AMD Strives for Growth Amidst AI Competition with Nvidia

Advanced Micro Devices (NASDAQ: AMD) may trail behind Nvidia in the race for AI chips, but it is still riding the wave of a growing AI market. Many customers are looking for alternatives to Nvidia, which is proving to be beneficial for AMD. Despite posting solid AI-related growth, the company’s shares have faced a downturn, leaving them barely positive for the year.

Let’s dive into AMD’s third-quarter results to determine whether this dip presents a buying opportunity or hints at potential challenges in its AI strategy.

Sales Surge in the Data Center Business

In the third quarter, AMD’s sales increased by 18% year over year, totaling $6.8 billion. Adjusted earnings per share (EPS) registered at $0.92, marking a 31% rise. This growth is a notable improvement compared to Q2, where sales climbed just 9% and adjusted EPS grew 19%.

The data center segment stood out with an impressive revenue jump of 122%, reaching $3.5 billion year over year, and a sequential increase of 25%. Sales growth in this sector was largely fueled by demand for Instinct graphics processing units (GPUs) and EPYC central processing units (CPUs). AMD noted that its EPYC CPUs are being widely adopted by major cloud providers like Microsoft and Meta Platforms, along with enterprise clients such as Adobe, Boeing, and Nestle.

Moreover, the client segment also experienced strong performance, rising 29% to $1.9 billion, primarily due to the demand for Zen 5 processors. However, challenges arose in the gaming segment, where revenue dropped 69% to $462 million, and in the embedded category, which fell 25% to $927 million. Adjusted gross margins improved as well, increasing 250 basis points to 53.6% and up 50 basis points sequentially.

During this quarter, AMD generated free cash flow of $496 million, ending with net cash and short-term investments totaling $4.5 billion, against $1.7 billion in debt.

Looking ahead, the company forecasts Q4 revenue to be approximately $7.5 billion, with a potential variation of $300 million. At the midpoint, this reflects expected year-over-year growth of 22%. AMD has also revised its full-year GPU data center revenue outlook, increasing it from over $4.5 billion to now exceeding $5 billion.

For 2025, AMD expressed optimism regarding continued growth in the data center arena, as companies invest significantly to enhance their infrastructure for AI workloads. Customers are gradually expanding their AI operations using AMD’s GPUs, which bodes well for future growth.

Image source: Getty Images.

Should Investors Consider Buying the Dip?

As with Nvidia, AMD’s expansion is closely tied to the growing demand for AI infrastructure. Nevertheless, AMD is finding more traction within AI inference, even making advancements in large language model (LLM) training. While it might not challenge Nvidia’s lead, AMD is successfully carving out its niche. The rapid growth of the AI infrastructure market suggests even small increases in market share could result in significant revenue growth for AMD.

The upcoming acquisition of ZTE Systems—which specializes in designing and developing data center equipment—should boost AMD’s competitive edge. This will position the company to offer comprehensive solutions incorporating its GPUs, CPUs, and networking equipment, allowing for quicker market deployments and potentially attracting infrastructure-hungry clients.

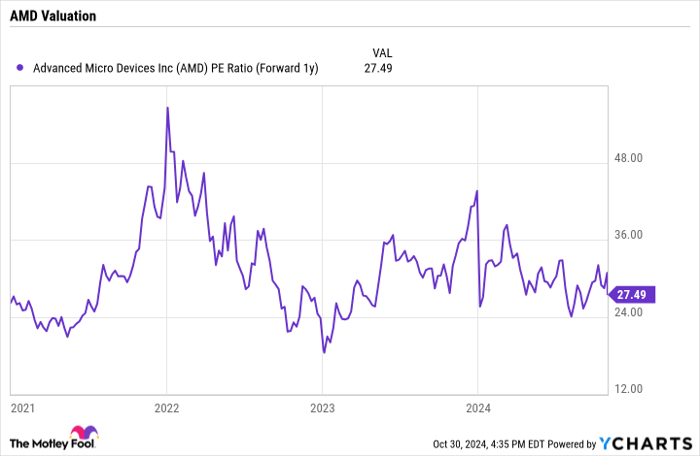

Evaluating AMD’s valuation, the company trades at a forward price-to-earnings ratio (P/E) of 27.5 times next year’s estimated earnings. Considering the robust growth potential ahead, this valuation appears quite reasonable.

AMD PE Ratio (Forward 1y) data by YCharts.

Despite a preference for Nvidia due to its remarkable growth, AMD is poised to benefit from the AI-driven data center expansion. The ZTE Systems acquisition could further enhance its standing in this sector.

Consequently, investors may find this recent stock dip a good opportunity to buy, as the long-term outlook for AMD remains strong, with no clear signs of weaknesses in the AI infrastructure narrative.

Seize This Chance for Potential Growth

If you’ve ever felt you missed the chance to invest in successful companies, now could be your opportunity.

Sometimes, our top analysts identify a “Double Down” stock—a recommendation for companies poised for notable growth. If you feared you missed out, this may be the best time to invest before the prices rise again. The numbers tell an impressive story:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,292!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,169!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $407,758!*

Currently, we have “Double Down” alerts for three exceptional companies, and an opportunity like this may not come around again soon.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Nestlé and advises the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.