Amazon: Is Now the Right Time to Buy? Insights on Stock Valuation

E-commerce leader Amazon (NASDAQ: AMZN) is among the few stocks I’d consider purchasing at any moment. However, seasoned investors like Warren Buffett emphasize that even the best companies should only be bought at sensible prices.

As 2024 approaches its conclusion, Amazon’s share price has increased by over 46% this year alone. Currently, it’s trading just 6% below its record high set two weeks ago. The big question now is whether Amazon is still a worthy investment despite these rising prices or if it makes sense to wait until 2025.

Is Amazon Stock Overvalued?

It’s not new to hear that Amazon’s stock appears pricey.

This online retail and cloud computing giant has solidified its status on Wall Street, boasting a market cap of $2.27 trillion and being part of the exclusive “Magnificent Seven” group of stocks. Presently, it’s trading at 47 times its earnings (P/E) and 53 times its free cash flow (P/FCF), which indicates that the stock is indeed not cheap.

A Stock That Never Seems Cheap

Conversely, it’s essential to recognize that Amazon shares have often felt expensive. Whatever metrics you might use, they rarely show the stock as a bargain.

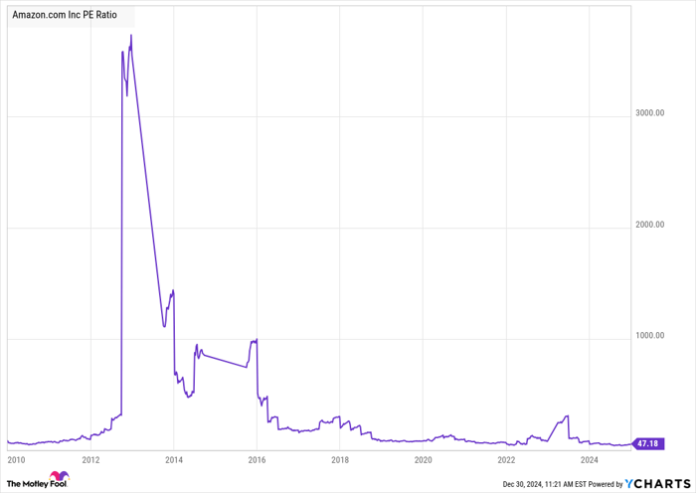

The current P/E ratio is near its lowest in 15 years:

AMZN PE Ratio data by YCharts

Similarly, the free cash flow ratio is low compared to its history. This viewpoint suggests that Amazon stock seemed appropriately priced during the post-2008 market meltdown and once its cloud division became profitable in the mid-2010s. Yet, Amazon faced cash profit dips in both 2013 and 2021 due to the costs of data center construction, top-tier shipping, and enhancements to its headquarters.

The average P/FCF for Amazon over the past 15 years stands at 108:

AMZN Price to Free Cash Flow data by YCharts

Moreover, Amazon has shown outstanding returns historically. While the S&P 500 (SNPINDEX: ^GSPC) expanded by 424% over the highlighted 15 years, Amazon far outperformed with a staggering 3,070% gain:

AMZN data by YCharts

The Challenge of Timing the Market

There’s a notable difference when it comes to timing your purchase correctly. For example, if you had bought Amazon shares right on June 2009, rather than six months later, your return could have soared to an impressive 5,550% instead.

Yet, timing the market remains an elusive challenge. Even Warren Buffett admits uncertainty in predicting the stock market over short periods.

Given this unpredictability, investors should focus on acquiring shares of strong companies when conditions seem favorable, allowing their solid business models to yield long-term growth and returns. This strategy has worked well for top investors like Buffett, and it could serve you well too.

Is It the Right Moment to Buy Amazon?

While it may not be the absolute best time to purchase Amazon stocks, it also isn’t a terrible idea.

Looking forward, Amazon stands to gain from a recovering economy, the ongoing artificial intelligence (AI) expansion, and its new drone delivery initiatives. This company is innovative with an adaptable business strategy, meaning its stock might feel pricey now but could still offer solid returns over the years.

That said, avoid putting all your financial eggs in one basket. Instead, consider starting a small investment in Amazon with price-averaging strategies, like buying in segments or setting up a dollar-cost averaging plan.

The path might have its ups and downs, but not investing could mean missing out on Amazon’s long-term shareholder returns.

Should You Invest $1,000 in Amazon Right Now?

Before deciding to buy Amazon stock, weigh your options:

The Motley Fool Stock Advisor analyst team recently highlighted their picks for the 10 best stocks to buy now, and surprisingly, Amazon did not make the list. The stocks that were recommended could bring significant gains in the near future.

Consider the past with Nvidia, which was recommended on April 15, 2005. If you had invested $1,000 at that time, it would now be worth $842,611!*

Stock Advisor offers a simple guideline for success, featuring portfolio building suggestions, analyst updates, and two new stock recommendations each month. This service has more than quadrupled its returns compared to the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.