Analyzing Stock Volatility During Trump’s First 100 Days in Office

President Donald Trump’s first 100 days in office spanned from January 20 to April 29. During this time, the S&P 500 (SNPINDEX: ^GSPC) and the Nasdaq Composite (NASDAQINDEX: ^IXIC) saw declines of 7% and 11%, respectively.

Various factors have pressured capital markets this year, including competition from artificial intelligence (AI) platforms in China, geopolitical tensions in Europe and the Middle East, and ongoing trade tariffs.

Let’s examine two notable growth stocks that faced significant volatility during Trump’s initial months in office. We will explore the reasons for their declines and evaluate potential future directions for each.

Image source: Getty Images.

1. Tesla

Tesla (NASDAQ: TSLA) is closely associated with the Trump administration, as shown in its stock price movements from November 5 (election night) to April 29.

Data by YCharts.

Initially, Trump’s election victory appeared to benefit Tesla, driven by two main factors. First, Elon Musk was appointed to lead the Department of Government Efficiency (DOGE), aimed at reducing waste and fraud in government departments. Second, Musk’s close ties to Trump raised expectations his influence might positively affect regulations concerning autonomous vehicles, a critical area for Tesla’s growth.

However, Musk’s involvement with DOGE generated significant public backlash, resulting in boycotts and negative sentiments towards companies connected with him. Consequently, Tesla’s stock price fell by 31% during the administration’s early days. Investors grew concerned about Musk’s divided focus between DOGE and Tesla, impacting the company’s brand reputation.

As of May 12, Tesla has seen a 9% rebound since the end of Trump’s first 100 days and Musk’s reduced role in DOGE. This partial recovery allowed Tesla to rejoin the trillion-dollar market cap club. However, it remains uncertain whether this rebound is sustainable.

The recent uptick in Tesla’s stock can largely be attributed to a temporary easing of the tariff conflict between the U.S. and China, which positively affected the broader stock market. Moving forward, Tesla faces a challenging competitive landscape in the electric vehicle (EV) sector and must also contend with damage incurred to its brand image due to Musk’s involvement in governmental affairs.

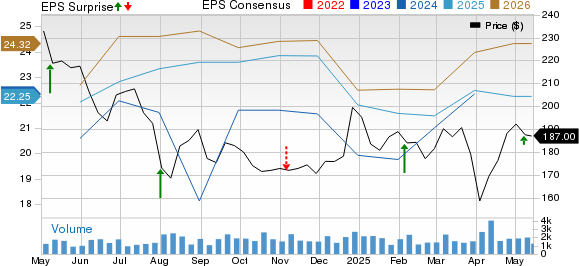

2. Eli Lilly

In contrast, shares of pharmaceutical leader Eli Lilly (NYSE: LLY) increased by 22% during Trump’s first 100 days. While this appears to be a gain, the situation is more complex.

Data by YCharts.

As depicted in the chart, Eli Lilly’s shares were under pressure for much of Trump’s early term but experienced a recovery in late April. Yet, the stock still trades below its 52-week highs. Analysts predict potential headwinds for Eli Lilly due to forthcoming changes in Trump’s tariff agenda, which may soon affect the pharmaceutical sector.

Moreover, on May 11, Trump signed an executive order aimed at establishing “most favored nation pricing” for pharmaceuticals sold in the U.S., intending to align drug prices with those in other countries. This presents an uncertain outlook for Eli Lilly and other pharmaceutical companies.

The impact of these actions on Eli Lilly is still unclear. It’s likely that the pharmaceutical industry will respond through legal challenges or lobbying efforts, delaying any permanent changes. Investors should also recognize that Eli Lilly’s diversified portfolio spans various healthcare sectors and operates globally, somewhat mitigating its reliance on the U.S. market.

Consequently, long-term investors might find buying opportunities if Eli Lilly’s stock experiences dips in the near future.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.