Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Dow Jones Lags Behind, Yet Blue Chip Stocks Shine Bright

As 2024 approaches, the Dow Jones Industrial Average is expected to trail the S&P 500 and the Nasdaq Composite in performance. Over the past five years, the Dow marked a total return of 68.2%, which pales in comparison to the S&P 500’s 102.8% and the Nasdaq’s impressive 132.7%.

Nonetheless, Dow stocks remain attractive options for those seeking reliable blue-chip companies that offer dividends. Known as industry leaders with strong earnings growth, these companies tend to be less volatile than growth stocks, especially during market downturns.

Investors eager to generate passive income through Dow stocks should consider McDonald’s (NYSE: MCD), The Home Depot (NYSE: HD), and Chevron (NYSE: CVX). A $3,500 investment in each can potentially yield over $325 in passive income by 2025, with the possibility of increased dividends in future years, assuming all three companies maintain their annual dividend hikes. Here’s why these stocks are compelling picks now.

Image source: Getty Images.

McDonald’s Loyalty Program: A Path to Growth

McDonald’s operates using a unique model, owning only about 5% of its restaurants while the rest are franchised. This allows McDonald’s to earn royalties and rent from franchisees, facilitating global expansion.

However, the fast-food giant has faced challenges. Recent reports show flat systemwide sales, with only a 2% rise in consolidated revenue and a 1% fall in diluted earnings per share. Systemwide sales are crucial as they reflect performance across all of McDonald’s 40,000-plus locations.

Inflation has prompted price hikes, which customers have resisted. Additionally, an E. coli outbreak in October has negatively impacted recent sales, which will likely be evident in upcoming earnings reports.

Despite these hurdles, patient investors may find McDonald’s appealing. The company boasts 48 consecutive years of dividend increases and currently offers a yield of 2.4%. With a price-to-earnings (P/E) ratio of 25.8, slightly below its five-year average of 26.5, McDonald’s is positioned as a reasonable investment.

Interestingly, the company’s loyalty program appears to be gaining traction. Innovative mobile ordering and a robust rewards program are attracting customers. McDonald’s aims to reach 250 million active users by the end of 2027, which should encourage more frequent visits and larger orders.

Home Depot: Anticipating a Recovery

Similar to McDonald’s, Home Depot has seen a slowdown in its business. The company thrives on strong home sales and spending on home improvement projects. However, rising interest rates have increased borrowing costs, resulting in fewer home sales.

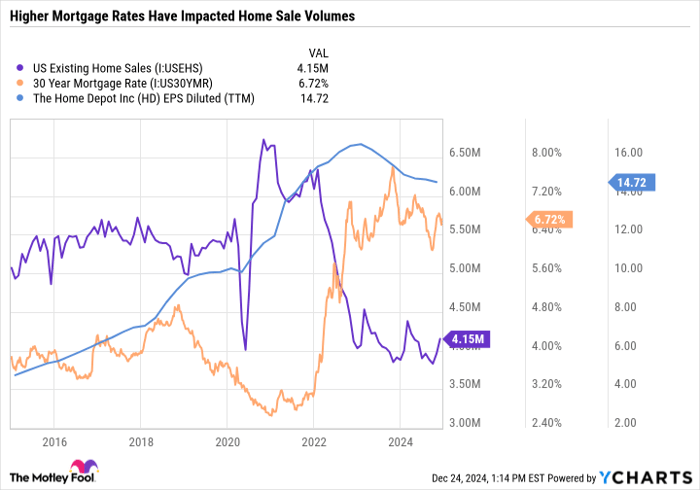

U.S. Existing Home Sales data by YCharts. EPS = earnings per share.

The chart illustrates Home Depot’s steady earnings growth over the last 15 years, with a recent dip reflecting macroeconomic factors. Increased sales during the pandemic impacted future performance, leading to a significant slowdown in 2023 and 2024.

While a rebound in Home Depot’s performance is expected in 2025, improvements may come gradually. The Federal Reserve’s potential for slower rate cuts may continue to exert pressure on the housing market, impacting consumer spending.

Despite these uncertainties, Home Depot is a solid business with a reasonable P/E of 26.8 and a dividend that has grown fivefold over the past decade. Offering a yield of 2.3% and a history of robust returns, Home Depot remains a strong dividend stock to consider.

Chevron: A Resilient Dividend Player

Chevron, along with the broader energy sector, has faced setbacks, with its stock declining over 11% recently amid modest gains in the S&P 500. Currently, West Texas Intermediate crude oil prices are at a yearly low. The Fed maintaining higher interest rates could slow down economic growth, impacting oil and gas demand.

Nonetheless, Chevron remains a compelling dividend stock, boasting a yield of 4.6% and a remarkable 37 years of increasing dividends.

Importantly, Chevron possesses the stability needed to support its dividend and investment plans, even in a lower oil price environment. The company has effectively lowered production costs through technological advancements and investments in high-margin regions, like the Permian Basin.

A significant factor to watch is Chevron’s recent $53 billion all-stock agreement to acquire Hess. This deal, announced on October 23, has faced delays due to contractual disputes with ExxonMobil and regulatory scrutiny. The Federal Trade Commission has cleared the deal, contingent upon Hess CEO John Hess not joining Chevron’s board.

If the acquisition finalizes, it stands to enhance Chevron’s cash flow and diversify its asset portfolio, providing access to low-cost offshore resources in Guyana. However, with many energy stocks hovering near their 52-week lows, hindsight may reveal a missed opportunity for Chevron to negotiate a better deal.

Regardless, the acquisition appears to be a solid long-term strategy, as Chevron’s strong balance sheet and attractive valuation make it an excellent high-yield dividend stock to consider now.

Is McDonald’s a Smart Investment Right Now?

Before committing to McDonald’s stock, it’s worth noting this:

The Motley Fool Stock Advisor analyst team has identified their pick for the 10 best stocks to invest in now, and McDonald’s did not make the cut. The stocks that did could deliver significant returns in the upcoming years.

For instance, when Nvidia appeared on this list on April 15, 2005, a $1,000 investment would now be worth $857,565!*

Stock Advisor offers a straightforward guide for success in investing, with portfolio-building advice, frequent analyst updates, and two new stock recommendations each month. This service has outperformed the S&P 500 more than fourfold since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron and Home Depot. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.