Intel Faces Challenges Amid Market Rivalries and Strategic Restructuring

Intel (INTC) has had a tumultuous period since its second-quarter earnings report, which caused its stock to behave erratically. With a Beta of 1.93, it reflects just how bumpy this ride has been for the company, its workers, and shareholders. The emotional toll can be significant, resulting in some decisions that may appear hasty. An example of this is the company’s recent issues over coffee and rental cars.

In efforts to manage costs, INTC also plans to shut down previous acquisitions, including Granulate, a cloud optimization firm bought for $650 million in 2022. This ongoing situation suggests we may see further takeover or merger activity in the near future.

On October 31st, INTC released its latest earnings report, which produced mixed but generally favorable results. The company recorded revenue of $13.3 billion, a decline of 6% from the same quarter last year. Furthermore, the gross margin slipped significantly to 15%, down from 42.5% in Q3 2023, mainly due to restructuring and impairment charges that totaled $15.9 billion. Looking ahead, Intel projects fourth-quarter revenue between $13.3 billion and $14.3 billion, with a non-GAAP EPS of $0.12. The company remains focused on improving its foundry initiative and future profit margins.

Let’s summarize Intel’s latest developments in three key points, reminiscent of a classic ’80s TV show. “Previously on INTC…”

- Delayed CHIPS Act: Intel is still waiting for funds promised by the CHIPS Act, intended to support U.S. semiconductor manufacturers. Despite investing around $30 billion in fabrication operations, these essential funds have not yet arrived, forcing the company into aggressive cost-reduction measures. CEO Pat Gelsinger has expressed his frustration about this delay, emphasizing the need for these funds.

- Market Challenges: Competing companies like Nvidia (NVDA) and AMD (AMD) are now posing a significant challenge to Intel’s leadership in the data center market. Once a front-runner, Intel is now falling behind, particularly as AMD’s EPYC processors are favored for their lower costs compared to Intel’s Xeon processors. Despite suggestions to ramp up production of Granite Rapids processors, Intel has yet to act, resulting in lost market share in the chipset arena.

- Strategic Moves: In the face of these hurdles, Intel has caught the attention of potential investors and buyers. Reports indicate that firms like Silver Lake and Bain Capital are preparing to bid on Intel’s minority stake in Altera, potentially helping recover some invested capital. Furthermore, discussions in Washington regarding additional government aid—possibly a bailout—are underway due to Intel’s crucial role in the U.S. supply chain. Possible mergers with companies such as AMD or Marvell Technology (MRVL) are also being considered, allowing Intel to concentrate more on its core manufacturing operations.

Wall Street’s Perspective on INTC

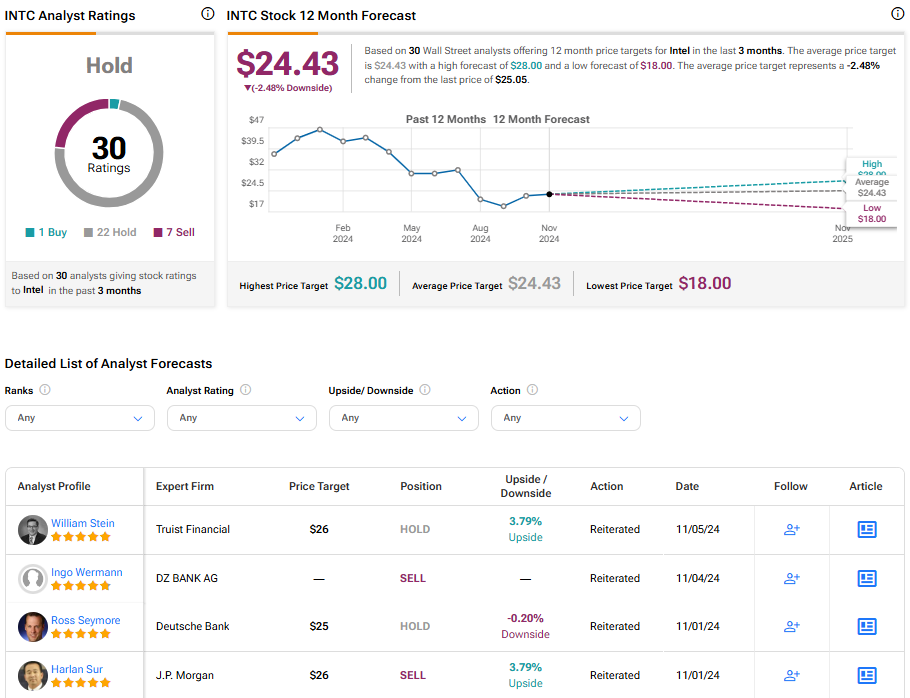

Currently, INTC stock carries a rating of Hold on Wall Street, with 1 analyst rating it as a Buy, 22 recommending Hold, and 7 suggesting Sell. The average price target stands at $24.43, indicating a downside of -2.48%.

See more INTC analyst ratings

What’s Next for Intel?

The Intel journey continues, but there are signs of potential recovery as the company trims operational costs and closes down unproductive operations like Granulate. Encouragingly, revenue has been growing, and the prospect of substantial cash inflows from the CHIPS Act or external investors looks promising. Intel’s future could swing in various directions, but we will keep our eye on the developments.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.