacrosanct RP2D – precipitated drooping spirits. Given the study’s variegated and sparse population (n=41), discerning the echelon of clinical activity amidst drug-administered participants proved a vexing feat.

Enter the Wall Street soothsayers! Behold, a string of them did take the liberty to downgrade the IMRX stock. Jeffries’ analysts hoisted a ‘Hold’ placard atop the ‘Buy’ signpost, while dramatically slashing the price target to a mere $3 per share, down from its former lofty perch nestled at $16.

Before the proclamation of the aforesaid results, the brass had ceremoniously commenced the dosing of patients in the phase IIa segment. This act segues into the scrutiny of the 320mg dose of IMM-1-104 in the splendid battlegrounds of pancreatic ductal adenocarcinoma (PDAC), non-small cell lung cancer (NSCLC), and melanoma, besides its concoctional escapades in PDAC.

The grand unveiling of the phase IIa segment’s initial bounty is slated for later this annum. A peek at these findings may usher in a clearer tableau, as the management is bent on enlisting a larger troupé scrubbed down by a more elongated follow-up stretch.

Beside the lustrous IMM-1-104, administrators have unleashed a secondary pipeline denizen, IMM-6-415, into the clinical arena. The initiation of its phase I/IIa foray in advanced solid tumors ensemble featuring RAS or RAF mutations is set to unfurl, with the first dose primed for administration ere this month’s curtains cascade.

Immuneering Corporation – A Price Metamorphosis

Immuneering Corporation price | Immuneering Corporation Quote

Zacks Rank & Noteworthy Selections

Sitting comfortably in the Zacks Rank #3 holder’s seat (a ‘Hold’ designation), Immuneering is not entirely cast away just yet. Flanking this outpost are more promising comrades within the healthcare cosmos: ADMA Biologics ADMA, ANI Pharmaceuticals ANIP, and the venerable GSK plc GSK, all cavorting with a Zacks Rank #1 (a ‘Strong Buy’ moniker) presently. Feast your eyes on the complete list of today’s Zacks #1 Rank stocks here…

Examine the whispers on the street – behold the grand tango of analysts and stock enthusiasts alike as they crunch the data for ADMA Biologics. From 22 cents to 30 cents, behold the sonnet of 2024’s earnings per share scaling new peaks in a mere 60 days. The saga of 2025 sings an even more tantalizing tune – 32 cents now swelling to a melodious 50 cents. The faithful shares of ADMA have soared 32.5% year to date.

ANIP’s currency too has been a lyrical delight, with the 2024 earnings per share prancing from $4.06 to a dignified $4.40 over the past two moons. The forthcoming 2025 has not been left behind, galloping from $4.80 to an astounding $5.01. Accompanying this rhythmic beat is the unyielding ascent of ANIP shares by 19.7% since the dawn of this year.

A similar melody resonates in the GSK hall of fame, with 2024’s earnings per share ascending from a humble $3.87 to the more princely $4.03 in the expanse of 60 days. The forthcoming 2025 has more to offer, with the bar raised from $4.20 to a gleaming $4.39. Suffice it to muse, shares of GSK have elevated by 13.8% since the curtain-raiser of this year.

The Infrastructure Stock Uproar Storming the Nation

The gust of wind propelling the United States toward infrastructural rejuvenation is palpable. It’s a call that transcends party lines, an imperative etched in stone. Trillions earmarked, legacies to be etched.

The looming query – Will you ride the early bird onto the right stocks, where the fields are ripest for reaping?”

Zacks unfurls a Special Report, a guiding torch to lead you through this labyrinth, and today, it’s all on the house. Unveil the quintet poised to glean the most from the symphony of reconstruction and repurposing, from highways to high-risers, from cargo trails to the tapestry of energy – a saga as expansive as your most vivid dreams.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Immuneering Corporation (IMRX) : Free Stock Analysis Report

Peruse the original documentation here at Zacks.com.

The views and opinions portrayed herein have sprung from the fertile mind of the author, and may not necessarily echo the reverberations of Nasdaq, Inc.