“`html

Investing in a Bull Market: Why Timing May Be Overrated

Investors often quote Warren Buffet’s famous advice from his 1986 Chairman’s letter: “Be fearful when others are greedy and greedy when others are fearful.”

However, there’s another insightful remark from the “Oracle of Omaha” that resonates with today’s investment climate.

When quizzed by a shareholder about waiting to invest in three potentially great companies, Buffett cautioned against such hesitation.

“To sit there and hope that you buy them in the throes of some panic… I’m not sure that will be a great technique,” he observed.

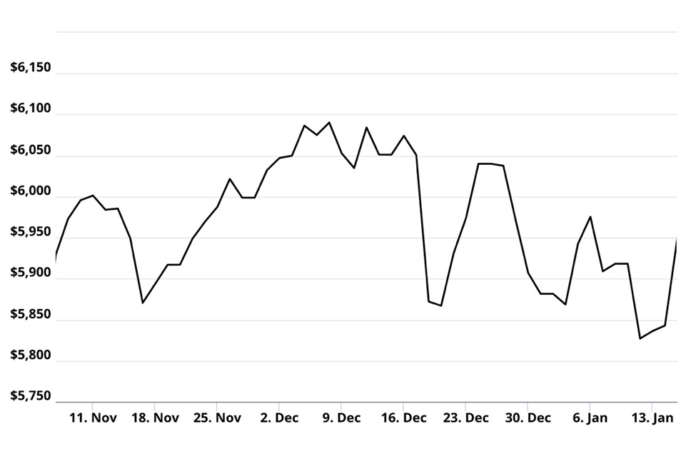

For the past two months, the stock market has indeed encountered challenges. Recently, the market lost all the gains made after the election, as illustrated by the S&P chart below.

Several factors contributed to this market dip…

Rising bond yields, decreased expectations for interest rate cuts by the Federal Reserve, and a renewed concern about inflation for 2025 influenced investor sentiment.

After a period of consecutive yearly returns exceeding 20%, many investors are understandably cautious, fearing a market downturn.

However, two recent soft inflation reports shifted the narrative.

In a stunning turn, the market experienced its best day since November. Traders were quick to adjust their forecasts, now anticipating at least one, possibly two interest rate cuts in 2025.

The VIX, known as the market’s “fear indicator,” started the week at 20 and dipped below 16 as of Friday morning.

As Donald Trump’s inauguration nears on Monday, investors are looking towards potential gains. His proposals for deregulation and other business-friendly initiatives are expected to further support the market.

What does the future hold? Where can investors strategically place their money now? In line with Buffett’s advice, which promising companies should we confidently invest in instead of waiting for an elusive market crash?

Our analysts are ready with specific recommendations for consideration.

Louis Navellier foresaw Trump’s electoral victory in the spring of 2024, well ahead of many analysts. He has been positioning his Growth Investor subscribers for a wave of executive orders and policies that are set to benefit select stocks in the first 100 days of Trump’s second term.

Here’s how Navellier summarized the larger picture in his latest Growth Investor issue.

The simple fact is that when the U.S. economy is performing well, people are more optimistic and likely to spend more, which boosts business activity. Corporate earnings are also expected to rise.

Notably, the earnings outlook has improved significantly. The S&P 500 is now projected to see over 10% average annual earnings growth for the next three quarters. FactSet forecasts 12.1% growth in the fourth quarter, 12.7% in the first quarter of 2025, and 12.0% in the second quarter of 2025.

If you read the regular Digest, you know that earnings are a crucial focus for Louis. This trend was evident last week with Cal-Maine Foods, Inc. (CALM). Here’s how he described its recent success.

The leading U.S. producer and distributor of shell eggs saw an increase in sales and rising egg prices this past quarter. Consequently, earnings skyrocketed 1,188% year-over-year, while sales also grew by 82% year-over-year. Earnings per share surpassed analysts’ expectations, leading to a notable stock rally on Wednesday.

I expect this momentum to continue as we enter earnings season.

In reality, earnings growth accelerated in the fourth quarter and is expected to keep increasing throughout 2025. FactSet anticipates the S&P 500 will achieve 11.9% average earnings growth alongside 4.6% average revenue growth for the fourth quarter.

The stock for CALM has risen 17% since Navellier selected it in November.

AD

Market Outlook Brightens as Inflation Data Exceeds Expectations

Forecasting Positive Trends in Inflation

On Monday, hypergrowth analyst Luke Lango confidently predicted positive inflation reports. In a message to Innovation Investor subscribers, he stated:

This week’s inflation reports will likely be soft.

Although the stock market is worried about reinflation pressures at the current moment, we are positive on current inflation trends. That’s because – based on real-time estimates – inflation appears to be turning a corner.

That is, throughout late 2024, both headline and core inflation rates were reinflating. But headline inflation rates are now starting to flatline, while core inflation rates are falling. That is, the trends in both headline and core inflation velocity are improving.

We like those trends and believe they bode well going into this week’s inflation reports.

Lango’s predictions proved accurate when the inflation reports showed soft results. What does he foresee for the market? He elaborated:

We think this is the start of a big, multi-week march higher in stocks.

Fundamentally, inflation fears should ebb over the next few weeks while economic growth hopes take center stage. We’re going into earnings season – the meat of it is the last week of January and the first week of February – and we think the earnings season will be good.

Plus, we have Trump’s inauguration next week and we expect a flurry of pro-growth policies to be announced in his first few weeks back at the White House.

The combination of those pro-growth policies and strong earnings should keep economic growth hopes front-and-center in the market, which should help propel stocks higher into February.

Among Lango’s picks in the AI sector is CyberArk Software (CYBR), a cybersecurity firm focused on identity security and privileged access management software. As artificial intelligence continues to develop, the risks associated with AI-driven hacks increase. Consequently, the demand for cybersecurity solutions is on the rise.

Since Lango’s recommendation in September, the stock has risen more than 32%.

Investing comes with its challenges; emotional reactions can impact decision-making. However, allowing fear of market corrections to hinder investments may result in missed opportunities.

Focusing on quality stocks at reasonable prices enhances your chances for success, even amidst market fluctuations.

As investing legend Warren Buffett once said, “Time is the friend of the wonderful company, the enemy of the mediocre.”

Wishing you a profitable weekend,

Luis Hernandez

Editor in Chief, InvestorPlace