GE Vernova Inc. GEV stock has seen remarkable growth since its debut in April. Investors have gravitated towards GEV because it represents a focused investment in the energy transition, with major players like Microsoft embracing nuclear energy to support their AI initiatives.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Investors may want to consider buying GEV stock and holding it for the long term, especially with Q3 earnings set to be revealed on October 23.

Nuclear Energy: A Driving Force for the Future

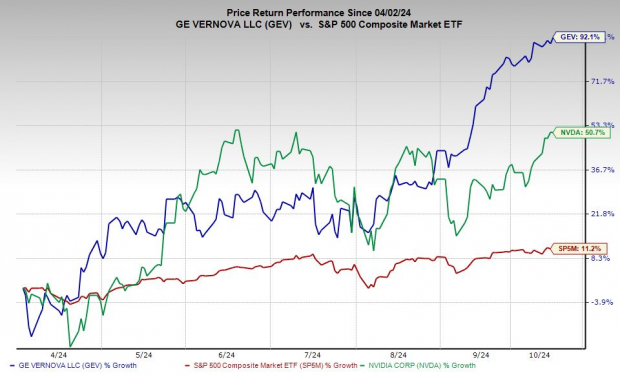

Currently, three of the top five performing S&P 500 stocks in 2024 are nuclear energy firms or involved in broad electrification trends: Vistra, Constellation Energy, and GEV Vernova. All three are in the Zacks Alternative Energy Innovators portfolio.

Wall Street recognizes that the AI boom requires a significant energy supply. This realization has led investors to favor nuclear and energy transition stocks. A recent deal between Constellation EnergyCEG and Microsoft (announced September 20) illustrates this shift: nuclear energy is becoming a vital source for powering AI developments.

The surge in nuclear energy and uranium stocks followed Constellation Energy’s announcement of a 20-year power purchase agreement with Microsoft. Major tech companies, including Amazon, are also seeking partnerships for nuclear and renewable energy sources.

Image Source: Zacks Investment Research

Citi analysts predict that data centers will account for 10.9% of U.S. electricity demand by 2030, a significant increase from the current 4.5%.

The U.S. power grid is currently undergoing a massive transformation to accommodate the energy transition, electrification, reshoring, and the AI revolution.

Nuclear energy firms are set to play a crucial role in this global energy shift.

Investing in GEV: A Smart Move for Energy Transition and AI Growth

GE Vernova launched in April following General Electric’s restructuring into three distinct firms: GE Aerospace (GE), GE HealthCare (GEHC), and GE Vernova.

According to CEO Scott Strazik, GEV is committed to accelerating the energy transition and focuses on electrification and nuclear energy.

Reporting through three segments—Power, Wind, and Electrification—GE Vernova contributes to about 25% of the world’s electricity through its gas and wind technology.

Image Source: Zacks Investment Research

The steam power division of GEV provides nuclear turbine technologies for all reactor types. Additionally, GEV’s Hitachi Nuclear Energy unit is known for advanced reactors, fuel, and nuclear services. The CEO mentioned that “gigawatts upon gigawatts of nuclear capacity” will be added every year.

Recently, the U.S. Department of Energy chose GE Vernova to aid in developing the next-generation nuclear and uranium sector.

GE Vernova will work with other innovative nuclear firms to provide deconversion services and secure domestic high-assay low-enriched uranium (HALEU) for advanced reactors, reinforcing U.S. leadership in nuclear energy.

The existing reactors operate on uranium enriched up to 5%, while HALEU is enhanced between 5% and 20%, necessary for the future small modular reactors (SMRs).

Strong Reasons to Consider GEV Stock

GEV’s Electrification backlog increased by 35% year over year to $4.8 billion in Q2, while the Power division saw a 30% growth to $5.0 billion. This positive news supported GE Vernova’s promising outlook. Analysts welcomed GEV’s strategy to downsize its offshore wind operations, which have faced inflation and supply chain issues.

