Alibaba vs. Amazon: A Decade of Diverging Stocks

In the past, Alibaba (NYSE: BABA) was often considered the Amazon (NASDAQ: AMZN) of China. However, the performance of their stocks over the last ten years tells a different story. While Amazon has seen its stock rise more than 1,400%, Alibaba’s stock has fallen over 15% during the same period.

Despite its stock struggles, Alibaba’s operational performance remains impressive. The company’s revenue skyrocketed from $12.3 billion in 2015 to $130.3 billion in 2024, more than a tenfold increase. Additionally, its operating income also expanded significantly, rising from $3.9 billion in 2015 to $14.1 billion in 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Although growth has slowed recently, Alibaba is taking steps to kickstart expansion. Time will tell if the stock can become a solid investment for the future.

Understanding Alibaba’s Business Ecosystem

Similar to Amazon, Alibaba is involved in various sectors including e-commerce, logistics, and cloud computing. Within its e-commerce segment, it owns popular platforms like Tmall and Taobao. Tmall specializes in business-to-consumer sales, allowing established brands to market their products, while Taobao caters to both businesses and individual consumers.

However, growth in Alibaba’s e-commerce division has been sluggish, affected by a weak Chinese economy and stiff competition. Notably, PDD Holdings — the owner of Pinduoduo — poses a significant challenge. Last quarter, revenue from Tmall and Taobao only rose 1%.

In response to this slow growth, Alibaba has invested in enhancing its service offerings and has switched to a new software service fee structure based on the gross merchandise value of transactions. This change replaces the previous annual service fee for Tmall. Additionally, the adoption of its new AI-powered marketing tool, Quanzhantui, shows promise in driving revenue growth.

Alibaba also owns two rapidly expanding international platforms, AliExpress and Trendyol, where revenue surged by 29% to $4.5 billion last quarter. Currently, the company is focusing on expanding these platforms into European and Gulf markets, although this segment is still not profitable.

Image source: Getty Images.

Alibaba’s cloud computing division, though similar to Amazon, does not take the lead in profitability. Last quarter, this segment grew revenues by 7%, with EBITA (earnings before interest, taxes, and amortization) rising 89% to $379 million. The company has been letting less profitable project-based contracts lapse, which has slightly hindered revenue growth but improved profitability overall.

AI-related products and services from Alibaba have seen significant growth, with triple-digit revenue increases reported over the past five quarters. Despite lacking access to advanced AI-chip technologies available to U.S.-based companies, Alibaba is investing heavily in AI infrastructure. In September, more than 100 new open-source AI models were launched, alongside a new text-to-video generation tool. To enhance market penetration amid fierce competition, the company also recently reduced prices for its large language models.

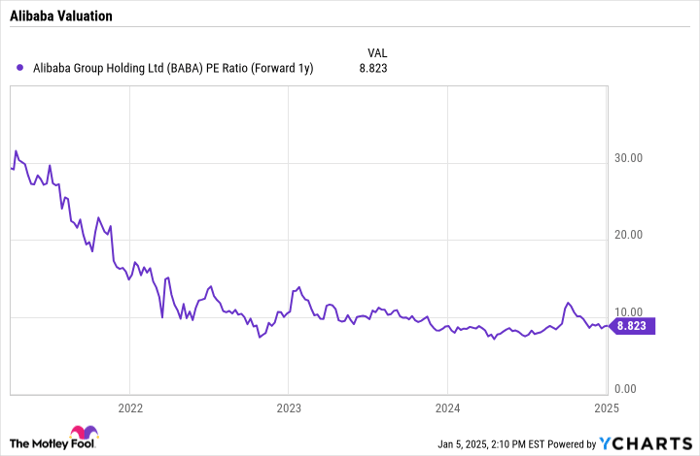

Valuation: A Look at Alibaba’s Stock Potential

Currently, Alibaba presents an attractive valuation opportunity, trading at a forward price-to-earnings (P/E) ratio of less than nine based on analysts’ next-year projections. The company boasts $43.6 billion in net cash on its balance sheet, plus $49.1 billion in equity investments in companies like Ant Group, Xpeng, and Weibo. Excluding net cash, its forward P/E drops below seven.

BABA PE Ratio (Forward 1y) data by YCharts.

Big investors are taking note of Alibaba’s valuation, including billionaire David Tepper of Appaloosa Management, who held more than 15% of his portfolio in Alibaba at the end of Q3. Tepper also has significant stakes in other Chinese companies like PDD and JD.com.

The Chinese government is making efforts to boost the economy, with additional stimulus anticipated in 2025 amid potential U.S. tariff increases. A stronger domestic economy would greatly benefit Alibaba. The company is also focusing on enhancing its e-commerce and cloud services while generating ample cash flow to fund share buybacks.

Should Alibaba begin trading at valuations comparable to Amazon, there could be upside of nearly four times its current valuation. Conversely, if it grows to match Amazon’s scale, the upside could exceed tenfold. Although these scenarios may not be realistic, an uplift in Alibaba’s valuation remains a possibility, offering investors a reasonable chance for growth. However, investing in this stock may not guarantee life-changing returns.

Seize This Opportunity for Potential Gains

Feeling like you missed past opportunities to invest in successful stocks? Opportunities like this may not come often.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are poised for growth. If you’re concerned you missed your chance, now might be an ideal time to invest.

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $387,474!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,399!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $475,542!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and this may be a rare chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alibaba Group. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends Alibaba Group and JD.com. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.