Assessing Wall Street’s Take on B2Gold: Is It Worth the Investment?

Investors frequently look to Wall Street analysts for guidance when deciding whether to buy, sell, or hold a stock. But do these ratings truly impact stock prices, and how reliable are they?

Before diving into the trustworthiness of brokerage recommendations, let’s examine how analysts currently view B2Gold (BTG).

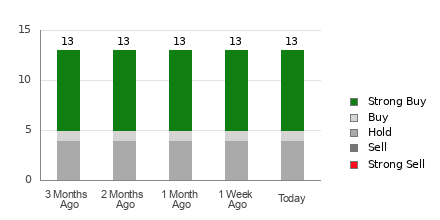

B2Gold holds an average brokerage recommendation (ABR) of 1.69, based on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This rating is derived from recommendations provided by 13 different brokerage firms. An ABR of 1.69 suggests a position between Strong Buy and Buy.

Out of these 13 recommendations, eight are classified as Strong Buy, while one is rated as Buy. Collectively, Strong Buy and Buy recommendations represent 61.5% and 7.7% of total ratings, respectively.

Trends in Brokerage Recommendations for B2Gold

View the price target and stock forecast for B2Gold here>>>

While the ABR suggests a favorable outlook for B2Gold, relying solely on this data for investment decisions may not be wise. Studies indicate that brokerage recommendations often fail to accurately predict which stocks will see significant price increases.

Why is this the case? Brokerage firms typically have a vested interest in the stocks they cover, leading to a tendency for analysts to issue overly optimistic ratings. Research indicates that for every “Strong Sell,” there are about five “Strong Buy” ratings issued by these firms.

This disparity reveals that brokers’ interests may not always align with those of retail investors, which can obscure true price expectations. Thus, using this information as a way to support your own research or as an additional tool might be a more effective strategy.

Our in-depth stock rating tool, the Zacks Rank, provides a different perspective. This system evaluates stocks from Zacks Rank #1 (Strong Buy) to Rank #5 (Strong Sell) and relies on actual earnings estimate revisions. It’s known for its reliable performance in predicting short-term price movements. Pairing the Zacks Rank with the ABR can help you make well-informed investment choices.

Understanding the Difference Between ABR and Zacks Rank

Although both metrics use a scale of 1-5, they measure different things.

The ABR is derived solely from analyst recommendations and usually includes decimals, such as 1.28. Meanwhile, Zacks Rank utilizes earnings estimate revisions to categorize stocks into whole number ranks, from 1 to 5.

Historically, brokerage analysts tend to show an optimistic bias. Their recommendations can often be more favorable than warranted by their underlying research, leading to potential investor misguidance.

Conversely, Zacks Rank focuses on earnings estimates, which are closely linked to stock price movements, based on historical data.

The Zacks Rank also maintains a proportional structure across stocks evaluated for current-year earnings; therefore, it effectively balances its five rankings.

Moreover, the relevance of these ratings can vary. The ABR might not always reflect the most current analysis, whereas the Zacks Rank updates quickly to account for new earnings trends, making it a more timely tool for forecasting stock prices.

Evaluating B2Gold as an Investment

For B2Gold, the Zacks Consensus Estimate for this year stands firm at $0.23, showing no change over the past month.

Stability in analysts’ earnings forecasts suggests B2Gold may perform in line with the broader market in the near future.

Based on the recent consensus estimate adjustments and other contributing factors, B2Gold has received a Zacks Rank #3 (Hold). For a complete list of Zacks Rank #1 (Strong Buy) stocks, click here>>>>

Considering this information, it might be wise to approach the favorable ABR for B2Gold with some caution.

Zacks Revealing Top 10 Stocks for 2025

Do you want early insights into our top picks for 2025?

Past performance suggests these stocks could achieve outstanding results.

From 2012 through November 2024, the Zacks Top 10 Stocks portfolio generated a remarkable +2,112.6%, significantly outperforming the S&P 500’s gain of +475.6%. Our Director of Research, Sheraz Mian, is evaluating 4,400 companies to uncover the best 10 stocks to invest in for 2025. Don’t miss your chance to access these selections when they are unveiled on January 2.

Be the First to Discover the New Top 10 Stocks >>

B2Gold Corp (BTG): Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.