Nvidia has been a monster winner in the artificial intelligence (AI) arms race. Its graphics processing units (GPUs) are the top pick for clients looking to outfit a server to train AI models. However, AMD (NASDAQ: AMD) also has a formidable offering but hasn’t seen nearly the same rise as Nvidia.

So, is this a buying opportunity for AMD because it’s also a significant player in the GPU industry? Let’s find out.

AMD’s GPUs aren’t in the same class as Nvidia’s

Since the start of 2023, AMD has been up over 150%, which is spectacular until you compare it to Nvidia’s 680% rise. Even this year, Nvidia is smoking AMD in terms of returns, as it has more than doubled while AMD is up around 16%.

So, why is there such a large stock performance discrepancy between two businesses competing in the same market? It all boils down to AMD’s business makeup and execution. Unlike AMD, Nvidia is solely focused on producing top-notch GPUs, be it for data centers, gaming, or automobiles. AMD’s resources are spread out among many divisions, as it has GPU and other data center products, CPUs for PCs, gaming GPUs that go into consoles, and embedded microprocessors.

This gives AMD a more complete ecosystem of products, but it doesn’t specialize in any one area. This is further exaggerated because Nvidia has nearly 30,000 employees, while AMD has 26,000. So, Nvidia has a larger workforce dedicated to GPUs, while AMD has a smaller workforce spread across many more lines. In the GPU-specific markets, AMD and Nvidia are direct competitors in data centers, gaming, and automotive, but competing with fewer resources.

Additionally, Nvidia’s data center division produced more revenue than AMD did companywide in similar quarters. In Nvidia’s Q1 FY 2025 (ending April 28), the data center division generated $22.6 billion in sales. Compared to AMD’s $5.5 billion in revenue companywide in Q1 (ending March 31), Nvidia’s revenue per employee is far higher.

This isn’t a great recipe for outperforming a competitor, so AMD has seen some stock interest, but not nearly as much as Nvidia. On the plus side, if the GPU market goes in the tank, AMD is a more balanced business, so it should be able to weather the storm better than Nvidia. Unfortunately for AMD, some other sides of the business aren’t doing so well.

AMD’s businesses are up and down

In the first quarter, AMD’s revenue trend across its four segments looked like this:

| Segment | Revenue | YOY Growth |

|---|---|---|

| Data center | $2.34 Billion | 80% |

| Client | $1.37 Billion | 85% |

| Gaming | $922 Million | (48%) |

| Embedded | $846 Million | (46%) |

Data source: AMD. YOY = year over year.

Moderation doesn’t appear to be AMD’s strong suit in Q1, as its four divisions were massively up or down. When every segment is combined, you get a year-over-year revenue growth rate of just 2% and an 11% decrease from Q4. If the “AMD is the next Nvidia” thesis were true, we’d see much higher growth in the data center division, as Nvidia has been consistently tripling its revenue from a year-over-year standpoint.

But just because it’s struggling now doesn’t mean it will in the future.

Some clients may turn to AMD’s products for a cheaper price or to diversify their servers just so they aren’t locked into one provider, which is likely why its data center products are still doing well (80% year-over-year growth is nothing to be sad about). Still, the lion’s share of revenue will go to Nvidia, which doesn’t bode well for AMD.

So, is the stock even worth buying at this point? I’d say no.

Wall Street analysts project 3% revenue growth this year and 28% next year. On the flip side, analysts expect 69% growth from Nvidia in fiscal year (FY) 2025 (ending January 2025) and 28% in FY 2026. So, success could be right around the corner for AMD.

However, you must pay a greater premium for AMD’s stock than Nvidia’s.

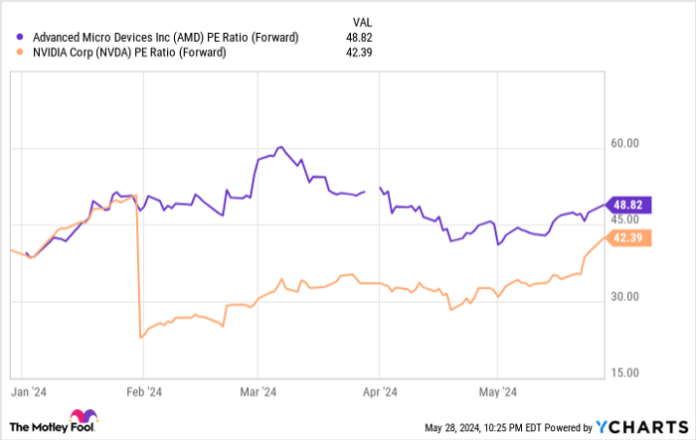

AMD PE Ratio (Forward) data by YCharts PE Ratio = price-to-earnings ratio.

At 49 times forward earnings, AMD stock isn’t cheap and is more expensive than a competitor that’s smoking it. However, AMD is slated to have strong growth in 2025, so we must also compare its valuation using 2025 earnings per share (EPS) estimates.

AMD and Nvidia are expected to generate $5.55 and $34.93 in EPS, respectively, for AMD’s FY 2025 (AMD’s FY 2025 ends December 2025) and Nvidia’s FY 2026 (Nvidia’s FY 2026 ends January 2026). Dividing their current stock prices by these projections yields a price-to-forward two-year earnings ratio. For Nvidia, that’s 32 times forward earnings. This extra year makes a big difference for AMD, as its ratio drops to 31 times forward earnings, nearly the same as Nvidia’s.

However, this is a long way into the future to get projections right, so not a lot of credence should be given to this analysis. Plus, even if it were perfectly accurate, do you really want to own a second-tier player in an industry where being the top dog is important? I don’t think so, which is why I don’t believe AMD is the next big AI stock.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 28, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.