“`html

China’s New Tariffs Target U.S. Goods: What’s Next for Oil Prices and Consumers?

The trade tension escalates.

This morning, a 10% tariff on a variety of Chinese goods went into effect. In response, China announced a 15% tariff on U.S. coal and liquefied natural gas, effective February 10. Additionally, a 10% tariff will be imposed on American crude oil, farm equipment, and certain auto parts.

These reactions appear largely symbolic and tactical. For instance, a part of China’s retaliation includes an investigation into Alphabet for potential antitrust violations. However, Alphabet halted Google services in China back in 2010, making this response less impactful. Such moves seem more focused on granting China some bargaining strength in ongoing negotiations.

While the situation has the potential to escalate, it remains relatively measured at this point.

We’ll keep you informed.

Oil’s Crucial Role in Trump’s Economic Plans

President Trump views oil as a pivotal element in his economic strategy. He is advocating for lower energy prices, but that may prove challenging with various stakeholders involved in the discussions.

Trump campaigned under the “drill, baby, drill” slogan, emphasizing the importance of U.S. oil production for several reasons:

First, an increase in U.S. energy production could lead to lower prices at the pump, which historically boosts consumer sentiment about the economy.

Second, reduced energy costs could alleviate inflation pressures across various products. Fossil fuels are integral components in everyday items—ranging from cameras to coffee makers—which underscores their role in keeping production costs down.

Third, cheaper energy may permit the Federal Reserve to implement further interest rate cuts, a tactic Trump considers important for stimulating economic growth.

In conclusion, increasing domestic drilling is central to Trump’s vision for the economy.

Challenges to Reducing Oil Prices

The dynamics of the U.S. energy sector have shifted significantly. Past breakthroughs in shale technology led to a drilling boom, but that growth is now tempered.

According to The Wall Street Journal, wildcatters are mostly gone, replaced by more disciplined oil giants.

Wall Street has pushed oil companies to focus more on generating cash for investors rather than pursuing unrestrained growth.

Production is also waning in many U.S. crude regions as oil fields mature and prime spots become scarce.

This means we likely won’t see the rapid growth we experienced during Trump’s first term when daily crude production surged from about nine million barrels to around 13 million.

“We’re not going to have the explosive growth that we’ve seen,” stated Richard Dealy, who manages Exxon Mobil’s operations in the Permian Basin.

In the short term, a significant increase in supply seems unlikely. However, if Trump successfully rolls back certain environmental regulations, more investment could flow into the sector, potentially boosting output and lowering prices. But energy executives may still hesitate to invest heavily in costly new projects. Therefore, where might Trump turn to lower prices now?

The Middle East.

As reported by the WSJ, [Trump’s advisers] suggest that persuading the Organization of the Petroleum Exporting Countries and Saudi Arabia to increase oil production might be his most effective strategy.

However, Saudi Arabia has indicated to former U.S. officials that it, too, is reluctant to boost global oil supply, according to sources familiar with the communications.

Currently, oil prices sit at $73 per barrel, a decrease from the $94 range a few years back. Lower prices have already impacted Saudi Arabia’s earnings. This raises the question: why would they support falling prices, unless to expand their market presence?

Trump wants to reclaim that market share for U.S. industries, complicating potential cooperation with Saudi Arabia.

Overall, it seems difficult to believe that Trump’s “drill, baby, drill” approach or his engagement with OPEC will lead to significantly lower oil prices in the immediate future.

Positive Prospects for the Energy Sector

Energy sector stocks currently have lower valuations compared to most other market segments. Furthermore, many leading companies offer substantial dividends. Ultimately, we believe that Trump will eventually persuade large energy companies to increase production, which will be essential as AI demands more energy, in line with noted economic concepts like Jevons Paradox.

Notably, renowned investor Louis Navellier recently recommended a reputable oilfield services company to his Growth Investor subscribers.

Oilfield service providers are favorably positioned today. Their success relies less on surging oil prices and more on a growing number of companies operating in the oil sector that require their goods and services.

Navellier’s investments are based on strong fundamentals rather than reliance on predictions, like a forthcoming drilling boom driven by Trump’s politics.

As he notes:

Total fourth-quarter revenue rose 8% year-over-year to $7.36 billion.

Fourth-quarter adjusted earnings surged 37% year-over-year to $0.70 per share, an increase from $0.51 per share in the previous year’s quarter. Analysts had anticipated adjusted earnings of $0.63 per share.

Over the past five years, [this company] has increased its dividend by over 16%.

