Is Costco a Smart Buy Today? A Closer Look at Its Valuation

Costco (NASDAQ: COST) is my go-to store for weekly grocery shopping, primarily due to its competitive prices and impressively fresh produce. Despite my frequent visits, I have yet to invest in the stock, which has a notable dividend history that typically attracts investors. While I’ve often considered purchasing it, prospective buyers may wonder whether adding Costco to their investment portfolio right now is wise for long-term returns.

Understanding Costco’s Unique Business Model

To start, Costco operates differently than conventional retailers. Customers pay an annual membership fee, which creates a consistent revenue stream. Surprisingly, these fees contribute around half of the company’s operating income, allowing Costco to focus on customer satisfaction rather than solely relying on product sales.

Image source: Getty Images.

Costco aims to keep customers happy by offering low prices, a pleasant shopping atmosphere, and a wide selection of products. Its success over the years illustrates that this strategy has paid off. Notably, Costco has seen revenue grow by about 8.5% annually over the last decade, while earnings have increased by 13.5%. Importantly, the company has consistently raised its dividend for 20 years, achieving an impressive annualized dividend growth of 12% in the last ten years.

Costco: An Attractive Retailer, but Caution is Advised

Generally, I approach retail stocks with caution, as they can quickly fall out of favor, leading to severe financial consequences—sometimes resulting in bankruptcy. I prefer to invest in retail-focused real estate investment trusts (REITs) that generate rental income regardless of which retailer occupies the space. However, Costco has managed to thrive, thanks in part to its robust business model. Still, the company’s high valuation leaves me hesitant to purchase shares at this time.

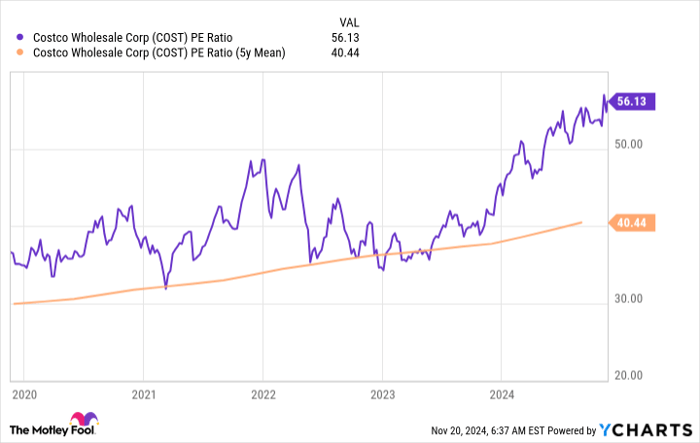

Costco currently trades at a price-to-sales ratio of approximately 1.6, compared to its five-year average of around 1.0. Presently, the price-to-earnings ratio is around 56, while its historical average is just under 41. Additionally, its price-to-cash flow and price-to-book values exceed their averages over the past five years. The dividend yield is only 0.5%, down from an average of about 0.7% over the same period.

The Verdict on Costco

In conclusion, while Costco is a well-managed company with a competitive edge, its current valuation is high. It’s a worthy addition to many investors’ watch lists, but not an immediate purchase consideration. Acquiring it at a reasonable price could lead to significant long-term benefits; however, overpaying may result in a stagnant investment for years.

Should You Invest $1,000 in Costco Wholesale Right Now?

Before making any investment, it’s important to weigh your options carefully:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy currently—Costco Wholesale is not on that list. The selected stocks have potential for substantial returns in the years ahead.

For context, consider Nvidia, which made this list on April 15, 2005. If you invested $1,000 at that time, you would now have $869,885!*

Stock Advisor provides a straightforward blueprint for success, including portfolio-building guidance, regular analyst updates, and two new stock recommendations each month. Stock Advisor has achieved returns more than quadruple that of the S&P 500 since 2002.*

View the 10 stock picks »

*Stock Advisor returns as of November 18, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.