Broadcom Outperforms Expectations Amid Struggles in AI Semiconductor Sector

2025 has presented challenges for artificial intelligence (AI) semiconductor stocks as negative news has overshadowed their strong financial performances. Yet, Broadcom (NASDAQ: AVGO) distinguished itself by exceeding Wall Street expectations with its fiscal 2025 first-quarter results (ended February 2), released on March 6. Following this announcement, shares of the chip designer rose by over 8% the next day.

Where to invest $1,000 right now? Our analyst team recently identified the 10 best stocks to buy today. Learn More »

Despite Broadcom’s impressive results, its stock remains down 20% year-to-date as of this writing. However, the current valuation presents a potentially attractive buying opportunity. Let’s explore the reasons behind investor enthusiasm for Broadcom’s performance and why this semiconductor stock may be worth considering now.

Broadcom’s Momentum in AI Technology

Broadcom specializes in designing application-specific integrated circuits (ASICs), which perform tailored tasks rather than general computing functions. The rising demand for AI training and inference has increased interest in these customized chips, which offer cost and performance advantages over general-purpose graphics processing units (GPUs) from companies like Nvidia.

This shift in market dynamics has led major cloud service providers to partner with Broadcom for custom AI processors, aiming to reduce their AI infrastructure costs. The significant demand for Broadcom’s AI chips and networking components propelled a 25% year-over-year revenue increase and a 45% surge in earnings per share.

Last quarter, Broadcom generated $4.1 billion in sales from AI chips and networking solutions, marking a remarkable 77% increase compared to the same period last year. Management noted that AI revenue surpassed expectations by $300 million, driven by stronger-than-anticipated demand from cloud customers.

On their latest earnings call, Broadcom officials highlighted aggressive investments by hyperscaler partners in next-generation AI models—requiring high-performance accelerators and large clusters at AI data centers. In response, Broadcom is increasing its research and development (R&D) efforts to deliver more capable custom AI processors, which will help customers manage larger AI workloads.

Currently, three hyperscale cloud customers utilize Broadcom’s AI chips, with R&D aligned with these customers through fiscal 2027. Broadcom anticipates a serviceable revenue opportunity of $60 billion to $90 billion over the next three years from these partnerships.

Additionally, Broadcom has been actively engaged with two other hyperscale clients to help them develop customized AI accelerators. Since December, two more cloud hyperscale customers have also joined Broadcom’s roster. Notably, the projected revenue opportunities for the next three years do not include earnings potential from these four new clients.

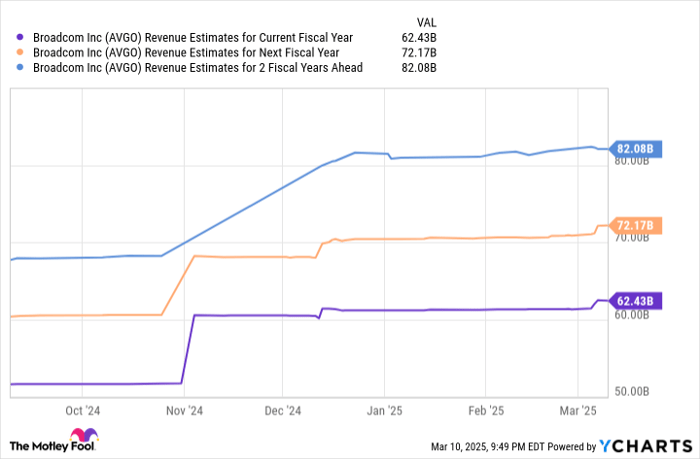

This indicates that Broadcom’s growth in AI has only just begun. Currently, more than 27% of the company’s revenue comes from AI, a figure anticipated to rise due to the significant addressable market within this segment. Consequently, analysts have revised their revenue growth expectations upwards.

AVGO Revenue Estimates for Current Fiscal Year data by YCharts

Positive Earnings Growth Signals Stock Price Potential

For Broadcom investors, the growing share of AI-focused revenue is benefiting margins. Specifically, the gross margin from its semiconductor segment rose by 70 basis points year-over-year in the last quarter, allowing the company to exceed its overall gross margin targets.

As Broadcom’s AI segment has ample growth potential, it is expected that the company’s margin profile will continue to improve, which supports projections for accelerated earnings growth.

AVGO EPS Estimates for Current Fiscal Year data by YCharts

With the stock currently trading at 30 times forward earnings, it remains an opportune time for investors to consider purchasing Broadcom shares. Comparatively, the tech-heavy Nasdaq-100 index is valued at the same earnings multiple. If Broadcom meets earnings projections of $9.12 per share in three years and maintains its P/E ratio of 30, the stock price could reach $274.

This represents a 48% increase from the current share price, but potential exists for even more significant gains as the market may assign a higher valuation due to Broadcom’s advancing growth profile and its advantageous position in the lucrative AI market. Therefore, astute investors may benefit from acquiring Broadcom stock before its price inflates further.

Is Now the Right Time to Invest $1,000 in Broadcom?

Before making a purchase, consider this:

The Motley Fool Stock Advisor analyst team has highlighted their view of the 10 best stocks to invest in now, and Broadcom didn’t make the list. The stocks that were included could yield substantial returns in the future.

For example, consider what happened when Nvidia was featured on this list on April 15, 2005… a $1,000 investment then would be worth approximately $666,539 now!

Stock Advisor offers a straightforward strategy for investors, encompassing portfolio guidance, regular analyst updates, and two new Stock picks each month. This service has significantly outperformed the S&P 500 since 2002.* Stay updated on the latest top 10 list when you join Stock Advisor.

*Stock Advisor returns as of March 10, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.