Intel Faces Major Setbacks as Rivals Surge Ahead

Stock Plummets Over 56% in 2024

Intel Corp. INTC has experienced a challenging start to 2024, with its stock price dropping more than 56% year-to-date.

What’s causing this decline? Intel, the top chipmaker globally, has struggled to keep pace with competitors such as Advanced Micro Devices Inc. AMD and Nvidia Corp. NVDA. The company is also falling behind Qualcomm Inc. QCOM in the smartphone market.

Intel’s dominance has faded, especially in the x86 chip space, as Nvidia has significantly cornered the AI chip sector.

Stock Price Plummets to Historic Lows

Intel’s stunted innovation is evident in its stock price, currently at $20.92—essentially returning to levels not seen in nearly 27 years.

Adding to Intel’s troubles, its market capitalization has diminished significantly. Rumors suggest that Qualcomm considered acquiring Intel; however, these talks reportedly fizzled out due to the complexities involved in such a merger.

Market Capitalization: A Stark Comparison

Currently, Intel’s market cap is $90.22 billion, while Qualcomm’s stands at $177.26 billion. AMD holds a market valuation over double that of Intel, at $224.91 billion. Nvidia, on the other hand, boasts a staggering market capitalization of $3.488 trillion, over 38 times that of Intel.

The challenges for Intel have intensified, leading to the departure of Pat Gelsinger, a key industry leader, in an unsatisfactory exit.

Innovation and Manufacturing Challenges Persist

Intel’s struggles are not new, but issues surrounding its latest desktop chips could be the tipping point. Reports surfaced regarding performance problems in Intel’s 13th and 14th generation chips. Although the company tried to address these through software updates, it ultimately decided to abandon the effort.

This situation forced Gelsinger to step down before completing the 18A fabrication process—a critical step for Intel’s future capabilities. While the process is reportedly in motion, no chips produced by this advanced technique have reached the market yet.

Analyst Opinions and Future Outlook

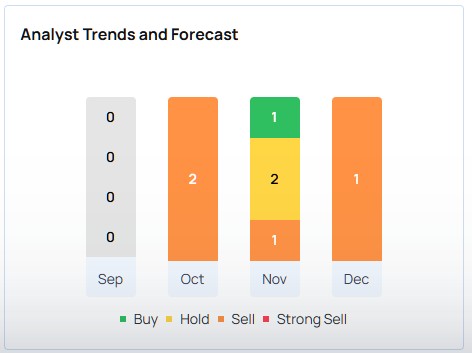

Intel closed at $20.92 on Friday, marking a slight 0.6% increase for the day but down 56.2% for the year. Analysts currently rate Intel stock as “Neutral”. Firms such as BofA Securities, Northland Capital Markets, and Mizuho have set an average price target of $24, signaling a potential upside of about 14.7%.

Can Intel turn its fortunes around? Only time will tell.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer:This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Unsplash

Market News and Data brought to you by Benzinga APIs