“`html

Qualcomm’s Modems at Risk as Apple Develops In-House Solutions

According to a recent report by Bloomberg, Qualcomm Incorporated’s QCOM modems are expected to be phased out in the next iPhone models, as Apple Inc. (AAPL) is close to finishing the development of its own modem. While neither company has officially commented, the speculation raises concerns over Qualcomm’s future revenue.

A modem is crucial for smartphones and laptops, allowing them to connect to the internet. Qualcomm’s modems have been integral to iPhones, ensuring fast web browsing and quick access to apps. Their technology requires specialized engineering and extensive industry knowledge, which has contributed to their high performance.

In 2019, Apple acquired Intel Corporation’s (INTC) modem business, aiming to strengthen its presence in this area. This acquisition helped Apple build a skilled team to support their modem development. Despite facing challenges along the way, reports suggest Apple is set to launch its in-house modem soon.

Impact on Qualcomm’s Stock

This news has sparked questions regarding a previous patent agreement between the two companies. In April 2019, Qualcomm and Apple ended ongoing patent disputes with a financial settlement, which included a six-year licensing agreement starting April 1, 2019, with a two-year extension and a multi-year chipset supply agreement.

As a result, Apple began directly licensing chips from Qualcomm instead of relying on manufacturers, which accounted for 20% of Qualcomm’s total revenues.

Qualcomm has anticipated this split by diversifying its revenue streams. The company remains well-positioned to achieve long-term revenue goals, thanks to robust 5G growth and a strategic shift from a mobile communication firm to a connected processor provider. This transition could expand Qualcomm’s total addressable market to around $900 billion by 2030.

Qualcomm is experiencing significant growth in EDGE networking, transforming connectivity in vehicles, businesses, homes, smart factories, PCs, wearables, and tablets. The company plans to integrate artificial intelligence (AI) to meet the rising demand for essential services that facilitate digital transformations in the cloud economy.

With the rapid rollout of 5G technology, Qualcomm stands to gain from investments aimed at enhancing its mobile licensing program. It envisions promising growth within the mobile space, fueled by the strength of its Snapdragon product lineup. Thus, QCOM stock appears to be in a solid position despite the impending competitive pressure from Apple.

Qualcomm’s Strength in Snapdragon and Automotive Sectors

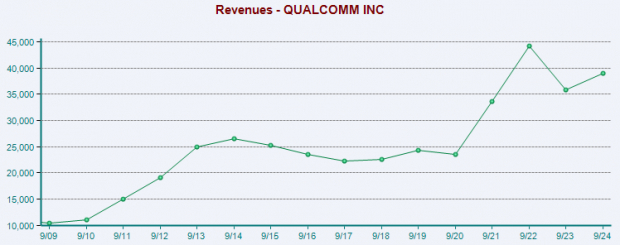

Over the years, Qualcomm has shown impressive revenue growth. The Snapdragon mobile platforms, featuring multi-core CPUs and advanced network connectivity, support immersive augmented reality and virtual reality experiences, as well as superior camera functionalities and top-tier security solutions.

Furthermore, Qualcomm’s automotive telematics and connectivity platforms are driving changes in the automotive industry, including the rise of connected vehicles, improved in-car experiences, and vehicle electrification. The company aims to become the top smartphone radio frequency front-end supplier by revenue soon.

In fiscal Q4 2024, automotive revenues soared 68% to a record $899 million, driven by a rise in new vehicle launches utilizing its Snapdragon Digital Chassis platform. This marks 16 consecutive quarters of double-digit growth in automotive revenues, with expectations of exceeding $4 billion in fiscal 2026.

Image Source: Zacks Investment Research

QCOM Stock Performance Analysis

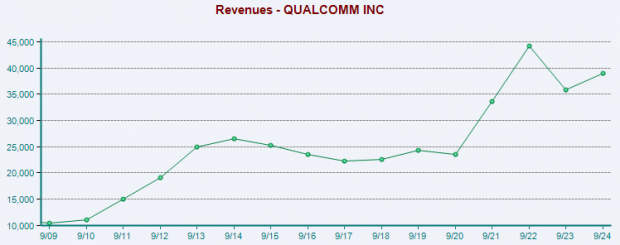

Reflecting a solid growth strategy, QCOM shares increased by 14.4% over the past year, compared to a 33.8% growth in the wireless equipment industry, trailing companies like Hewlett Packard Enterprise Company (HPE) and Broadcom Inc. (AVGO).

One-Year QCOM Stock Price Performance

Image Source: Zacks Investment Research

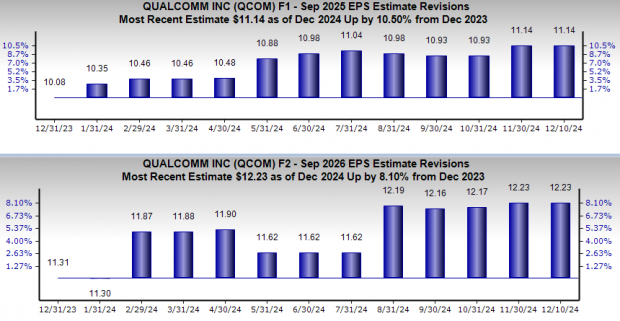

Trends in Earnings Estimates for QCOM

Earnings predictions for Qualcomm have risen. Estimates for fiscal 2024 increased by 10.5% to $11.14, while forecasts for fiscal 2025 jumped 8.1% to $12.23. This upward revision indicates positive market sentiment surrounding the stock.

Image Source: Zacks Investment Research

Conclusion

Given its solid fundamentals and promising revenue potential driven by strong demand trends, Qualcomm remains an attractive investment. The company’s focus on quality, effective operational execution, and ongoing portfolio improvements add value for customers. With rising earnings estimates, QCOM is gaining favor among investors. While Qualcomm’s revenues may face challenges due to Apple’s modem developments, its diversified revenue base will help mitigate any potential impacts.

The stock has a trailing four-quarter average earnings surprise of 7.6% and holds a VGM Score of A. Currently, Qualcomm carries a Zacks Rank #2 (Buy), indicating strong recommendations for interested investors.

Only $1 for Exclusive Access to Zacks Recommendations

No tricks here.

Years ago, Zacks surprised its members by offering 30-day access to all recommendations for just $1, without any future obligations.

While many took advantage of this, others hesitated, thinking there had to be a catch. The intention is to help you explore services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Interested in the latest from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Intel Corporation (INTC) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`