Broadcom Joins $1 Trillion Club Amid AI Revenue Surge

On Friday, December 13, the landscape of America’s technology giants changed. An eighth company joined the exclusive group of tech firms valued at $1 trillion or more.

- Apple: $3.7 trillion.

- Nvidia: $3.3 trillion.

- Microsoft: $3.3 trillion.

- Amazon: $2.4 trillion.

- Alphabet: $2.3 trillion.

- Meta Platforms: $1.5 trillion.

- Tesla: $1.4 trillion.

Broadcom (NASDAQ: AVGO) saw its stock price jump 24% after releasing its financial results for fiscal 2024 (ending November 3), propelling it into this elite valuation club.

Broadcom’s Quick Ascent in AI Hardware

Before 2016, Broadcom was just a semiconductor supplier for various tech applications. However, after merging with Avago Technologies, the company transformed itself. It has since spent nearly $100 billion on acquisitions, including notable names like CA Technologies, Symantec, and VMware. These moves have diversified its business and significantly contributed to its current revenue profile.

Recently, the focus has shifted to Broadcom’s semiconductor and networking businesses, fueled by soaring demand for artificial intelligence (AI) infrastructure from major tech players. Broadcom designs custom AI accelerators for three significant customers; while their identities remain undisclosed, they likely include the likes of Microsoft, Amazon, Alphabet, and Oracle. Notably, shipments of these AI accelerators doubled in the fourth quarter from the previous year.

This growth is particularly significant. Nvidia’s GPUs are currently the most in-demand chips for AI, and although these hyperscalers purchase Nvidia products, Broadcom allows them to create their custom chips suited to their specific needs—this can lead to substantial cost savings, as Nvidia’s offerings are quite pricey.

Moreover, Broadcom reported a fourfold increase in AI connectivity revenue, boosted by sales of its Tomahawk and Jericho data center switches. These devices ensure efficient data transfer between multiple chips and devices, which can translate to considerable cost savings for AI developers that utilize thousands of chips.

Image source: Getty Images.

AI Revenue Reaches New Heights

For fiscal 2024, Broadcom reported a record $51.5 billion in total revenue, marking a 44% growth from fiscal 2023. However, much of this increase came from the addition of VMware’s revenue due to the acquisition last year.

The company’s AI revenue, on the other hand, saw a remarkable spike. It surged by 220% to $12.2 billion, mainly due to the strong sales of AI accelerators and networking equipment. Broadcom anticipates maintaining this momentum into fiscal 2025.

While Broadcom’s overall revenue grew, so did its expenses, largely tied to acquisitions like VMware. Research and development costs soared by 78% to $9.3 billion—a significant portion of its total operating expenses of $19 billion for fiscal 2024.

Consequently, Broadcom’s net income fell to $5.9 billion, a 58% drop from the previous year. This decline impacts the valuation of its stock based on GAAP earnings, which we will discuss shortly.

On a non-GAAP basis, which removes certain expenditures tied to acquisitions and non-cash expenses, Broadcom’s net income was $23.7 billion—a 28% increase from fiscal 2023. This figure provides a clearer representation of the company’s business trajectory.

Valuation Concerns for Broadcom Stock

For fiscal 2024, Broadcom achieved GAAP earnings per share (EPS) of $1.23, resulting in a high price-to-earnings (P/E) ratio of 183. This figure stands out starkly compared to the Nasdaq-100, which has a P/E ratio of about 35.

With a non-GAAP EPS of $4.96, Broadcom’s P/E ratio drops to 45. Although this is relatively improved, it remains high within the tech sector. Notably, some investors question the validity of non-GAAP EPS as a true measure of profitability.

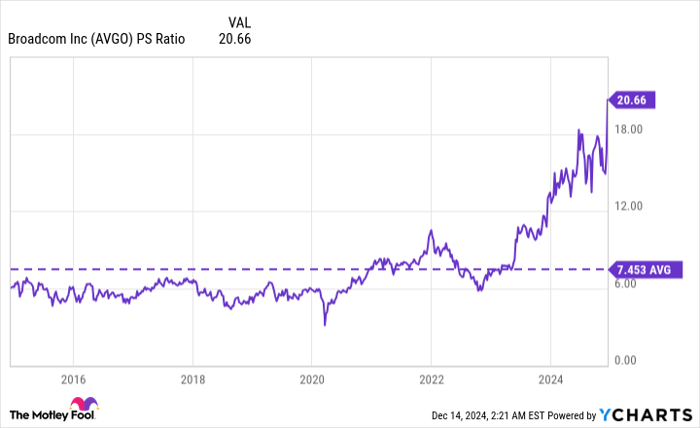

An alternative way to assess Broadcom’s valuation is through the price-to-sales (P/S) ratio, calculated by dividing the market capitalization by annual revenue. Presently, Broadcom’s P/S ratio is 20.7, nearly three times its 10-year average of 7.4:

AVGO PS Ratio data by YCharts

Thus, the stock appears priced high based on both its P/E and P/S ratios. Consequently, purchasing Broadcom shares may not be advisable for short-term investors looking to stay for around 12 months.

Conversely, long-term investors could find an appealing case for buying shares. Broadcom anticipates its annual AI revenue could reach between $60 billion and $90 billion by fiscal 2027, driven by increased demand for accelerators and networking products.

Given that AI revenue recently stood at $12.2 billion in fiscal 2024, this projection reflects a remarkable potential growth of 514% over the next three years, based on the midpoint of the estimate.

While waiting for a more favorable buying opportunity might be wise, Broadcom nonetheless presents a quality choice for tapping into the AI sector’s growth.

Is Now the Time to Invest in Broadcom?

Before making a decision to invest in Broadcom, consider this:

The Motley Fool Stock Advisor analysts recently highlighted what they believe are the 10 best stocks available for investors today, and unfortunately, Broadcom is not among them. The selected stocks have the potential for significant returns in the future.

Think about how Nvidia was featured on April 15, 2005… had you invested $1,000 at our recommendation, you would today have $822,755!

Stock Advisor equips investors with a straightforward strategy for success, offering portfolio-building guidance, regular market updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 more than fourfold since 2002.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Randi Zuckerberg, who formerly directed market development for Facebook and is the sister of Meta Platforms CEO Mark Zuckerberg, is a member of the board. Anthony Di Pizio holds no positions in any of the stocks mentioned. The Motley Fool maintains investments in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool also recommends Broadcom and the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.