Amazon and Tesla Shine in Q3 Earnings Reports

The Q3 earnings season for the Mag 7 group has wrapped up following Nvidia’s latest quarterly results. This cycle showcased robust growth, although not all companies enjoyed positive reactions afterward.

In contrast, both Tesla (TSLA) and Amazon (AMZN) reported encouraging results that boosted their stock prices after earnings were announced.

Amazon Delivers Strong Growth with AWS

Amazon’s latest figures came in impressive, exceeding analyst expectations for both earnings per share (EPS) and revenue. The company saw EPS rise by an impressive 70% year-over-year, and revenue reached $60 billion, marking an 11% increase from the previous year.

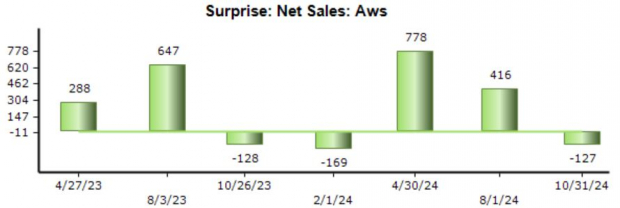

The standout in this report was Amazon Web Services (AWS). AWS revenues climbed 19% from a year ago, totaling $27.5 billion. While this growth matched the previous quarter, it confirms an ongoing strong performance.

Furthermore, AWS’s profitability surged, with operating income rising to $9.3 billion compared to $5.4 billion last year. Below is a chart comparing these results with expectations, noting that the recent $27.5 billion result slightly missed estimates by $127 million.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

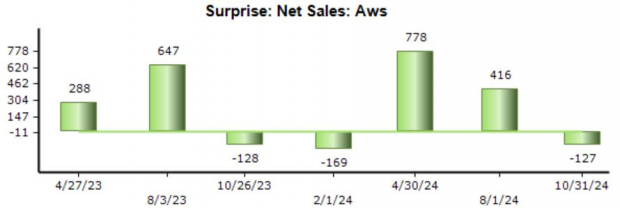

Post-release, analysts have raised their earnings forecasts for Amazon, contributing to the stock’s Zacks Rank of #2 (Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

As the leader in the cloud market, Amazon’s AWS continues to thrive, particularly amid the growing interest in artificial intelligence. AWS offers various services, including computing power and machine learning tools, solidifying its competitive edge.

Tesla Reports Increased Profitability

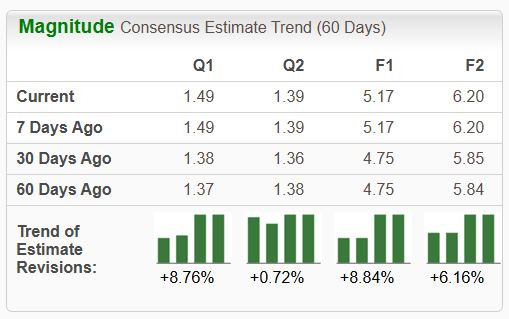

While Tesla’s electric vehicle (EV) production and delivery numbers are noteworthy, the major driver for an uptick in shares was the rise in gross margins. The company reported a gross margin of 19.8%, up from 17.9% during the same quarter last year.

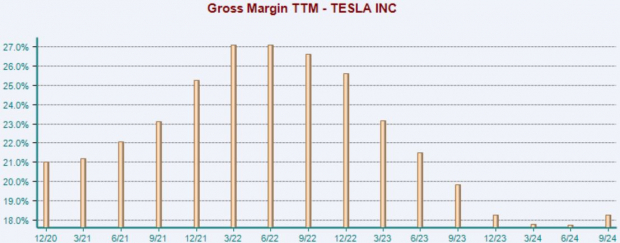

Significantly, Tesla recorded its lowest cost of goods sold (COGS) per vehicle to date, which bodes well for future performance. Analysts have also updated their EPS estimates following this favorable report, and Tesla now holds a Zacks Rank of #1 (Strong Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock’s current upward trajectory is notable, aided in part by the recent U.S. elections. Analysts anticipate continued growth into the next fiscal year, projecting a 30% increase in EPS alongside a 16% rise in sales.

Conclusion

Now that Nvidia’s quarterly results are in, the broader Q3 earnings season for the Mag 7 group is complete. Overall, the group displayed solid growth, with Amazon (AMZN) and Tesla (TSLA) standing out in the post-earnings landscape.

Tesla’s improved profitability played a significant role in its rising share price, aided by developments from the U.S. elections. The company is positioned as the top choice for those looking to invest in the EV market, with promising growth expected ahead.

Amazon’s strong AWS performance contributed to positive post-earnings movements, reflecting solid underlying momentum. As the leading player in cloud computing, Amazon is well-positioned to benefit from the current AI trend, with the upcoming holiday season likely providing additional boosts.

Discover Top Stock Picks for Potential Growth

Among thousands of stocks, five Zacks experts have highlighted their favorites poised for a significant rise of 100% or more. Director of Research Sheraz Mian has selected one particular stock projected to have the most explosive upside.

This company targets younger consumers, achieving nearly $1 billion in revenue last quarter. A recent dip makes now an excellent opportunity to invest. While not every elite pick results in gains, this stock could outperform previous Zacks Stocks Set to Double, such as Nano-X Imaging which increased by +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Interested in the latest insights from Zacks Investment Research? Download the report on 5 Stocks Set to Double today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

For more details, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.