Expectations indicate that GEV will grow sales by 5% in 2024 and by 6% the following year. Earnings per share (EPS) are projected to nearly double from $3.19 in FY24 to $6.19 in FY25.

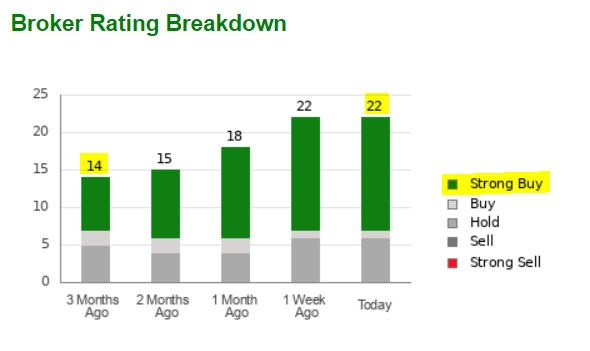

The earnings projections for FY25 and FY26 have improved significantly, prompting more Wall Street analysts to start covering GEV stock.

GE Vernova Stocks Surge: A Look at Performance and Analyst Recommendations

Increased Analyst Recommendations Showcase Growing Confidence

GE Vernova (GEV) recently saw an impressive increase in brokerage recommendations, up to 22 from just 14 three months ago. Currently, 70% of these recommendations are classified as “Strong Buys.”

Image Source: Zacks Investment Research

Outstanding Performance in the S&P 500

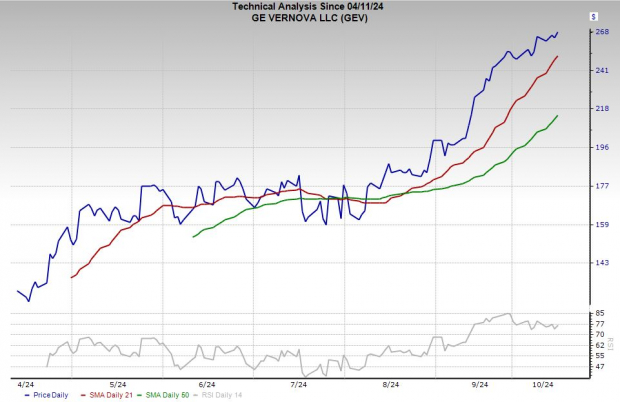

In 2024, GE Vernova stands out as the fifth-best performing stock in the S&P 500, with a remarkable 90% gain since its initial public offering. The stock has outperformed formidable competitors, including Nvidia and Vistra (VST), particularly with a 50% increase over the past three months.

Is GE Vernova Overheating?

Currently, GEV is trading at new highs, prompting some analysts to suggest that the stock may be slightly overheated. If there were to be any pullbacks in price surrounding the upcoming earnings announcement, particularly down to the 21-day or 50-day moving averages, it could present an attractive buying opportunity. However, long-term investors are advised to avoid trying to time the market too precisely.

Upcoming Earnings Announcement

Investors should note that GE Vernova is scheduled to release its Q3 earnings results on October 23, which could further influence stock performance.

Unlock Exclusive Research with Zacks

Discover exclusive investment insights with Zacks. They are currently offering a special deal: a 30-day access pass to all their stock picks for just $1. This unique opportunity has been taken advantage of by thousands who want to delve deeper into Zacks’ portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which collectively achieved 228 positions with significant gains in 2023.

To stay updated with the latest recommendations from Zacks Investment Research, download “5 Stocks Set to Double” for free, or check out their stock analysis reports for notable companies including:

- Microsoft Corporation (MSFT): Free Stock Analysis Report

- Constellation Energy Corporation (CEG): Free Stock Analysis Report

- Vistra Corp. (VST): Free Stock Analysis Report

- GE Vernova Inc. (GEV): Free Stock Analysis Report

For more details, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.