Federal Reserve Cuts Rates Again, but Market Reaction Fuels Concern

Today, the Federal Reserve reduced interest rates by 25 basis points in a divided decision, with one president advocating for stable rates. The new target for the federal funds rate is now set at 4.25% to 4.50%.

While this cut was anticipated, the updated forecast for rate cuts in 2025 shocked the markets.

The consensus among Fed officials is down to only two rate cuts next year, compared to the four cuts projected in September.

This adjustment is largely due to a new estimate for inflation. As of September, the median official expected inflation to hit 2.1% by the end of 2025. That figure has now risen to 2.5%.

During his press conference, Federal Reserve Chairman Jerome Powell noted, “We’re on track to continue to cut,” but insisted that officials need to observe significant progress on inflation before implementing further cuts:

As we consider future cuts, we’re going to look for developments regarding inflation… We have been experiencing stagnant 12-month inflation.

Powell expressed broad optimism regarding the economy, stating, “I think it’s pretty clear we have avoided a recession,” and “we think the economy is in a really good place.”

In contrast, Wall Street reacted negatively to Powell’s comments. Its interpretation was that “fewer rate cuts in 2025 equals less support for stocks.”

The Dow plummeted by over 1,100 points, marking its first 10-day losing streak since 1974. The S&P 500 decreased by 3%, while the Nasdaq fell by 3.6%.

Additionally, the 10-year Treasury yield surged to 4.51%, reaching levels above 4.5% for the first time since last May.

Wall Street faces a significant issue.

What Lies Ahead for the 10-Year Yield and Its Impact on Stocks?

For new readers of the Digest, the 10-year Treasury yield is critical for the global economy and investment markets.

Fluctuations in this yield directly influence interest rates and asset values worldwide.

As it rises, stock prices often feel the pinch, since a higher yield implies an increased discount rate, leading to a decrease in the current valuation of stocks.

Since the Fed initiated rate cuts in September, the 10-year yield has been on the rise – contrary to typical expectations. Its sharp increase has raised concerns that, without a reversal in trend, it could seriously impact your investments.

Ten-Year Treasury Yield Reactions Since September Rate Cuts

In most cases, lower interest rates lead to lower Treasury yields. However, since the first cut on September 18th, the 10-year yield has skyrocketed from about 3.71% to 4.51%.

This is an unusual development.

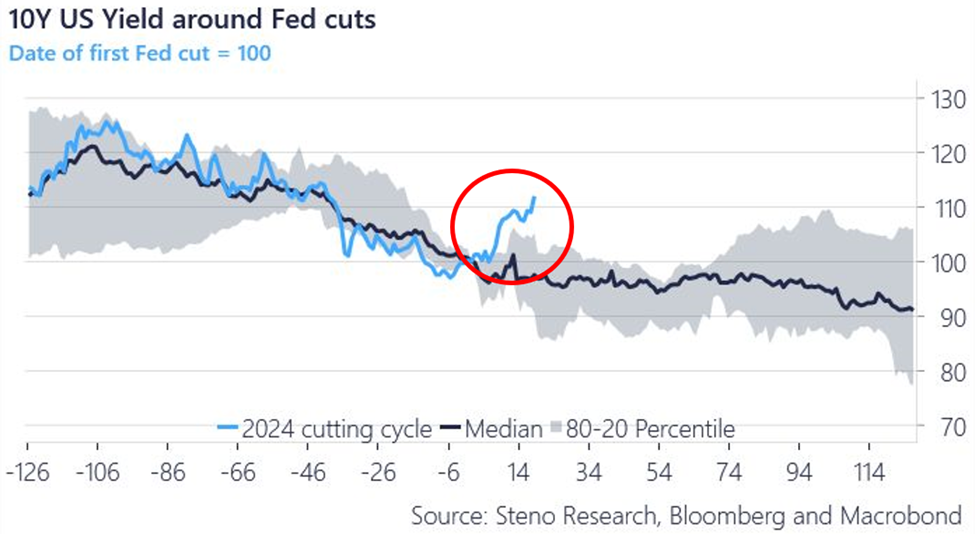

Below is a chart from Steno Research showcasing how the 10-year yield has reacted historically to Fed rate cuts, comparing it to current behavior.

Source: Steno Research / Bloomberg / Macrobond

The trend has only intensified since the chart was published, with the 10-year yield moving upwards from approximately 4.19% to the current 4.51%.

Interestingly, this yield was just 4.38% before the FOMC decision and Powell’s comments earlier today.

Why this rise despite rate cuts?

Bond Market’s Focus on Growth, Inflation, and Spending Over Fed Policy

The bond market has reacted unusually, believing inflation and government spending forecasts will counter the Fed’s rate-cut plans.

