Wall Street Analysts Favor Interactive Brokers: Insights for Investors

Investors frequently turn to recommendations from Wall Street analysts to guide their decisions on buying, selling, or holding stocks. Any changes to these ratings by brokerage analysts can have significant influences on stock prices. But, how valid are these recommendations?

Let’s examine the outlook from analysts regarding Interactive Brokers Group, Inc. (IBKR) and analyze the effectiveness of such brokerage recommendations.

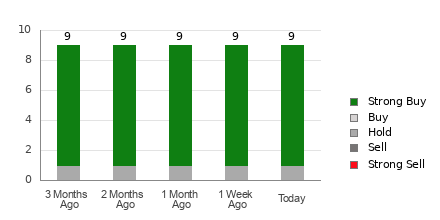

Currently, Interactive Brokers holds an average brokerage recommendation (ABR) of 1.22, on a scale from 1 to 5 (with 1 indicating Strong Buy and 5 indicating Strong Sell). This ABR is calculated based on the recommendations from nine brokerage firms, indicating a preference that leans between Strong Buy and Buy.

Of the nine recommendations contributing to this ABR, eight are Strong Buy, showcasing that 88.9% of the advice favors purchasing the stock.

Current Trends in Brokerage Recommendations for IBKR

Explore Interactive Brokers’ price target and stock forecast here>>>

While the ABR seems to encourage investment in Interactive Brokers, relying solely on this metric can be risky. Research suggests that brokerage recommendations often fail to accurately identify stocks that will see substantial price gains.

This discrepancy often arises because brokerage firms may have vested interests in the stocks they analyze, leading to a pronounced bias in their ratings. Studies indicate that for every “Strong Sell” recommendation, there’s typically five “Strong Buy” recommendations.

This imbalance signifies that brokerage analysts’ interests don’t always align with those of retail investors, casting doubt on how much guidance these recommendations truly offer when predicting a stock’s future performance. Investors should consider using this information in conjunction with their own analysis or alongside a proven forecasting tool.

Zacks Rank offers a unique approach, categorizing stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It has consistently demonstrated its effectiveness in predicting stock price movements based on earnings estimate revisions.

Differentiating ABR from Zacks Rank

Although both Zacks Rank and ABR use a scale of 1 to 5, they are fundamentally different.

The ABR is based solely on brokerage recommendations and may include decimal values (e.g., 1.28). Conversely, Zacks Rank is a quantitative rating tool that relies on changes in earnings forecasts and is represented in whole numbers.

Brokerage analysts have historically been overly optimistic with their ratings, influenced by their firms’ interests, often leading to recommendations that do not reflect true market potential.

In contrast, Zacks Rank is driven by earnings estimate shifts, which have been shown in studies to closely correlate with stock price movements in the near term.

The Zacks Rank also maintains a balanced distribution across stocks covered by analysts, ensuring fair representation across its five tiers.

Moreover, ABR may lack timeliness; adjustments by brokerage analysts don’t always reflect current market trends swiftly. In contrast, Zacks Rank adapts more rapidly, responding quickly to changes in earnings estimates.

Is IBKR a Worthwhile Investment?

Analyzing recent trends, the Zacks Consensus Estimate for Interactive Brokers has risen by 2.2% over the past month, now sitting at $6.90.

This increased optimism, reflected in the analysts’ updated earnings per share (EPS) forecasts, suggests that IBKR could experience a significant upswing in the near future.

The notable adjustment in consensus estimates, combined with other earnings-related factors, has culminated in a Zacks Rank #2 (Buy) designation for Interactive Brokers. For a comprehensive list of Zacks Rank #1 (Strong Buy) stocks, you can visit here>>>>

Thus, the ABR for Interactive Brokers can serve as an additional resource for investors in their decision-making process.

New Opportunities: Zacks’ Top 10 Stocks for 2025

Investors still have a chance to explore Zacks’ 10 handpicked stocks for 2025. This portfolio, curated by Zacks Director of Research Sheraz Mian, boasts remarkable success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. With over 4,400 companies analyzed, these selections promise substantial growth potential.

Discover the new Top 10 Stocks >>

Get your free stock analysis report for Interactive Brokers Group, Inc. (IBKR)

Click here to read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.