Stanley Druckenmiller Shifts Strategy: Exits Nvidia for Banking Opportunities

Artificial intelligence (AI) stocks have dominated headlines this year, witnessing rapid growth and achieving high valuations. Some analysts predict this trend will continue as interest rates drop and the Federal Reserve steers the U.S. economy towards a soft landing, marked by reduced inflation and the avoidance of a significant recession.

On the flip side, some investors are wary of a potential overvaluation in the AI sector. Among them is billionaire hedge fund manager Stanley Druckenmiller, who manages investments through his Duquesne Family Office. Recent filings with the Securities and Exchange Commission (SEC) reveal significant changes in Druckenmiller’s portfolio at the close of the third quarter.

Why Druckenmiller Sold Nvidia

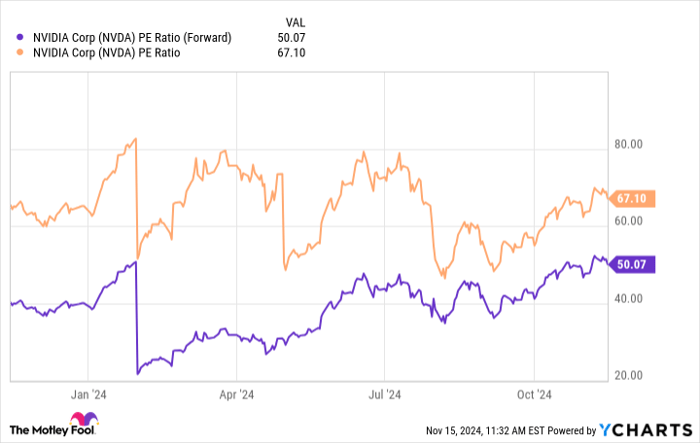

Druckenmiller has clearly changed his perspective on Nvidia. During the second quarter, Duquesne reduced its stake in the chipmaker by a remarkable 83%. Although he remains optimistic about AI’s future, Druckenmiller cited valuation concerns: “What changed is it tripled in a year, and I thought the valuation was rich,” he told Bloomberg. He later admitted that selling Nvidia too soon might have been a mistake and expressed interest in repurchasing it if prices drop.

NVDA PE Ratio (Forward) data by YCharts

Valuation holds significant importance when investing. Even fantastic companies can sometimes be overpriced, while poor performers might trade at bargains. Thus, sometimes, even the strongest beliefs about a company must be tempered by its market price.

Bank Stocks Gaining Appeal

Banks may not spark excitement as investments compared to tech giants like Nvidia, yet Druckenmiller is making a bullish move into the banking sector. Many investors abandoned banks due to a banking crisis in early 2023, stringent regulations, and fears of rising regulatory capital requirements. However, with recent interest rate cuts and a favorable economic outlook, bank stocks have surged, especially following the elections.

In the third quarter, Druckenmiller seized the opportunity to invest heavily in U.S. banks, moving away from prior investments in foreign banks. Rather than opting for a broad regional banking ETF, he concentrated on super-regional banks. His strategy likely reflects a belief in increased profitability in a more favorable economic climate. Additionally, he may be anticipating a wave of mergers and acquisitions among banks as regulatory pressures ease.

His insights reflect concerns over long-term bond yields, which could benefit banks through an expanding yield curve. When the yield curve steepens, longer-term bonds yield more than shorter-term ones, enhancing banks’ profit margins, as they usually borrow at lower rates and lend at higher ones. This strategy helps Druckenmiller hedge against potential risks tied to the national debt situation.

Uncertainty Surrounds the AI Stock Surge

While Druckenmiller’s recent moves might suggest caution towards the AI sector, he also initiated a new position in Taiwan Semiconductor Manufacturing (NYSE: TSM) in the third quarter. This dual approach indicates he is not entirely abandoning AI, but prefers to buy in during market dips when opportunities arise. Other notable investors, like Warren Buffett, seem to share a similar sentiment.

Even seasoned investors can make mistakes, so retail investors should carefully evaluate their own goals and risk tolerances before following anyone’s lead. While high valuations could lead to potential corrections, long-term investors may choose to maintain their positions despite market fluctuations.

Is Now the Right Time to Invest in Nvidia?

If you’re considering investing in Nvidia, here’s something to think about:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy right now, and Nvidia wasn’t included in this list. The analysts think these stocks could yield significant returns over the coming years.

Reflect on Nvidia’s past performance; had you invested $1,000 upon their recommendation back on April 15, 2005, you’d now have approximately $858,854!*

The Stock Advisor program continues to guide investors with insights on portfolio building and regular analyst updates, offering two new stock recommendations each month. This service has significantly outpaced the S&P 500’s returns since 2002.*

Discover the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Citigroup is an advertising partner of Motley Fool Money. Bram Berkowitz holds shares in Citigroup. The Motley Fool has positions in and recommends Nvidia, Taiwan Semiconductor Manufacturing, Truist Financial, and U.S. Bancorp. Additionally, the Motley Fool recommends Ameris Bancorp. Please refer to the Motley Fool’s disclosure policy for more details.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.