Align Technology Faces Challenges Amidst Industry Competition and Economic Shifts

Align Technology, Inc. (ALGN), based in Tempe, Arizona, is a key player in the orthodontic sector, renowned for its Invisalign clear aligners and iTero intraoral scanners. With a market capitalization of $17.1 billion, the company also produces software for dental labs and practitioners.

Large-Cap Stock Leading the Way in Orthodontics

ALGN is categorized as a “large-cap stock” given its market cap above $10 billion, signifying its significant presence and influence within the medical instruments and supplies industry. The company has maintained a strong reputation by combining advanced 3D digital scanning with tailored aligner production, enabling a seamless orthodontic process that keeps it ahead of competitors.

Recent Stock Performance and Economic Trends

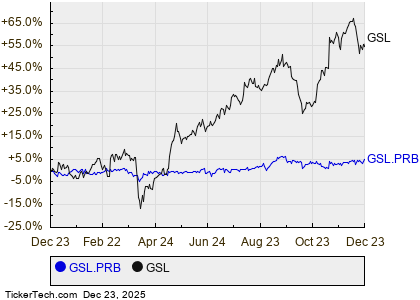

Despite its strong fundamentals, ALGN has seen a decline of 31.8% from its 52-week high of $335.40, reached on March 21. In the last three months, the stock fell 9.6%, in contrast to the Nasdaq Composite ($NASX), which gained 14.1% during the same period.

Year-to-date, ALGN shares have dropped 16.5%, and over the past year, they have decreased by 10.3%, while the NASX has gained 34% and 35.7%, respectively. This downturn is further supported by its trading trends; ALGN has been below its 200-day moving average since April, although it did trade above its 50-day moving average in late November.

Impact of Market Conditions on ALGN

The decline in ALGN’s performance can be attributed to seasonal variations in the clear aligner market and a lack of consumer confidence within the U.S. dental sector. Additionally, global political tensions and ongoing healthcare labor challenges have also posed hurdles for the company.

Q3 Results Fall Short, But Earnings Beat Expectations

On October 23, ALGN reported its Q3 results, which revealed total revenues of $977.9 million—falling short of analyst forecasts that predicted $991.2 million. However, the adjusted earnings per share (EPS) of $2.35 exceeded expectations of $2.31. For the upcoming Q4, ALGN anticipates revenues between $995 million and $1 billion.

Market Outlook and Analyst Sentiment

In contrast to ALGN, rivals such as DENTSPLY SIRONA Inc. (XRAY) have struggled, experiencing declines of 46.1% year-to-date and 44.2% over the last year. Despite ALGN’s recent challenges, Wall Street analysts maintain a moderately positive outlook, with a “Moderate Buy” consensus rating from 12 analysts and a mean price target of $268.82, indicating a potential upside of 17.5% from current levels.

On the date of publication, Neha Panjwani did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.