Three Stocks That Could Multiply Your Investment by 2023

Identifying the fastest-growing stocks isn’t overly difficult, but finding ones that could increase fivefold in value over the next five years is a real challenge. Companies must not only perform well but also be in growing industries, while ideally facing temporary setbacks to present opportunities. Here are three stocks that may help turn a $1,000 investment into a $5,000 position by 2030.

Amazon: Dominance in E-Commerce and Cloud Growth

Amazon (NASDAQ: AMZN) leads the e-commerce sector in North America, holding a significant 40% share according to Digital Commerce 360. Its international sales are also impressive, showing a 12% growth in the third quarter of last year, indicating the company is likely to sustain profitability.

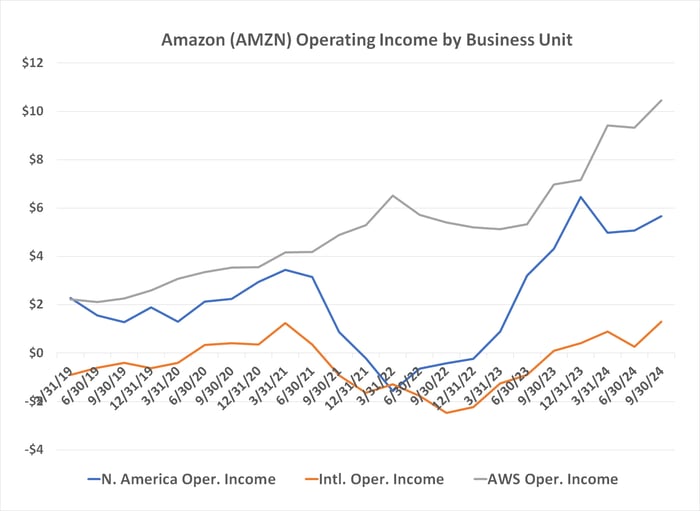

However, the real driving force behind Amazon’s potential is its cloud computing division, Amazon Web Services (AWS). Recent reports show AWS saw a revenue growth of 19% last quarter, contributing over 60% to the company’s operating income. This segment continues to expand, with growth expected to remain strong.

Data source: Amazon Inc. Chart by author. Figures are in billions.

The global cloud computing market is projected to grow at an annual rate of over 16% until 2030, boosting Amazon’s e-commerce expansion as well.

Iovance Biotherapeutics: A Game-Changer in Cancer Treatment

Investors in Iovance Biotherapeutics (NASDAQ: IOVA) have faced challenges over the past four years. The stock peaked at $54.21 in January 2021, only to decline back to around $6.00 in 2023. This downturn may present a strong buying opportunity.

Iovance specializes in a unique treatment for melanoma called lifileucel, which gained FDA approval in February 2024. The company has generated nearly $60 million in revenue from this drug in a recent quarter, although its stock hasn’t reflected this success.

This situation is common in biopharma markets, especially for companies developing groundbreaking treatments. Iovance operates in an emerging segment that could grow by nearly 40% annually until 2032, potentially reaching a market value of $2.5 billion. This makes Iovance’s growth potential particularly enticing.

Roku: Streaming Ahead of the Competition

Lastly, consider Roku (NASDAQ: ROKU), a company that thrived during the COVID-19 pandemic as people turned to streaming services. Roku’s stock experienced significant fluctuations, losing over 80% of its value during 2021 and 2022. However, it still commands a 37% share of the North American connected-TV market, far ahead of the nearest competitor.

Roku has faced challenges overseas but is focusing on domestic growth where it has substantial opportunities. The worldwide streaming market is expected to expand at around 11% annually through 2032. The company’s revenues are projected to improve, and analysts foresee a path to profitability, with an expected per-share income of $0.36 in 2026.

Data source: StockAnalysis. Chart by author.

Roku’s stock may begin to rise before reaching profitability, driven by optimistic growth expectations.

Should You Invest in Amazon Right Now?

Before purchasing Amazon shares, it’s worth noting that the Motley Fool Stock Advisor has identified the 10 best stocks for current investment—none of which include Amazon. The selected stocks are expected to yield significant returns in the future.

For instance, Nvidia was on this list back in April 2005, and a $1,000 investment would have grown to approximately $843,960!

The Stock Advisor service offers a straightforward investing strategy, providing updates and two new stock recommendations each month. Since its inception in 2002, it has significantly outperformed the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no positions in any of the mentioned stocks. The Motley Fool has positions in and recommends Amazon, Iovance Biotherapeutics, and Roku.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.