To learn more, visit the Growth Investor subscriptions.

In summary, the energy market will be crucial in shaping Trump’s broader economic strategy.

Finding Opportunities Amid Strained Consumer Sentiment

The unexpected resilience of U.S. consumers over the past two years has been noteworthy. Although many indicators suggest a decline in economic well-being, a predicted consumer recession has yet to emerge, as shoppers have maintained their spending.

This does not imply that consumers are unaffected—shifts in spending patterns are evident. As reported by MarketWatch, surveys indicate that middle-income Americans are not benefitting from a growing economy, struggling with high costs for everyday needs such as housing, transportation, and healthcare.

With consumer prices having risen by 2.9% year-over-year in December and new tariffs expected to further drive prices upward, caution remains essential.

“`

Walmart’s Success Amid Financial Strain: A Deep Dive into Retail Patterns

As middle-income households face financial stress, many have started to cut expenses for 2025, impacting their shopping choices.

The Consumer’s Role in the Economy

The U.S. consumer drives nearly 70% of our GDP, making their spending behavior crucial for understanding market trends and investment decisions.

This raises an important question: Where do financially stressed Americans prefer to shop?

If you guessed Walmart, you’re right.

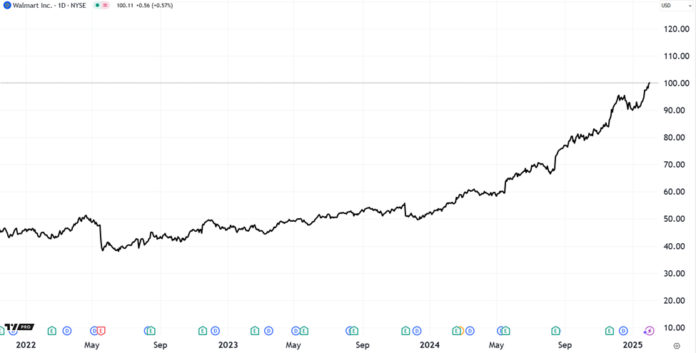

This preference reflects Walmart’s recent achievement of reaching a new 52-week high even as the market reacts to tariff concerns. As I write this, Walmart is on track for a new all-time high.

(Full disclosure: I own Walmart shares in my personal account.)

Source: TradingView

Contrasting Strategies: Walmart vs. Dollar General

Not all retailers focusing on budget shoppers are successful right now. For example, Dollar General (DG) shows a starkly different performance trend compared to Walmart.

Source: TradingView

The question arises: Why is this happening?

While both retailers cater to cost-conscious consumers, they differ significantly in their business strategies. Walmart stands out due to its effective use of AI technology.

AI: Walmart’s Competitive Advantage

Reflecting on Walmart’s progress this past summer, CEO Doug McMillon noted that the company is utilizing generative AI to enhance customer and employee experiences. He explained that without generative AI, it would require nearly 100 times the current workforce to complete similar tasks.

For instance, by showing associates high-quality images of products, the company speeds up the process of online order picking.

Dollar General, while making attempts to adopt AI, lags far behind Walmart in critical areas such as supply chain management, checkout automation, and personalized marketing.

This effective use of technology contributes to notable differences in operational success between the two companies.

Investing in AI-Driven Companies

Investment expert Luke Lango emphasizes the importance of identifying companies that are making strides with AI today. Currently, the market is shifting from companies building AI infrastructure, known as “AI Builders,” to those applying AI technologies, referred to as “AI Appliers.” Walmart falls into the latter category.

In the initial phase of AI development, companies invested heavily in infrastructure, while today’s focus is on creating practical AI applications. As Lango points out, the emergence of DeepSeek indicates a move towards stronger performance among AI Applier stocks.

He highlights, “The biggest takeaway is the shift from AI Builder stocks to AI Applier stocks.” By democratizing AI software and partially commoditizing AI hardware, this new phase may impact the pricing power of companies like Nvidia while benefiting AI Appliers.

Investors are optimistic about the AI sector for 2025, particularly regarding those firms that excel in implementing AI applications.

Final Thoughts

- China’s recent tariff actions have not created severe disruptions yet.

- The complexities in the oil market continue, but top fossil fuel investments remain strong.

- Consumers are adjusting their spending habits; investors should adapt accordingly.

- Walmart benefits not only from changing consumer trends but also from its AI integration.

- Expect AI Appliers to outpace AI Builders moving forward.

We will continue to provide updates on these developments in the Digest.

Wishing you a pleasant evening,

Jeff Remsburg