Cisco’s Q2 2025 Earnings Anticipation: Solid Growth and Challenges Ahead

Cisco Systems CSCO plans to report its second-quarter fiscal 2025 earnings on February 12.

Check out Zacks Earnings Calendar for the latest EPS estimates and surprises.

The company projects second-quarter fiscal 2025 revenues to range from $13.75 billion to $13.95 billion. Non-GAAP earnings are estimated between 89 and 91 cents per share.

The Zacks Consensus Estimate for revenues stands at $13.86 billion, reflecting a growth of 8.36% compared to the same quarter last year. Meanwhile, the earnings consensus has remained consistent at 91 cents per share over the past month, signaling a year-over-year growth of 4.6%.

Cisco Systems, Inc. Price and EPS Surprise

Cisco Systems, Inc. price-eps-surprise | Cisco Systems, Inc. Quote

CSCO’s earnings have exceeded the Zacks Consensus Estimate for the past four quarters, averaging 4.14% above expectations.

Let’s explore the key factors influencing this upcoming announcement.

Driving Forces Behind CSCO’s Q2 Earnings

Cisco is likely to see positive results in its second-quarter fiscal 2025 due to a heightened demand for networking products. Strong sales for its Nexus brand data center switches and the popularity of its 400-gig and 800-gig switches, which leverage Silicon One technology, are significant contributors.

The current Zacks Consensus Estimate for Networking revenues in the fiscal second quarter is $6.663 billion, which indicates a 6% decline year-over-year.

Collaboration product orders surged in the fiscal first quarter, thanks to increased demand for devices and the Cisco Cloud Webex Suite. Recent additions, such as Webex AI Agent, AI Agent Studio, and Cisco AI Assistant features for Webex Contact Center, are expected to enhance revenue growth.

The consensus estimate for Collaboration revenues stands at $1.004 billion, suggesting a year-over-year increase of 1.5%.

Cisco also benefits from a robust security segment, shown by significant demand for solutions like XDR, Secure Access, and Multicloud Defense. The acquisition of Splunk has played a critical role in this growth.

Security orders soared more than double year over year in the first quarter of fiscal 2025, largely driven by Splunk’s advanced threat intelligence capabilities.

The Zacks Consensus Estimate for fiscal second-quarter Security revenues is currently $1.987 billion, which indicates an impressive year-over-year growth of 104.2%.

CSCO’s Stock Performance: A Bright Spot

In the last 12 months, Cisco shares have increased by 24.5%, outperforming the Zacks Computer & Technology sector, which rose by 20.7%, and the Zacks Computer Networking industry, which gained 23.6%.

CSCO Stock’s Performance

Image Source: Zacks Investment Research

Despite this growth, Cisco’s stock may be on the pricey side; its Value Score of D indicates a potentially high valuation at present.

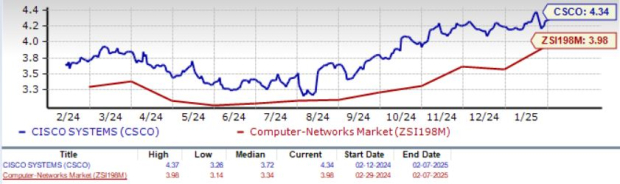

Currently, CSCO is trading at a forward 12-month price-to-sales (P/S) ratio of 4.34X, compared to the industry average of 3.98X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Promising Opportunities Ahead for Cisco

Cisco stands at a strong advantage given the rising demand for AI-related workloads. The company’s innovative portfolio, combined with substantial investments in AI, cloud technologies, and cybersecurity, holds great promise. Cisco aims for over $1 billion in orders for fiscal 2025.

The Cisco 8000 series, featuring the Silicon One G200, consists of scalable, programmable, low-power switches that are ideal for AI networks, further driving their adoption by hyperscalers seeking power efficiency.

HyperFabric, a fabric-as-a-service solution from Cisco, is set to launch in early 2025. It will simplify the management of infrastructure while providing real-time insights into network performance.

Cisco’s wireless innovations include Wi-Fi 7 access points equipped with AI, enhancing secure and adaptable connectivity. Paired with Cisco Spaces, these solutions facilitate optimized smart workplaces.

Additionally, CSCO’s software suite includes advanced platforms like AppDynamics for complete observability and Cisco SecureX for integrated security. New collaboration tools leverage conversational intelligence to enhance customer satisfaction and efficiency.

Strategic Partnerships Strengthening CSCO’s Future

Cisco’s strategic partnerships with major companies like Meta Platforms META, Microsoft, NVIDIA NVDA, Lenovo, and AT&T T are pivotal.

Collaboration with NVIDIA is crucial for enhancing Cisco’s datacenter infrastructure offerings. New NVIDIA-powered AI servers and AI PODs, integrated with the company’s AI Enterprise software, are streamlining AI infrastructure management.

Conclusion

Cisco’s upcoming results are expected to capitalize on a strengthening networking sector and expanding security operations. Its rich portfolio and strategic partnerships could significantly boost CSCO’s stock performance in fiscal 2025.

Cisco currently holds a Zacks Rank #2 (Buy), suggesting that investors may want to consider acquiring shares ahead of the fiscal second-quarter earnings announcement. A complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss the chance to invest early in our handpicked top 10 stocks for 2025. Selected by Zacks Director of Research Sheraz Mian, this portfolio has shown remarkable success. From its inception in 2012 through November 2024, the Zacks Top 10 Stocks gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has analyzed over 4,400 companies covered by the Zacks Rank to identify the top 10 to buy and hold for 2025. You can be among the first to discover these newly released stocks with high potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Download your free copy of “7 Best Stocks for the Next 30 Days.”

AT&T Inc. (T): Free Stock Analysis Report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.