“`html

Sterling Infrastructure Anticipates Q4 Financial Results Amid E-Infrastructure Boom

Sterling Infrastructure, Inc. (STRL) is set to announce its fourth-quarter results for 2024 on February 25, after the market closes.

Explore the latest EPS estimates and surprises in the Zacks Earnings Calendar.

In the preceding quarter, STRL reported impressive financial results, exceeding the Zacks Consensus Estimate by 17.3%. Sterling’s third-quarter 2024 earnings per share (EPS) reached $1.97, marking a 56% increase compared to the same period last year. The company achieved a gross profit margin of 22%, although revenue of $593.7 million fell short of expectations by 1%. With a backlog of $2.1 billion and a combined backlog of $2.37 billion, Sterling is well-positioned for future growth. The E-infrastructure segment has been a primary driver, particularly with data center projects comprising over 50% of the backlog and operating margins climbing to 25.8%.

Sterling has consistently surpassed earnings expectations, beating the consensus in each of the last four quarters, with an average surprise of 21.5%, indicated in the chart below.

Image Source: Zacks Investment Research

EPS and Revenue Estimates for STRL

The Zacks Consensus Estimate for STRL’s third-quarter EPS has risen to $1.34 over the last 60 days, indicating a 3.1% increase from the previous year. Revenue estimates stand at $533.8 million, reflecting a growth of 9.8% year-over-year.

Looking ahead to 2025, STRL is projected to experience an 8.1% increase in EPS compared to the prior year.

Image Source: Zacks Investment Research

What the Zacks Model Indicates for Sterling

According to our reliable model, STRL is not expected to report an earnings beat this quarter. A positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) is necessary for prediction of an earnings surprise, which does not apply here.

Earnings ESP: STRL’s Earnings ESP currently stands at 0.00%. Discover optimal stocks to invest in or sell before earnings announcements with our Earnings ESP Filter.

Zacks Rank: As of now, the company holds a Zacks Rank of #3. A complete list of today’s Zacks #1 Rank stocks can be found here.

Factors Impacting Sterling’s Q4 Outcomes

Sterling has made a name for itself in the thriving e-infrastructure and transportation sectors. A focus on high-margin projects and effective execution has driven record earnings growth throughout 2024. With significant backlog, continuous federal infrastructure investment, and heightened demand for data centers, the company is on track for a successful quarter.

In terms of segments, E-Infrastructure Solutions is the largest segment, contributing 45% of third-quarter 2024 revenues. Major clients include Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Walmart Inc. (WMT), and Hyundai Motor Group. The sector is poised to gain from substantial capital investments in data centers and advanced manufacturing. Improved supply chain conditions along with a push for significant projects are expected to enhance sales and profit margins. Data centers currently account for 50% of STRL’s E-Infrastructure backlog, driven by AI technology advancements.

The Transportation Solutions segment, making up 38% of total third-quarter revenues, is also set to benefit from strong demand and gains across its geographic reach. The segment stands to advantage from robust state and local funding due to the Infrastructure Bill’s allocation of $643 billion for transportation programs, including $284 billion in additional funds, and a $25 billion commitment to airports over five years.

Sterling’s Building Solutions segment, which comprised 17% of third-quarter revenues, focuses on concrete foundations for residential and commercial projects. Despite a favorable overall outlook, the residential construction market faces challenges such as affordability issues and high-interest rates, which have tempered demand. Although ongoing softness in this area may persist into the fourth quarter, a recovery is anticipated by early 2025, with strong potential in Houston and Phoenix.

Acquisitions have played a pivotal role in STRL’s growth, enhancing operations and revenues. Strategic investments aimed at profitability and efficient service delivery, alongside favorable buyouts, are expected to have fueled considerable growth in the third quarter. Additionally, reductions in income tax rates and lower net interest expenses throughout the year may have further improved profit margins.

STRL Stock Performance and Valuation Insights

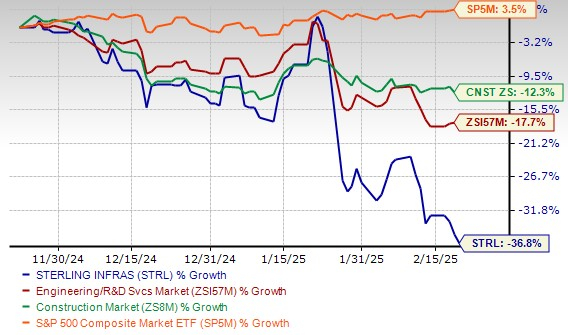

In recent months, STRL stock has experienced a decline and has underperformed relative to the Zacks Engineering – R and D Services industry.

In particular, Sterling’s stock has decreased by 20% since the selloff triggered by DeepSeek AI on January 27, 2025. It has dropped 39.7% since its 52-week high of $206.07 recorded on January 22, currently trading well below both 50-day and 200-day moving averages, as shown below.

STRL’s 3-Month Stock Performance

Image Source: Zacks Investment Research

STRL Stock’s 50-Day & 200-Day Moving Averages

Image Source: Zacks Investment Research

Now is a crucial time for assessing the investment potential of STRL. Despite boasting a solid backlog and benefitting from AI-induced infrastructure trends, the company appears to have stretched its valuation.

At present, STRL is trading slightly above the industry average, with a forward 12-month P/E ratio of 18.98—higher than the Zacks Engineering – R&D Services industry average of 18.33 and significantly exceeding its three-year median of 15.24.

Overall, STRL continues to present a challenge regarding its valuation amidst ongoing market fluctuations.

“`

Current Performance Review of STRL

Despite a notable decline in its stock price, Sterling Infrastructure, Inc. (STRL) still boasts a trailing 12-month return on equity that outperforms the average for its industry.

Image Source: Zacks Investment Research

Future Prospects for STRL

The infrastructure sector is on an upward trend, and STRL is well-positioned to take advantage of this growth due to its reputable standing and extensive history of collaborating with major clients. Currently, the existing capacity for data centers is inadequate to keep pace with the escalating demand fueled by advancements in artificial intelligence (AI) and other emerging technologies.

Despite facing stock challenges, STRL stands to gain significantly from ongoing investments in AI infrastructure. Major players like Amazon and Meta are ramping up their capital expenditures for 2025, with Amazon planning around $105.2 billion (approximately $26.3 billion per quarter) and Meta increasing from $39.23 billion in 2024 to between $60 and $65 billion.

Moreover, the introduction of the Stargate Project by President Donald Trump, a $500 billion initiative over four years aimed at enhancing AI infrastructure, is expected to further boost demand for AI data center construction.

However, STRL’s dependence on contracts from tech giants makes it vulnerable to fluctuations in AI-related spending. If there are signs of a slowdown in capital expenditures, it could lead to a significant selloff in its stock. Although Sterling is a robust company with a bright future, its current stock price may be considered excessive given recent financial setbacks.

With the market showing volatility and a high valuation for STRL, investors might prefer to await more stable performance metrics and favorable market signals before making any investment decisions. The impending earnings call on February 25 will be critical in assessing the company’s direction.

Top Investment Opportunities

In light of the current market environment, experts have identified seven top stocks from a pool of 220 Zacks Rank #1 Strong Buys that are poised for potential early price increases. Notably, this list has historically outperformed the market, achieving an average annual gain of +24.3% since 1988.

For a closer look at these recommendations and to stay informed regarding investment strategies, consider downloading the free report on the “7 Best Stocks for the Next 30 Days.”

Explore the latest investment insights:

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For more details, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.