Is Archer Aviation’s Air Taxi Dream Worth the Investment?

The second half of 2024 has been advantageous for many speculative high-growth stocks. Archer Aviation (NYSE: ACHR) stands out, having surged over 100% in the last month, coinciding with the U.S. presidential election. This air taxi company aims to establish a network of electric vertical take-off and landing vehicles (eVTOL) in wealthy cities worldwide, utilizing a point-to-point transportation strategy.

What’s the verdict on investing in Archer Aviation stock today? Let’s dive into this rising air taxi startup and examine its potential.

Exploring the Future of Air Taxis

Archer Aviation is setting up a fleet of eVTOL taxis, which are designed to operate more quietly than traditional helicopters, making them suitable for urban environments. The company’s goal is to tackle congested routes, such as the journey from downtown Manhattan to local airports. For example, a trip from southern Manhattan to Newark Airport could take just nine minutes, presenting a significant time-saving advantage for affluent customers.

Archer plans to manufacture approximately two aircraft per month, with hopes of launching operations in cities like New York, Tokyo, and Abu Dhabi by 2025. The company has an impressive order book estimated over $6 billion, indicating strong commercial interest in eVTOL technology, provided the necessary infrastructure develops alongside it.

As Archer Aviation begins test flights, the potential for growth appears limitless. Urban centers across the globe continuously struggle with traffic, suggesting a lasting demand for such point-to-point networks. While challenges lie ahead, air taxi services may become a crucial transportation solution within the next decade in select cities.

Financial Challenges: No Revenue and Heavy Losses

While the potential for Archer Aviation is substantial, there are evident challenges. To date, the company has yet to generate any sales and remains entangled in the regulatory approval process with the Federal Aviation Administration (FAA). Although revenues will likely stream in once operations launch, that moment has not arrived.

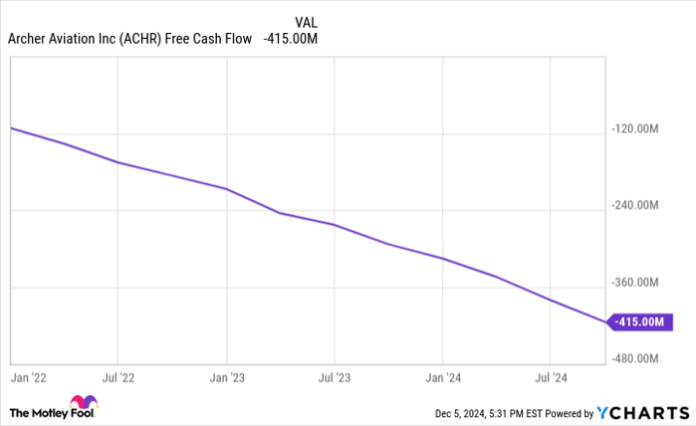

The financial outlook remains concerning due to the absence of revenue. Over the past year, free cash flow has dropped to negative $415 million. Additionally, cash burn is expected to worsen as the company invests in developing its eVTOL fleet. Even when operations commence, financial losses are likely to continue. In a favorable scenario of operating 100 routes generating $100 an hour, total annual revenue would amount to only $87.6 million, falling short of covering expenses.

ACHR Free Cash Flow data by YCharts

Time to Buy, Sell, or Hold Archer Aviation Stock?

There’s no doubt that Archer Aviation has significantly outperformed the market in recent months. Nevertheless, its future performance remains uncertain. After evaluating recent developments, I believe Archer Aviation stock is currently a sell for investors.

The market valuation stands at $3.3 billion for a company with no annual sales. Moreover, even with an optimal operational network, revenues are unlikely to surpass current costs. It’s important to consider that an eVTOL taxi network involves considerable expenses, including electricity, pilot salaries, and depreciation, which will hinder profit margins.

As of the last quarter, Archer Aviation had over $500 million in cash, with plans to secure an additional $400 million in funding. However, given its current cash burn rate, these funds could potentially last only two years. It is improbable the company will achieve positive free cash flow by then.

Due to the extensive spending before launching operations, I maintain skepticism regarding long-term profitability for Archer Aviation. This situation suggests that investors should carefully reassess their positions regarding this stock.

Should You Invest $1,000 in Archer Aviation Today?

Before making any investment decisions regarding Archer Aviation, consider this:

The Motley Fool Stock Advisor analysts have recently identified their list of the 10 best stocks to buy now – and Archer Aviation does not feature among them. The selected stocks are projected to deliver substantial returns in the coming years.

For example, when Nvidia made their recommendations on April 15, 2005, if you invested $1,000 then, it would now be worth $872,947!

Stock Advisor offers a structured approach to investing, including strategies for portfolio building, regular analyst updates, and two new stock picks each month. This service has reportedly outperformedthe S&P 500 by more than quadrupling its returns since 2002.

Explore the 10 stocks now »

*Stock Advisor returns as of December 2, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.