Intapp Prepares for First-Quarter Earnings Release

Intapp (INTA) will announce its first-quarter fiscal 2025 earnings on November 4.

Projected Earnings and Revenue Expectations

For this fiscal quarter, Intapp anticipates revenues between $117.2 million and $118 million, with earnings expected to fall between 12 cents and 14 cents per share.

The Zacks Consensus Estimate currently stands at 13 cents per share. This forecast remains unchanged over the past month and reflects a notable 116.67% increase compared to the earnings reported during the same quarter last year.

Stay informed about all quarterly releases with the Zacks Earnings Calendar.

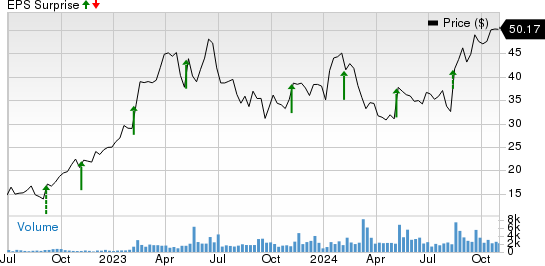

Intapp, Inc. Price and EPS Surprise

The Zacks Consensus Estimate for revenue this quarter is $117.85 million, signaling a 16.01% rise from last year.

Intapp has exceeded the Zacks Consensus Estimate for earnings in all of the last four quarters, with an average surprise of 77.08%.

Growth Drivers for This Quarter

Intapp’s performance in the first quarter is expected to benefit from its expanding Cloud Annual Recurring Revenue (ARR) and increasing demand for Software-as-a-Service (SaaS) solutions.

The company saw a 33% year-over-year growth in cloud ARR, reaching $297 million in the fourth quarter of fiscal 2024, a trend likely to continue in the upcoming quarter.

Intapp’s strong focus on vertical SaaS solutions tailored for industries like investment banking, legal, and consulting places it in advantageous positions this fiscal quarter.

SaaS revenues are projected to be between $75.3 million and $76.3 million.

The recent introduction of AI-driven solutions, such as Intapp Assist for DealCloud and Intapp Walls for Copilot, is anticipated to enhance customer attraction by providing increased productivity and compliance solutions. These innovations address critical operational challenges in their key markets.

Additionally, Intapp’s expanded partnership with Microsoft (MSFT), which features Copilot and offerings in the Azure Marketplace, is expected to enhance the client experience for users of Microsoft products. This could draw in new customers while encouraging current clients to utilize more of Intapp’s software alongside Microsoft tools.

International revenue now accounts for roughly 34% of total revenue, reflecting Intapp’s ongoing global expansion. The acquisition of Transform Data International further strengthens its market presence in the EMEA region, which is expected to enhance client acquisition this quarter.

Earnings Forecast Insights

According to Zacks’ methodology, stocks with a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically have better chances of achieving earnings beats. Currently, Intapp has an Earnings ESP of 0.00% and a Zacks Rank of #3.

Additional Stocks to Consider

Investors may want to keep an eye on these companies, which also show strong potential for earnings beats in their forthcoming reports:

Shopify (SHOP) boasts an Earnings ESP of +4.13% and a Zacks Rank of #1. Shopify shares have risen by 0.4% year-to-date, with an upcoming earnings report scheduled for November 12.

Arista Networks (ANET) has an Earnings ESP of +0.72% and a Zacks Rank of 2. The company’s shares have surged 64.1% year-to-date, with its third-quarter 2024 results expected on November 7.

Zacks’ Chief Research Officer Identifies “Stock Most Likely to Double”

A team of specialists has pinpointed five stocks poised to gain 100% or more in the near future. One stock, highlighted by Director of Research Sheraz Mian, stands out as the most likely to see significant growth.

This notable stock belongs to an innovative financial firm, boasting a rapidly expanding customer base of over 50 million and a variety of advanced solutions. Given its trajectory, this investment may yield remarkable returns. While past selections have varied, this firm could potentially outperform previous high-flyers like Nano-X Imaging, which gained +129.6% in less than nine months.

Want the latest investment insights? Download the report: 5 Stocks Set to Double.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Intapp, Inc. (INTA): Free Stock Analysis Report

For the complete article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.