The Trade Desk: A High-Flying Stock in a Growing Industry

Tech stocks have been the stars of the stock market for the past ten years and are expected to keep shining for the next decade. The rise of generative artificial intelligence has opened new doors for technology, prompting cloud infrastructure companies to increase their investments.

One enduring winner in this sector is digital advertising. Alphabet and Meta Platforms, two of the top advertising platforms, have seen significant success, and advertising has also become a major profit driver for Amazon.

A lesser-known success story is The Trade Desk (NASDAQ: TTD), a leading independent demand-side platform (DSP). This company offers a self-serve, automated, cloud-based platform enhanced by artificial intelligence (AI) that assists advertisers in managing their ad campaigns. The Trade Desk has established its industry leadership through advanced technology and extensive relationships with advertisers and platforms.

It has also rolled out Unified ID 2.0 (UID2), a prominent cookieless tracking program that provides an alternative for companies focused on user privacy.

So, could investing in The Trade Desk secure your financial future? Let’s explore what the company has to offer.

Image source: Getty Images.

Building an Impressive Track Record

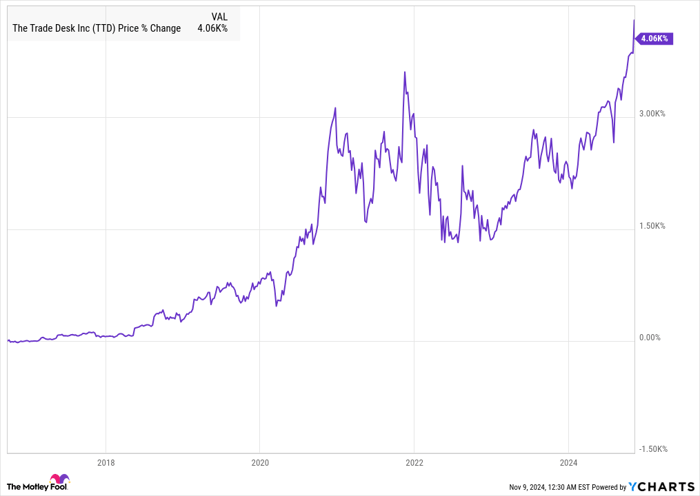

In the stock market, successful companies often continue to thrive, and The Trade Desk exemplifies this trend. The stock has surged over 4,000% in less than ten years, maintaining steady growth despite some volatility during the pandemic.

Revenue growth has also been strong since The Trade Desk went public, as illustrated in the chart below.

TTD data by YCharts

With the exception of the pandemic, The Trade Desk has posted over 20% revenue growth in every quarter since its IPO. The company shows little sign of slowing down, especially as the digital advertising market rebounds from a downturn in 2022 and 2023.

Recently, The Trade Desk reported 27% growth for the third quarter. CEO Jeff Green highlighted opportunities in connected TV (CTV), which is the ad-based streaming market that continues to expand as major platforms enroll new users. Earlier this year, the company also formed a partnership with Netflix, which is one of the streaming giants collaborating with The Trade Desk.

Financially, The Trade Desk reported adjusted net income of $207 million on $628 million in revenue for the third quarter. Remarkably, it has maintained a customer retention rate of 95% or higher every quarter for a decade.

Is The Trade Desk a Key to Long-Term Wealth?

While The Trade Desk has many strengths, some concerns center around its valuation. The stock trades at a price-to-earnings ratio of roughly 200. However, many believe the stock holds significant upside, particularly as its Kokai AI platform opens up new growth avenues.

The Trade Desk is currently well ahead of competitors in adtech, poised to benefit from trends in CTV, retail media, and potential new opportunities within digital media. Given the stock’s valuation, investors might consider purchasing shares strategically during market dips. The company’s solid business model and consistent growth position it as a strong contender for long-term investment success. With favorable trends and a history of excellence, The Trade Desk could help secure your financial future.

Should You Invest $1,000 in The Trade Desk Now?

Before investing in The Trade Desk, it’s worth noting this:

The Motley Fool Stock Advisor team identified what they consider to be the 10 best stocks for investors to consider now, and surprisingly, The Trade Desk is not on that list. The selected stocks have the potential to deliver exceptional returns in the coming years.

For instance, consider when Nvidia made it onto this list on April 15, 2005. An investment of $1,000 would have grown to an impressive $890,169!

The Stock Advisor provides investors with a user-friendly roadmap to success, including tips on portfolio building, regular insights from analysts, and two new stock picks each month. The Stock Advisor service has seen more than quadruple the returns of the S&P 500 since 2002.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon, Meta Platforms, Netflix, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Netflix, and The Trade Desk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.