“`html

Wall Street’s Bull Market: How the Magnificent Seven Shaped 2024’s Gains

Year two of Wall Street’s bull market rally didn’t disappoint. When the finish line was crossed, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite respectively gained 13%, 23%, and 29% in 2024.

While a mix of factors contributed to this impressive performance, including the rise of artificial intelligence (AI) and Donald Trump’s election victory in November, the key driver that propelled Wall Street’s three major stock indexes to multiple record highs last year was the strength of the “Magnificent Seven.”

Where should you invest $1,000 now? Our analyst team has identified the 10 best stocks for immediate investment. See the 10 stocks »

Image source: Getty Images.

The Magnificent Seven is comprised of seven influential companies on Wall Street:

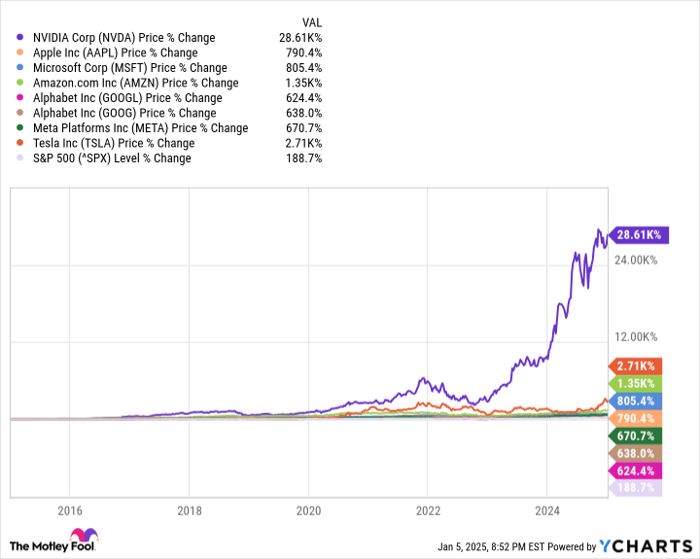

Two key traits distinguish these companies. First, they have outperformed the benchmark S&P 500 significantly over the past decade. While the S&P 500 has gained nearly 189% in the last ten years, individual performances soared: Amazon by 1,350%, Tesla by 2,710%, and Nvidia by an astonishing 28,610%!

NVDA data by YCharts.

The second characteristic of the Magnificent Seven is their sustained competitive advantages within their markets:

- Nvidia dominates the graphics processing unit (GPU) market in enterprise AI data centers.

- Apple leads U.S. smartphone sales with the iPhone and boasts a robust share buyback program.

- Microsoft’s Azure ranks as the world’s second-largest cloud service, with its Windows operating system leading PCs globally.

- Amazon retains the top global online marketplace and leads in cloud services with Amazon Web Services (AWS).

- Alphabet’s Google commands nearly 90% of worldwide internet searches, while its Google Cloud is the third-largest cloud provider.

- Meta Platforms owns Facebook, which attracted 3.29 billion daily active users in the last quarter.

- Tesla stands as North America’s top electric vehicle manufacturer, consistently achieving profitability.

While these companies share impressive traits, their outlooks for 2025 differ significantly. As the bull market looks to extend into a third year, one stock from the Magnificent Seven stands out as a promising buy, while another may not be wise to hold in 2025.

Must-Buy Magnificent Seven Stock for 2025: Alphabet

Among these standout performers, Alphabet is emerging as the frontrunner in the new year.

First, it’s crucial to highlight Alphabet’s dominance in internet search. Google has maintained an impressive 89% to 93% share of worldwide searches over the past decade, solidifying its position as the preferred choice for businesses aiming to reach consumers. This strong position translates to robust ad-pricing power for Alphabet.

Additionally, Alphabet owns YouTube, the second most-visited social media platform. The rise of Shorts—short videos under 60 seconds—and a user base of roughly 2.5 billion should boost YouTube’s advertising and subscription revenues.

Historically, Google has thrived during economic growth periods while enduring recessions. This trend suggests that ad-based companies like Alphabet are likely to see prolonged success relative to downturns.

