Should You Invest in Amazon Now? An In-Depth Look

Peter Lynch, the former manager of the Magellan Fund, famously advised investors to “buy what you know.” His approach has delivered remarkable success throughout his investment career.

This is one reason I personally hold shares of Amazon (NASDAQ: AMZN). My household receives products from Amazon multiple times each week. I use my Kindle device to read books every day. Many of the websites I frequent rely on Amazon Web Services (AWS) for hosting. Even Alexa, Amazon’s virtual assistant, feels like a member of our family.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. Learn More »

Amazon appears to be a strong addition to nearly any portfolio. But is purchasing Amazon stock now a path to financial security?

A Look Back: The Numbers Speak

If we reflect on whether investing in Amazon in the past would have provided financial freedom, the answer is a clear “yes.” In his best-selling book One Up on Wall Street, Lynch discusses “10-bagger” stocks that yield tenfold returns, yet Amazon’s performance far exceeds that. Since its initial public offering (IPO) in May 1997, Amazon’s share price has increased by over 2,255x.

To put this into perspective, if you had invested $10,000 in Amazon when it first became available, that investment would be worth about $22.5 million today. That’s certainly a way to secure your financial future.

However, it’s not necessary to have invested at the IPO to enjoy major gains. For example, if you bought $10,000 of Amazon shares in February 2005, when the company already had a market cap of over $14 billion, your investment would still have grown to approximately $1.25 million.

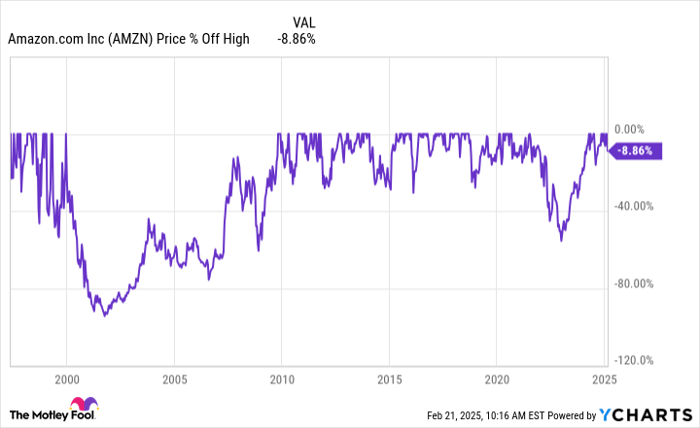

Of course, maintaining those Amazon shares would have been a challenge, as the stock faced considerable fluctuations along its journey. Many investors may have been tempted to sell during periods of high returns. Nonetheless, those who held onto their Amazon shares have generally seen remarkable success.

AMZN data by YCharts

Is It Too Late for Amazon?

However, past performance does not guarantee future results. Just because Amazon has a strong track record doesn’t mean it will continue to achieve such impressive gains.

Investing in Amazon at its IPO meant taking a risk on an emerging company facing stiff competition in the e-commerce realm. If you bought stock in early 2005, you’d be aware that AWS was still over a year from launching.

Today, Amazon boasts a market cap of over $2.3 trillion and leads in both e-commerce and cloud services. Despite its commitment to the “day one” philosophy championed by founder Jeff Bezos, it’s important to recognize that the company has matured significantly.

Some might argue it’s too late for Amazon to deliver life-changing investment returns, as the company has undoubtedly grown large and complex. Identifying new growth opportunities can be more difficult at this scale.

Reasons to Consider Amazon Stock

The first is the growth potential of AWS. The rise of artificial intelligence, particularly generative AI, is creating substantial demand for cloud services. Amazon’s CEO, Andy Jassy, suggests that IT spending will move from primarily on-premises to predominantly cloud-based within the next 10 to 15 years, positioning AWS as a key beneficiary of this shift.

Don’t Miss Your Chance

On rare occasions, our expert analysts make a “Double Down”” stock recommendation for companies they believe are poised for exceptional growth. If you’re concerned about missing your chance to invest, now might be the best time to act. The following figures demonstrate the potential:

- Nvidia: An investment of $1,000 since we advised doubling down in 2009 would now be worth $348,579!*

- Apple: Investing $1,000 when we doubled down in 2008 would have grown to $46,554!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $540,990!*

We are currently issuing “Double Down” alerts for three promising companies, and this may be a rare opportunity not to be missed.

Learn more »

*Stock Advisor returns as of February 21, 2025

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Keith Speights is invested in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.