The Data-Marketing Dynamo: Cardlytics Stock

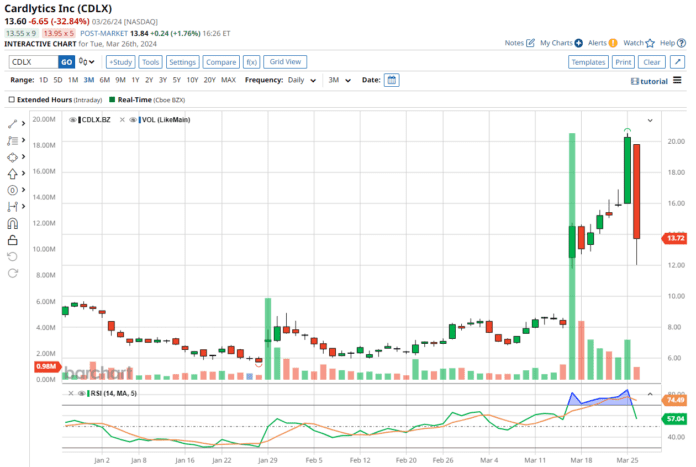

Cardlytics (CDLX) dances at the intersection of data and marketing, flaunting its prowess in the financial services domain where targeted advertising takes the spotlight. The company’s intricate dance with banks involves analyzing customer purchase data to curate personalized deals from merchants. With a current market cap of $893 million, Cardlytics has indeed caught the investor’s eye. The recent rollercoaster ride of CDLX shares this March highlights the drama – soaring after earnings, plunging post a senior notes offering, yet boasting a 47.6% rise year-to-date.

Enter Clifford Sosin, a heavyweight stakeholder, whose recent whopping $13.9 million bet on Cardlytics shares has raised eyebrows. Through CAS Investment Partners, Sosin secured slightly over 1.5% of the company’s market cap over two whirlwind days of buying. This investment spree marks Sosin’s return to CDLX stock after two years, a period witnessing notable price fluctuations since his last buy-in.

CDLX Triumphs on Q4 Results

Cardlytics’ stellar Q4 performance added more fuel to the investment fire, with the company reporting revenues of $89.2 million, a remarkable 8.1% uptick from the previous year. Despite a wider per-share loss than the consensus estimate, the silver lining lay in a significantly narrower loss compared to the previous year. Furthermore, Cardlytics managed to clinch a full-year profit of $4 million on an EBITDA basis. With consistently outperforming bottom-line expectations in three of the past five quarters, CDLX stands tall.

Strategic Brilliance: Leverage of Bank Partnerships and Dosh Acquisition

Cardlytics wields a unique power, tapping into a colossal 50% of card swipe data in the U.S., covering a staggering 168 million bank customers. This data trove, courtesy of partnerships with major U.S. banks, forms the bedrock of Cardlytics’ robust digital advertising platform, enabling companies to craft targeted marketing campaigns based on consumer behavior. Additionally, the strategic acquisition of Dosh in 2021 has widened Cardlytics’ reach in the cash-back fintech realm, promising a stronger foothold in the underbanked category.

Analyst Sentiments and Future Projections

Analysts have donned CDLX stock with a “Strong Buy” rating, pegging a mean target price of $17, with a high target of $18. With 2 out of 3 analysts echoing a bullish stance, CDLX’s upward trajectory seems to have garnered favor on Wall Street. As the stock flirts with these target prices and inches closer to realizing its full potential, the intrigue surrounding Cardlytics only intensifies.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.