Reflect back to September…

At that time, traders were nearly convinced that by January, the Fed would lower its target rate to between 3.75% and 4.00%. Specifically, there was an 88.6% probability of this outcome.

Today, the probability has completely evaporated to 0%.

Likewise, the chance of a drop to a rate of 4.00% – 4.25% has similarly fallen to 0%.

It is noteworthy how significantly futures traders have misjudged the Fed’s movements over the past year.

Driving this major shift is a rising concern about inflation and increased government spending, which translates to more debt issuance.

According to Barron’s from yesterday:

Bond investors have been abandoning longer-term Treasuries since the Fed began cutting rates in September…

Some economists fear that lower borrowing costs, coupled with new government policies, will spark inflation, exacerbating the sell-off.

The Treasury Department is expected to auction more bonds as the deficit continues to rise, which typically results in higher yields.

According to T. Rowe Price’s Chief Investment Officer of fixed income, Arif Husain, the 10-year yield could potentially reach 5% or even 6% by 2025:

The new U.S. administration presents significant new variables, creating greater uncertainty and a wider range of potential outcomes. Is a 6% 10-year Treasury yield feasible? Absolutely.

And still, today, the Fed decided to cut rates once more.

Will the Recent Spike in Inflation Lead to Lower Treasury Yields Soon?

For insights, we turn to hypergrowth expert Luke Lango:

The stock market rally has faced challenges due to concerns over inflation, but recent data do not back this inflation anxiety.

As we approach Wednesday’s Federal Reserve announcement, the market indicates a 99% chance of a rate cut, with two additional cuts anticipated in 2025. Altogether, this suggests three rate cuts by the end of next year.

This development presents significant downside risk for Treasury yields. Historically, in previous “soft landing” scenarios such as 1995/96, 1998, and 2019, the 10-Year Treasury yield has typically dropped to align with the Fed Funds rate.

If the Fed executes three rate cuts by late 2025, the Fed Funds rate could decrease from [4.50%] today to 3.75% over the next 12 months.

This suggests that, following historical trends, the 10-Year Treasury yield might fall from [4.50%] to 3.75% within the same time frame. Should this yield drop occur, we could see a rally in stocks. We’re optimistic about this scenario.

Let’s hope Luke’s analysis is accurate.

Is the Rising 10-Year Yield Really a Problem for Stocks?

While I acknowledge that stocks have indeed risen since September, this increase is connected to optimistic forecasts regarding inflation and interest rate cuts in 2025.

However, it is important to note that those forecasts have faltered recently, creating a contrasting market for stocks.

Earlier today, prior to the Fed announcement, the S&P 500 was less than 1% away from its all-time high.

But has it really reached that peak?

Since late November, the market dynamics have changed. The S&P appears to be climbing, but much of this rally is primarily fueled by a few major tech stocks—often referred to as the Magnificent 7. Meanwhile, the majority of stocks in the S&P have been declining.

Below is a comparison illustrating this scenario:

The S&P 500 is compared to the S&P 500 “Equal Weight” index, which gives every stock equal representation rather than emphasizing larger ones.

The chart below shows the performance over the last three months. The S&P is represented in black, while the S&P Equal Weight is in red.

You’ll notice they moved similarly until just after Thanksgiving when the S&P Equal Weight Index fell 4%, while the S&P 500 largely remained unchanged.

Since the December FOMC meeting, both indices have experienced a decline.

Source: TradingView.com

Will the average stock regain its strength and rise alongside tech giants?

It largely hinges on whether the 10-year Treasury yield stabilizes.

If it doesn’t, this bullish outlook faces significant challenges.

Confused About Investment Strategies? Here’s a Thought from Experts Luke, Eric Fry, and Louis Navellier

Consider investing in AI.

The market may seem overvalued, and the bullish outlook relies on several uncertain assumptions.

However, investing in AI leaders can be a way to navigate these risks, as many are poised for significant growth as AI enters its next phase.

According to Luke, Eric, and Louis, the revolutionary shift in AI is about to expand, potentially increasing the number of leading companies beyond the current “Magnificent 7” to include new entrants in the “AI Eight”, “AI Nine”, and beyond.

Previously, we saw a boom among AI infrastructure companies like Nvidia, which experienced substantial investment and rising stock prices.

Now, the focus is shifting to “AI Appliers”—companies that integrate AI into their existing products and services.

These companies are numerous and expanding rapidly.

Luke, Eric, and Louis recently introduced their new AI Appliers Portfolio during a broadcast. This portfolio features top picks among the upcoming leaders in AI that are expected to benefit as AI technologies broaden in 2025.

For more details, you can check out their broadcast and discover which AI appliers they believe are promising as we head into the new year.

As we reflect on today’s Fed announcement, another rate cut has been confirmed.

Let’s hope this decision doesn’t have negative repercussions in the near future.

Wishing you a pleasant evening,

Jeff Remsburg