Moreover, Alphabet’s future growth prospects heavily rely on its cloud service platform. Google Cloud is projected to achieve sustained double-digit revenue growth as businesses increasingly invest in cloud services. The inclusion of generative AI solutions into Google Cloud will also enhance customer value and potentially increase cash flow significantly through the late 2020s.

Alphabet benefits from a substantial cash reserve, closing out the third quarter with $93.2 billion in cash and marketable securities. This financial strength supports a significant capital-return program. Apart from Apple, no other S&P 500 company has repurchased more stock than Alphabet, totaling $286.7 billion as of September 30, 2024.

Finally, Alphabet’s current valuation presents an attractive opportunity for long-term investors, with shares valued at 15.7 times forecast cash flow for 2025—about a 13% discount compared to its average over the past five years.

Image source: Getty Images.

Magnificent Seven Stock to Avoid in 2025: Nvidia

Not every member of the Magnificent Seven is a sound investment choice. As we move into 2025, Nvidia may be a stock to consider avoiding.

Nvidia has enjoyed a market value surge exceeding $3 trillion over the last two years, largely due to its dominance in AI GPUs. The H100 GPU and the upcoming Blackwell chip are critical components of high-performance data centers.

Furthermore, Nvidia has capitalized on the shortage of AI GPUs, allowing it to charge premium prices and significantly boost its gross margin.

However, the concern lies in the fact that these factors seem to be already reflected in Nvidia’s stock price.

Competition is escalating from various fronts, and while Nvidia remains strong, potential investors should approach with caution as the market adjusts to these dynamics.

“`

Nvidia Faces Tough Competition and Market Uncertainty Ahead

Significant Threats Emerge from Key Customers and Trade Policies

As Advanced Micro Devices (AMD) ramps up production, Nvidia risks losing crucial data center space due to actions taken by its most prominent clients. Core customers such as Microsoft, Meta, Amazon, and Alphabet are developing their own GPUs for data center use. While these chips may not match Nvidia’s Hopper or Blackwell in computing performance, their availability and lower prices could entice data centers away from Nvidia’s expensive offerings.

Trump’s Trade Policies and Historical Trends Could Impact Nvidia’s Future

The uncertainty surrounding President-elect Donald Trump’s administration brings additional challenges for Nvidia. Trump has proposed a 35% tariff on imported goods from China, potentially straining relations with the second-largest economy globally. Meanwhile, the Biden administration has already restricted shipments of advanced AI chips to China since 2022. Such trade complexities could hinder Nvidia’s operations and growth.

Looking at historical patterns, Nvidia might be facing a familiar narrative. Over the past 30 years, emerging technologies often experience a bubble that eventually bursts. Investors tend to overestimate new technologies’ early-stage utility, leading to market corrections. Currently, many businesses lack solid strategies to ensure returns on AI investments, suggesting that the sector may be positioned to follow this boom-bust cycle.

Worrisome Valuation Signals Caution for Investors

Nvidia’s valuation further raises concerns. Although its forward price-to-earnings (P/E) ratio remains reasonable, its price-to-sales (P/S) ratio stands at 32—after exceeding 40 in previous months—aligning with levels that have typically triggered downturns for leading firms during prior market corrections.

A Timely Investment Opportunity Beckons

Feeling like you’ve missed the opportunity to invest in successful stocks? The moment may not be lost.

Our skilled analysis team occasionally issues a “Double Down” stock recommendation, signaling companies poised for significant growth. If you believe you’ve missed your chance to invest, now could be the perfect time before the opportunity slips away.

- Nvidia: Investing $1,000 when we doubled down in 2009 would have grown to $387,474!*

- Apple: A $1,000 investment from our 2008 recommendation would now be worth $46,399!*

- Netflix: If you had put in $1,000 when we recommended it in 2004, it would be worth $475,542!*

We are presently issuing “Double Down” alerts for three exceptional companies, possibly offering a rare investment chance.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Suzanne Frey, an executive at Alphabet, is a board member of The Motley Fool. John Mackey, former CEO of Whole Foods Market, which is part of Amazon, is also on the board. Randi Zuckerberg, ex-director of market development for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a board member as well. Sean Williams holds positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has stakes in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. They also recommend long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool upholds a specific disclosure policy.

The views expressed here are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.