Investing for 2025: Focus on Marvell Technology and Amazon

The tech-heavy Nasdaq Composite finished 2024 strong, up 29% and hitting several all-time highs. While business cycles don’t align perfectly with the calendar, now is a prime moment to evaluate current trends that support long-term investing. With holiday bonuses and retirement plan contributions making their way into accounts, consider these two stocks that are well-positioned for the future.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this moment. See the 10 stocks »

Marvell Technology: Capitalizing on the Data Center Boom

Significant uncertainty surrounds the potential size of the market for hyperscale data centers, which are typically over 100,000 square feet. Major projects are consistently announced, making it hard to track developments.

For example, Meta Platforms is planning a massive 715,000-square-foot facility in Wyoming at a cost of $800 million. Meanwhile, Amazon is developing a sprawling campus in Virginia that could exceed 2 million square feet, and Elon Musk’s xAI Colossus in Memphis, Tennessee, is set to host 100,000 Nvidia GPUs, indicating plans for further expansions.

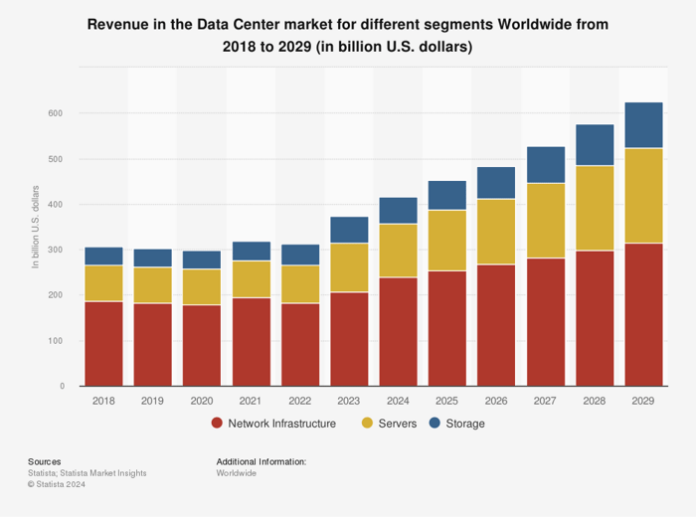

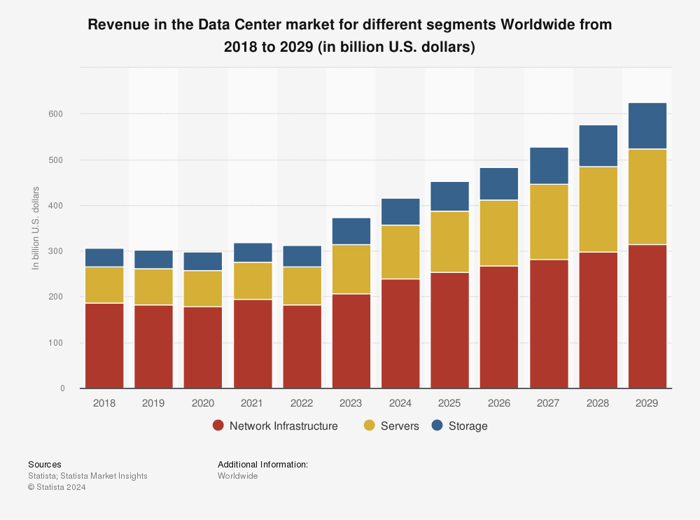

By 2024, hyperscale data centers surpassed 1,000 in number, and forecasts suggest at least 120 new facilities will open yearly for several years. This growth will drive demand for infrastructure essential for operations—such as networking hardware, servers, and storage solutions. According to Statista, the global infrastructure market is predicted to expand by 50%, reaching over $620 billion between 2024 and 2029.

Statista

As a specialist in data infrastructure, Marvell Technology (NASDAQ: MRVL) stands to gain significantly from this trend. With a market cap of $100 billion, Marvell generated $5.4 billion in revenue over the last four quarters. Although their overall growth dipped last year due to reduced sales in consumer and automotive sectors, sales are starting to rebound.

MRVL revenue (TTM) data by YCharts; TTM = trailing 12 months.

Data center sales jumped 98% year-over-year, amounting to $1.1 billion in the last fiscal quarter. For its upcoming fourth quarter of fiscal 2025, Marvell anticipates these sales will exceed $1.3 billion.

Although Marvell hasn’t yet shown profitability according to generally accepted accounting principles (GAAP), its non-GAAP (adjusted) metrics reveal a promising financial future. These adjusted figures exclude several non-cash expenses like stock-based compensation and amortization of intangible assets.

In its third quarter, Marvell presented non-GAAP earnings per share (EPS) of $0.43 and expects $0.59 for the fourth quarter. Analysts predict an EPS of $2.76 for fiscal 2026, suggesting a forward price-to-earnings ratio of 43—relatively high for tech stocks. Investors should prepare for possible volatility while considering a long-term strategy like dollar-cost averaging to make the most of price fluctuations. Marvell possesses a significant growth potential in a booming market, and good entry points may emerge over time.

Amazon: A Powerhouse in Cloud Services

Amazon (NASDAQ: AMZN) stands as a cornerstone in the tech industry. Renowned for its dominance in online retail, the company’s true financial strength lies in Amazon Web Services (AWS), the leading segment in cloud services and data centers. Marvell supports Amazon by providing infrastructure for AI and data centers, which greatly benefits Marvell.

Over the past year, 60% of Amazon’s operating profits—$36.4 billion out of $60.5 billion—came from AWS, boasting a remarkable 35% profit margin, compared to just 5.9% and 1.5% from its North America and international segments, respectively.

The insatiable data demands of AI should drive continued growth for AWS, which operates similarly to a utility, billing companies based on data usage and storage.

With data usage unlikely to slow down, Amazon enjoys a powerful growth trend. Last quarter, AWS sales increased by 19% to $27.5 billion, while total sales rose 11% to $159 billion across all segments.

Though recent stock price increases have diminished its discount, Amazon still trades below its five-year averages for both earnings and operating cash flow:

AMZN PE ratio; data by YCharts. PE = price to earnings.

On a forward basis, the price-to-earnings ratio is currently at 36, making it less expensive than its historical level. With favorable conditions for data centers, especially driven by AI, both Marvell and Amazon present strong investment opportunities.

A Second Chance to Catch a Winning Opportunity

If you’ve ever felt you missed out on investing in top-performing stocks, now may be an opportune moment.

On selected occasions, our skilled analysts issue a “Double Down” stock recommendation for companies poised for success. If you believe you missed your chance, now is a prime opportunity to invest before it’s too late. Consider these past successes:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $387,474!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,399!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $475,542!*

Currently, we are identifying three exciting companies for our “Double Down” alerts, and this opportunity may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Nvidia. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.