Intel Faces Tough Competition in Chip Market

Chipmaker Intel (INTC) has encountered significant challenges lately, dealing with increased competition in the chip industry. Historically, Intel was only behind Nvidia (NVDA) in the data center market, but its position has now slipped to third place, following Advanced Micro Devices (AMD).

Intel’s Setback in Data Center Sales

Due to intensifying rivalry, Intel’s struggles have spread to data center sales. While the Xeon processor remains the most popular choice for servers in data centers, more of the highest-end systems are now using AMD’s EPYC processor instead. The shift suggests that Intel’s dominance is vulnerable.

Price differences play a crucial role in this shift. For instance, Intel’s top processor, the 128-core Xeon 6980P “Granite Rapids,” is priced at $17,800. In contrast, AMD’s 96-core 6979P is available for just $11,805, allowing buyers to save a substantial amount. A report by Tom’s Hardware indicates that if Intel increases Granite Rapids production, it could regain some market share. However, there are currently few indicators that such action is being taken.

Positive Developments for Intel

On a brighter note, Intel may be approaching a turnaround. Recent reports suggest that Silver Lake and Bain Capital are interested in bidding for Intel’s minority stake in Altera. This potential sale has sparked optimism, as it may help Intel recover a portion of the $17 billion it invested in Altera nearly a decade ago.

While it’s too soon to predict the outcome, the presence of competition could benefit Intel, especially as the company continues to look for support under the CHIPS Act.

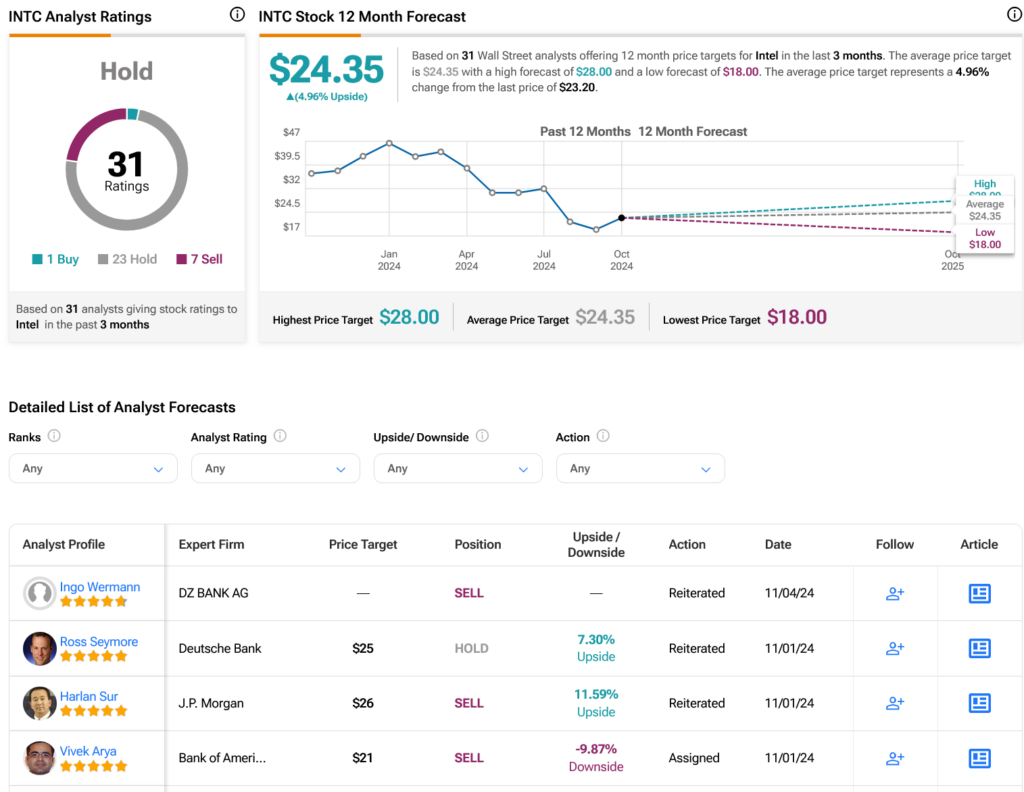

Wall Street’s Consensus: Hold

According to recent assessments from Wall Street analysts, INTC stock holds a consensus rating of Hold. This rating is based on one Buy, 23 Holds, and seven Sells over the past three months. After experiencing a 37.78% decline in share price within the last year, the average price target for INTC is $24.35 per share, suggesting a modest upside potential of 4.96%.

See more INTC analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.