Investing in Nvidia: Key Insights for Future Wealth

Many people aspire to retire as millionaires, but achieving that goal can be challenging. The key is to invest in strong companies consistently over the long term.

Currently, the artificial intelligence (AI) sector offers some of the most significant growth opportunities ever seen. Could Nvidia (NASDAQ: NVDA) be the key to a prosperous retirement? The answer might surprise you.

Where should you invest $1,000 today? Our analysts have revealed their picks for the 10 best stocks to consider right now. Learn More »

Growth Potential of Nvidia

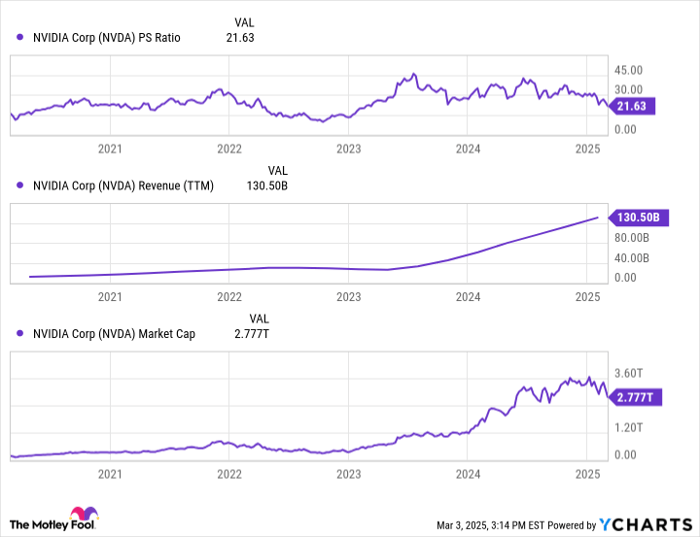

Nvidia’s revenue has surged dramatically in recent years, climbing from less than $40 billion in sales in 2023 to over $130 billion today. This growth trajectory shows no signs of slowing down.

This is largely due to the early stages of the AI revolution. Nvidia’s GPUs, which are essential for training and executing AI models, are regarded as the industry gold standard.

According to McKinsey & Co., investments in new AI software and services have skyrocketed. Their report notes, “Equity investments in generative AI jumped from $5 billion in 2022 to $36 billion in 2023,” with expectations for even greater figures in 2024.

The firm projects that the AI Software and Services sector will grow from $85 billion in revenue in 2022 to a staggering $1.5 trillion by 2040, with optimistic estimates suggesting a rise to $4.6 trillion in the same timeframe. This indicates a revenue growth pace for AI that we have never encountered before.

I have previously discussed how Nvidia’s CUDA developer suite fosters a vendor lock-in effect. This dynamic could help Nvidia maintain a dominant market share for AI GPUs for years to come. Thus, Nvidia is well-positioned to capitalize on a rapidly expanding market with a leading product. This is a significant factor in the company’s valuation rising to the trillions.

However, it’s crucial to note that Nvidia stocks are quite valuable at present. It’s noteworthy that a trillion-dollar company has a price-to-sales ratio of 21.6, typically considered high, even for smaller firms.

NVDA PS Ratio data by YCharts

Is Nvidia Stock a Winning Investment?

This raises the question: Is Nvidia Stock still a worthwhile investment? You may be surprised.

Short-term fluctuations are always possible with high-multiple stocks like Nvidia. In early 2025, for example, Nvidia’s valuation suffered a rapid drop of hundreds of billions after the announcement of a competitor’s chatbot created using cheaper chips.

However, it’s essential to realize that generating significant retirement wealth doesn’t happen instantly. It also doesn’t come from merely finding one good investment. Successful retirement investing requires a long-term view and the strategic accumulation of investments that can grow wealth consistently over time. Patience is vital in this journey.

While Nvidia Stock may seem overpriced now, long-term growth can make almost any current price-to-earnings ratio appear favorable in hindsight. The company boasts a strong competitive advantage from its vendor lock-in and will likely witness astonishing market growth, even at conservative estimates.

For those aiming for a wealthy retirement, including Nvidia shares in your portfolio could be a wise decision. However, it’s equally important to understand that achieving financial success often requires time and a well-diversified portfolio.

Should You Invest $1,000 in Nvidia Now?

Before committing funds to Stock in Nvidia, it’s essential to consider the following:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks currently available for investment… and Nvidia was not included in this list. The featured stocks are expected to yield substantial returns in the years to come.

If you had invested $1,000 in Nvidia when it made the list on April 15, 2005, you’d currently have $690,624!*

Stock Advisor delivers a straightforward plan for investor success, featuring portfolio-building advice, regular analyst updates, and two new Stock recommendations each month. This service has achieved returns more than quadrupling that of the S&P 500 since 2002*. Be sure to check out the latest top 10 list available upon joining Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.