Understanding the Dow: High-Yield Stocks Worth Considering

The Dow Jones Industrial Average (DJINDICES: ^DJI) consists of 30 major companies that represent the U.S. economy. Due to its long-standing history, it remains a popular choice for investors seeking dependable dividend income.

In recent years, the Dow has adapted to the rise of technology, leading to significant gains. Notably, more traditional companies such as Coca-Cola, Home Depot, and McDonald’s have seen remarkable increases in their stock prices, helping the index reach a record high on October 11.

Nevertheless, not every component in the Dow promises high yields or reliable dividends. Boeing is currently facing numerous challenges that resulted in a suspended dividend. Additionally, tech giants like Microsoft, Apple, and Salesforce all offer dividends of less than 1%, while Amazon does not distribute dividends at all.

Johnson & Johnson (NYSE: JNJ), Dow (NYSE: DOW), and Chemical giant Chevron (NYSE: CVX) rank among the highest-yielding stocks in the index. An investment of $2,500 in each would provide an average yield of 4.2% and generate at least $300 in annual passive income. Here’s why these three dividend stocks are considered good buys right now.

Image source: Getty Images.

Challenges Faced by Johnson & Johnson

Johnson & Johnson (J&J), recognized as a Dividend King, boasts an impressive 62 consecutive years of dividend increases. Despite this reputation, its stock performance has struggled recently.

Initially, J&J played a key role in COVID-19 vaccine developments, which positively impacted its business. However, dwindling vaccine demand has dampened results, leading to many reports excluding this impact.

Adjusting to the spinoff of its consumer health division in August 2023 has also presented challenges. Brands like Band-Aid and Tylenol are now part of Kenvue. While this focus on its Innovative Medicine and MedTech sectors may lead to growth, it has also removed some stable income-generating products from J&J’s portfolio.

Additionally, lawsuits regarding its talc-based products have been a concern. J&J restructured its approach, forming Red River Talc LLC, which filed for Chapter 11 bankruptcy on September 20 to manage current and future claims.

After navigating these difficulties, J&J is poised for recovery. Strong free cash flow should support its dividend obligations, and with a yield of 3.1%, it offers an attractive alternative compared to the S&P 500 yield of just 1.2%.

Dow’s Potential for Economic Growth

This Dow is distinct from the Dow Jones Industrial Average, focusing on chemical production for various uses, including plastics and coatings. Its operations are divided into three primary segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings.

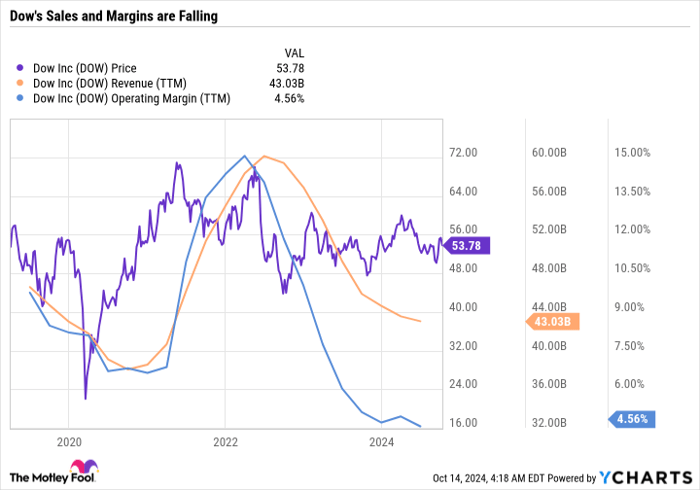

Being capital-intensive, Dow’s performance can fluctuate based on global demand. Revenue and margins boomed in 2021 and early 2022, but have since declined. The company’s stock price has similarly stagnated post-spinoff.

DOW data by YCharts.

While Dow attributes its setbacks to macroeconomic conditions, easing interest rates may positively impact its business. For instance, affordable mortgage rates could enhance demand for housing, boosting Dow’s construction chemicals segment.

Analysts predict a significant revenue increase for Dow, projecting earnings per share (EPS) of $3.55 in 2025, up from an estimated $2.26 in 2024. Although the stock may appear costly based on historical earnings, it could prove more attractive if it meets these expectations.

Despite some volatility, Dow has maintained its reputation as a reliable income stock since its 2019 spin-off. With a yield of 5.2%, it is the second-highest in the Dow Jones, trailing only Verizon Communications. Although it hasn’t increased its dividend since the spinoff, the company has focused on stock buybacks as part of its strategy to return 65% of earnings to shareholders.

Chevron: A Reliable Energy Investment

Like Dow, Chevron’s results can fluctuate dramatically with commodity prices. However, its diverse operations and solid balance sheet set it apart. Chevron has a significant refining business and has consistently raised its dividend for 37 straight years.

Currently, Chevron offers a yield of 4.3%, the third-highest in the Dow. The company’s robust history of dividend increases, in tandem with its high yield, positions it as a strong option for passive income seekers.

For investors wary of plummeting oil prices, Chevron’s margin for supporting its dividend remains considerable. With capital expenditures and buybacks reaching five-year highs, the company could adjust spending if conditions deteriorate, just as it did through the 2020 oil price crash when it maintained its dividend.

Chevron represents a balanced investment opportunity for those looking to safely navigate the oil and gas sector while earning passive income.

A New Opportunity Awaits

Do you feel like you missed out on investing in top-performing stocks? Opportunity may be knocking again.

Our investment team occasionally recommends a “Double Down” stock for companies poised for growth. If you think you’ve missed the boat, now might be the perfect time to invest:

- Amazon: a $1,000 investment in 2010 would have grown to $21,285!*

- Apple: invest $1,000 in 2008 would yield $44,456!*

- Netflix: a $1,000 investment in 2004 would amount to $411,959!*

We currently have “Double Down” alerts for three promising companies, creating a unique opportunity for prospective investors.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Chevron, Home Depot, Kenvue, Microsoft, and Salesforce. The Motley Fool recommends Johnson & Johnson and Verizon Communications and recommends the following options: long January 2026 $13 calls on Kenvue, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.