Meta Platforms Thrives with Strong Q3 2024 Performance Driven by AI Investments

Meta Platforms Inc. META continues to dominate the social media landscape, revealing impressive earnings for the third quarter of 2024. The company’s growth is largely powered by its push into generative artificial intelligence (AI).

Year to date, META’s stock has surged by 58.5%, outpacing the S&P 500’s increase of 20.5%. Furthermore, short-term projections indicate a strong potential for additional gains.

Over the long run, META’s earnings per share (EPS) growth rate surpasses that of the S&P 500 index, which is expected to positively impact its stock over the next 3 to 5 years. Currently, Meta Platforms holds a Zacks Rank of #2 (Buy). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below highlights Meta Platforms’ price performance through this year.

Image Source: Zacks Investment Research

Highlights from META’s Q3 Earnings Report

For Q3 2024, META announced earnings of $6.03 per share, exceeding the Zacks Consensus Estimate by 16.18%. The company’s revenues reached $40.59 billion, also surpassing predictions by 0.1%.

Comparing year-over-year figures, total costs and expenses rose by 13.9% to $23.24 billion. As a percentage of revenues, total costs decreased to 57.3% from 59.7% in the same quarter last year.

The push into generative AI has been a boon for META’s advertising revenues, which comprise 98.9% of revenues from its Family of Apps. These revenues grew by 18.6% year over year to $39.89 billion, making it 98.3% of total revenues for the quarter. Increased retention among advertisers using AI tools has also contributed to this growth.

Revenues from the Family of Apps, which includes Facebook, Instagram, Messenger, and WhatsApp, rose by 18.8% year over year to $40.32 billion.

Daily Active People (DAP) across Meta Platforms reached 3.29 billion, a 4.8% increase from the previous year.

Looking ahead, META anticipates total revenues between $45 billion and $48 billion for Q4 2024, with an estimated impact from foreign exchange assumed to be neutral. The company expects 2024 expenses to range between $96 billion and $98 billion.

The company also foresees significant operating losses from Reality Labs and has adjusted its capital expenditure forecast to between $38 billion and $40 billion, higher than earlier guidance.

What’s Next for META Stock?

META will soon receive shipments of NVIDIA Corp.’s NVDA new flagship AI chip, known as Blackwell. This chip is expected to drive future innovation for the company.

META’s AI-driven advertising platform is improving ad effectiveness and returns for advertisers, enhancing performance across sectors like e-commerce and gaming.

The company plans to invest between $3 billion and $40 billion in AI initiatives in 2024, with further capital spending potentially exceeding $50 billion in 2025.

On July 24, META launched its Llama 3 AI model, paired with NVIDIA’s latest HDX H200 chip. This technology has the potential to turn $1 in investment into $7 in revenue over four years, allowing META to compete effectively in the AI landscape.

Recently, on October 24, Meta Platforms solidified a multi-year agreement with Thomson Reuters Corp. TRI to enhance its AI chatbot with access to news content, marking a significant collaboration between technology and media.

Positive Earnings Estimates for META

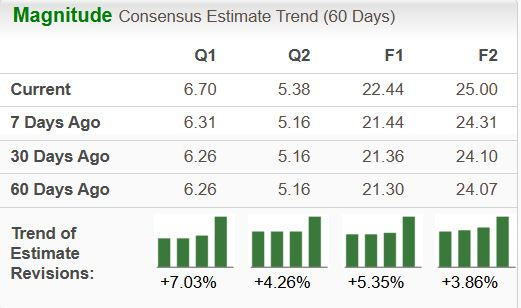

For Q4 2024, the Zacks Consensus Estimate anticipates revenues of $46.98 billion, a year-over-year growth of 17.1%, and EPS of $6.70, up by 25.7% compared to last year.

Positive revisions have been noted for META’s earnings estimates for both 2024 and 2025. The current Zacks Consensus Estimate shows revenue growth of 20.8% and EPS growth of 50.9% for 2024. The projections for 2025 indicate increases of 14.6% for revenues and 11.4% for EPS.

Image Source: Zacks Investment Research

Currently, META is trading at a favorable valuation compared to its peers. Its forward price/earnings (P/E) ratio stands at 25.3, below the industry average of 31.2. The company also boasts a strong return on equity (ROE) of 35.6%, contrasting with the industry’s negative ROE.

Brokerage firms project an average short-term price target that suggests an 11.7% increase from the last closing price of $560.68. Target prices range between $475 and $811, indicating a possible upside of 44.6% against a maximum downside of 15.3%.

Long-term, META holds a projected EPS growth rate of 20.1%, significantly outpacing the S&P 500’s growth rate of 13.1%, suggesting a favorable risk/reward scenario for investors over the long term.

Image Source: Zacks Investment Research

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, five Zacks experts each selected their top choice to potentially double in value soon. Among these, the Director of Research, Sheraz Mian, handpicks one stock he believes could experience the most considerable upside.

This selected company targets millennial and Gen Z markets, reporting nearly $1 billion in revenue last quarter alone. A recent dip in value presents a prime opportunity for investment. While not every recommendation succeeds, this pick may significantly outperform earlier Zacks stocks like Nano-X Imaging, which increased by +129.6% in just over nine months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Thomson Reuters Corp (TRI): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.