Intel’s Fourth Quarter Surprises Investors with Positive Earnings and Revenue Growth

Intel Corporation (INTC) showcased strong fourth-quarter 2024 results, surpassing the Zacks Consensus Estimate for both adjusted earnings and revenue. The company’s quarterly revenue approached the upper limit of its guidance, driven by growth in its core x86 architecture and heightened interest in its Intel 18A process node.

Explore updated EPS estimates and surprises on Zacks Earnings Calendar.

Commitment to Core Strategy Remains Firm

Despite ongoing efforts to enhance operational efficiency, Intel’s management confirmed that the core strategy will stay the same. The focus will be on executing operational goals diligently to become a leading foundry in the industry.

This path, however, calls for a significant cultural shift. Intel needs to transition from its previous “no wafer left behind” approach—which emphasized extra capacity to meet demand—to a new “no capital left behind” mindset. The latter aims to maximize efficiency by utilizing every wafer that can be produced from current resources.

Intel’s AI Chip Innovations Gain Traction

Intel has made impressive strides in the AI PC market, with plans to ship over 100 million units by the end of 2025. The Panther Lake chip, based on Intel 18A technology, is set to launch in late 2025, while Clearwater Forest, Intel’s first 18A server product, is expected in the first half of 2026.

The new Intel Core Ultra includes a neural processing unit for power-efficient AI acceleration, boasting 2.5 times better energy efficiency than previous models. With improved GPU and CPU capabilities, this chip aims to enhance AI solutions effectively, exemplified by the recent vPro platform release, which further promotes energy efficiency across applications.

Challenges and Competitive Pressures

Despite gaining ground in AI, Intel faces fierce competition from NVIDIA Corporation (NVDA), whose H100 and Blackwell graphics processing units dominate the market. Many leading technology firms are rapidly adopting NVIDIA’s GPUs for AI applications, contributing to a significant revenue surge for NVIDIA.

Intel’s shift to producing more AI PCs has impacted short-term margins, particularly due to the higher costs associated with its Irish facility. Additionally, ongoing costs related to non-core sectors, unused capacity, and an unfavorable product mix have further strained margins.

The rise of over-the-top service providers adds to Intel’s difficulties in maintaining customer relationships and competitiveness. Price-sensitive competition is increasing, which could lead to further challenges in attracting and retaining clients and adversely affect financial results.

Moreover, the growing demand for silicon chips to support AI initiatives poses challenges for Intel. Although it relies heavily on Taiwan Semiconductor Manufacturing Company Limited as a supplier, ongoing geopolitical tensions between the U.S. and China complicate issues related to chip supply and may hinder Intel’s ambitions of becoming a premier foundry.

Image Source: Zacks Investment Research

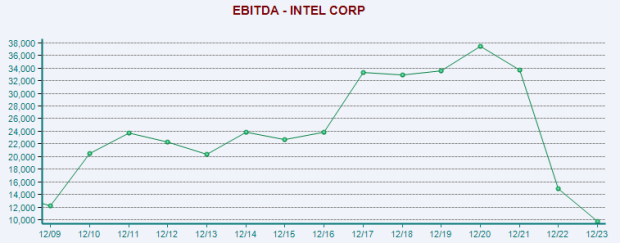

Stock Performance Review

Over the past year, Intel’s stock has decreased by 54.7%, while the industry has shown a growth of 59.4%. This stark contrast largely stems from Intel’s financial struggles and operational setbacks, prompting a comprehensive assessment of its business segments.

Management is exploring various strategies, including potentially separating its product design from manufacturing roles and determining which factory projects to discontinue. Plans to create an independent subsidiary for Intel Foundry aim to enhance strategic benefits and improve capital efficiency, although this division reported an operating loss of $2.26 billion last quarter.

One Year INTC Stock Price Performance

Image Source: Zacks Investment Research

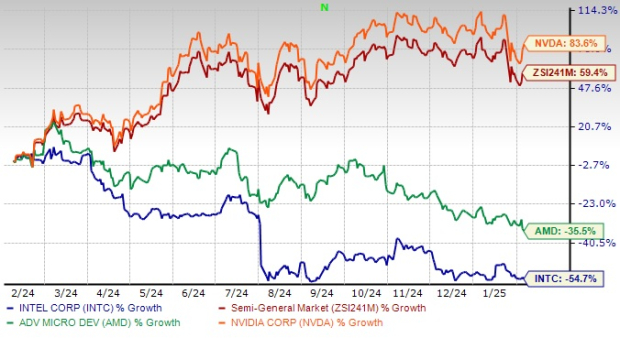

Current Earnings Estimate Trends

Earnings estimates for Intel for 2025 have dropped from 78 cents to 51 cents over the last week, and estimates for 2026 have fallen by 19.6% to $1.19. This downward revision indicates growing bearish sentiment surrounding the stock.

Image Source: Zacks Investment Research

Concluding Thoughts

While Intel’s advances in AI technology offer significant potential for the semiconductor industry, the company must address important challenges related to scalability, performance, and interoperability. By streamlining its operations and simplifying its product portfolio, Intel aims to enhance efficiency and deliver value to its stakeholders. Management has reassured investors by reiterating its short-term goals while staying focused on core competencies.

Nevertheless, recent product launches may seem “too little, too late” for Intel. Persistent margin pressures, compounded by strong export restrictions and unfavorable product mix, are weighing heavily on its financial outcomes. With falling earnings estimates and subpar stock performance compared to industry peers, Intel is grappling with negative investor perceptions. Currently holding a Zacks Rank #3 (Hold), caution is advised for prospective investors in this uncertain environment.

Explore New Opportunities: The Future of Nuclear Energy

The demand for electricity is on the rise, prompting a shift away from fossil fuels like oil and gas. Leaders from the U.S. and 21 other nations have pledged to triple global nuclear energy capacity, which could yield substantial profits for related stocks.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights key players and innovative technologies poised for success in this shift, featuring three standout stocks ready to capitalize on these changes.

Download Atomic Opportunity: Nuclear Energy’s Comeback for free today.

Looking for the latest investment recommendations from Zacks Investment Research? Get our insights on 7 Best Stocks for the Next 30 Days. Click to access this free report.

Intel Corporation (INTC): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.