“`html

Intuit Inc. Faces Headwinds Amid Transition to AI and Competition

Intuit Inc. INTU stock has tripled the Zacks Tech sector over the last 20 years and doubled Tech during the past decade. However, INTU is down -3% in the past three years while the Tech sector has surged.

Recently, Intuit’s stock dipped after it struggled to reach new all-time highs. This decline was influenced by news reports regarding Elon Musk’s interest in developing a free IRS mobile app.

Stay Updated with Zacks’ Earnings Calendar for the latest in market news.

Intuit, the tech leader behind TurboTax, Credit Karma, QuickBooks, and Mailchimp, is set to release its Q1 FY25 results on Thursday, November 21, after the market closes. Investors may find opportunities in Intuit for both short-term gains and long-term growth.

Understanding Intuit’s Recent Stock Performance

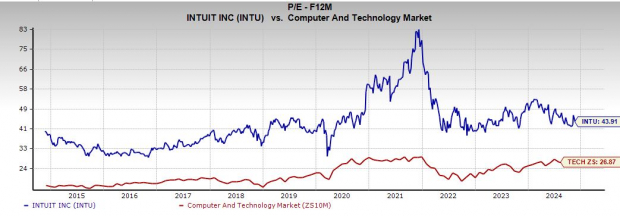

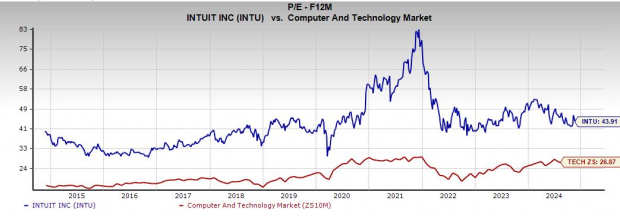

The stock price of Intuit has fallen in recent years largely due to its high valuation. Currently, INTU trades at 43.9X forward 12-month earnings, compared to the Tech sector average of 26.8X.

For most of the last decade, investors were willing to pay a premium for Intuit stock due to its robust growth in a stable industry. However, rising interest rates and concerns about artificial intelligence’s impact on tax preparation have caused some anxiety in the market.

Image Source: Zacks Investment Research

Lately, additional worries have emerged regarding the IRS’s upcoming free online tax preparation service, particularly with news that Elon Musk is interested in a free IRS mobile app. Despite these developments, it seems unlikely that the government can compete effectively with Intuit’s established services.

Furthermore, Intuit currently trades at a 45% discount compared to its peak forward earnings from the past decade, even though it is just 9% below its all-time price highs.

Why Investors Might Still Bet on Intuit

Intuit’s TurboTax software has transformed the company into a significant player, boasting a market cap of $181 billion and consistent double-digit growth in both sales and earnings. Since taxes are a constant in society, competition from a government-backed tax service seems unlikely to pose a long-term threat.

During the pandemic, Intuit expanded its software offerings, venturing into various areas of consumer finance, marketing, and digital advertising. Today, the company serves about 100 million customers across TurboTax, QuickBooks, Credit Karma, and Mailchimp.

While TurboTax captures a significant part of the market, Intuit’s portfolio also includes Credit Karma, which provides personal finance tools like credit cards and loans.

Additionally, products like QuickBooks cater primarily to small businesses and entrepreneurs, offering a range of financial services, including payroll and payment processing.

Image Source: Zacks Investment Research

In fiscal 2024, Intuit’s sales from the Small Business and Self-Employed Group increased by 19%, with online revenue growing by 20%. Overall, total revenue rose 13% during FY24, reflecting a 16% average growth over the last nine years.

Looking ahead, Intuit is expected to grow its revenue by 12% in FY25 and FY26, increasing from $16.29 billion in FY24 to $20.46 billion. The company’s consistent revenue growth places it alongside giants like Microsoft MSFT.

Earnings per share (EPS) is projected to grow by 14% in FY25 and FY26, following an 18% rise last year. Recent earnings revisions for INTU have plateaued, resulting in a Zacks Rank of #3 (Hold).

This summer, Intuit demonstrated its commitment to AI by announcing plans to reduce its workforce by 1,800 employees (10% of its total) while also hiring the same number of individuals primarily focused on engineering and customer service to enhance AI capabilities.

The company anticipates these AI initiatives will benefit its mid-market customer base and expand its global outreach.

Should Investors Consider Buying INTU Stock Amidst Market Fluctuations?

Over the past two decades, Intuit’s stock price has climbed by 3,000%, outperforming the Tech sector’s 725% and similar to Microsoft’s 1,444%. Although INTU has gained 600% in the last decade, it has seen a recent decline of 3%, creating a potential opportunity for investors.

“`

Intuit Stock Faces Volatility Amid Market Fluctuations

Stock Reaches New Highs Before Declining

Intuit Inc. (INTU) recently surpassed its 2021 highs but has since seen a decline of 10% since November 13, partially due to hitting overbought levels indicated by its RSI metrics. Stocks in the tech sector have risen 25% over the past three years, highlighting the contrasting performance of Intuit in this period.

Image Source: Zacks Investment Research

Currently, INTU’s stock is trading 13% below its average price target set by Zacks. It is testing support at its 21-day moving average, indicating a potentially critical moment for the stock’s performance.

Zacks Research Highlights Potential for Future Gains

Zacks’ team has identified five stocks that they believe have the potential to double in value over the coming months. Among these, Sheraz Mian, Director of Research, points to one particular stock with significant upside potential.

This leading stock comes from a financial firm renowned for its innovative services and an impressive customer base of over 50 million. While not all Zacks selections achieve their targets, this particular choice stands out as it could greatly outperform previous recommendations, such as Nano-X Imaging, which surged by 129.6% in about nine months.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.